Professional Documents

Culture Documents

Caz WTC 140409

Uploaded by

Saad Ullah Khan0 ratings0% found this document useful (0 votes)

14 views23 pagesinsurance and takaful

Original Title

CAZ_WTC_140409[1]

Copyright

© © All Rights Reserved

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentinsurance and takaful

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

14 views23 pagesCaz WTC 140409

Uploaded by

Saad Ullah Khaninsurance and takaful

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You are on page 1of 23

1

World Takaful Conference

Dubai, 14 - 15 April 2009

W.I.I.D

Presentation

by

Chakib Abouzaid

Takaful Re

2

Introduction

The World Islamic Insurance Directory (WIID), over the three editions has

become the main source of statistics on Takaful;

The 3

rd

edition captures the information from more than 160 companies

across 26 countries;

More important, this edition has improved the accuracy of the statistics and

the profile of the companies;

The statistics presentation aims to respond to the following questions:

Is Takaful really growing? How much was the growth in the past years? Is this

growth sustainable?

What are the prospects for the development of Takaful in the coming years in

MENA and Far East?

Is Takaful moving really to the west? In UK, USA & Canada, the experience is

still new to draw conclusions.

3

Data collection methodology

The WIID is a compilation of comprehensive questionnaires

obtained from the companies;

In some cases, the data is sourced from the companys annual

report, when the questionnaire was not returned to us;

For some countries considered as Islamic (KSA, Iran), we are using

the market report;

The Directory reflects the information provided to us by the

companies and the markets reports;

Takaful Re and MIR are doing their best to maintain the reliability of

the data. However, the accuracy is not guaranteed as we do not

audit the companies Financial statements;

The WIID can improve the accuracy and the quality of the

information if we could receive a positive feedback from all the

companies.

4

Definitions

Islamic = Takaful

+

Cooperative Companies

(KSA)

+

Iranian market

KSA: Article 1

Insurance in the Kingdom shall be undertaken through registered insurance companies

operating in a cooperative manner as it is provided within the article establishment of

the National Company for Cooperative Insurance promulgated by Royal Decree M/5

dated 17/5/1405 H, and in accordance with the principles of Islamic Sharia.

Iran : The Sharia law is the corner stone of the whole system

5

Region 2005 2006 2007 Est.

Africa 181.1 215.2 246.4

East Indian Sub-Continent 7.8 11.2 12.8

Far East 536.7 695.4 872.4

GCC 1,547.1 2,088.5 2,560.8

Levant 14.7 17.7 21.7

Middle East (Non Arab) 2,372.4 2,880.1 3,505.0

Grand Total 4,659.8 5,908.1 7,219.1

Contributions per Region

6

Contributions 2005/06/07

181.1

7.8

536.7

1,547.1

14.7

2,372.4

215.2

11.2

695.4

2,088.5

17.7

2,880.1

246.4

12.8

872.4

2,560.8

21.7

3,505.0

2005 2006 2007 est

Africa East Indian Sub-Continent Far East GCC Levant Middle East (Non Arab)

7

Region 2005 2006 2007 est

Africa 3.9% 3.6% 3.4%

East Indian Sub-Continent 0.2% 0.2% 0.2%

Far East 11.5% 11.8% 12.1%

GCC 33.2% 35.3% 35.5%

Levant 0.3% 0.3% 0.3%

Middle East (Non Arab) 50.9% 48.7% 48.6%

Islamic / Takaful Market by region

8

Africa

3%

East Indian Sub-

Continent

0%

Far East

12%

GCC

35%

Levant

0%

Middle East (Non

Arab)

50%

Africa East Indian Sub-Continent Far East GCC Levant Middle East (Non Arab)

Contributions by Region

9

Contributions volume and split by LOB

Islamic insurance is growing all over the world:

The contribution increased in 2007 from USD 5.9 to 7.2 billion

There is no major change in the split by geographical area;

Cooperative KSA is the main component of the GCC Islamic/

Takaful markets;

The Iranian market represents over all 48%;

Motor remain the main line of business 42%, property 25% and

Family + Medical 25%

The differences in statistics comes from the definition and whether

cooperative Saudi model and Iranian markets are included or not

10

Contribution Split 2007 by Line of business

Motor

42%

Property & Accident

25%

Marine & Aviation

8%

Family & Medical

25%

Motor Property & Accident Marine & Aviation Family & Medical

11

Number of Islamic/Takaful companies

Africa, 26

East Indian Sub-

Continent, 12

Far East, 35

GCC, 72

Levant, 9

Middle East (Non

Arab), 18

Others, 7

Africa East Indian Sub-Continent Far East GCC Levant Middle East (Non Arab) Others

179 companies

* GCC: 72 companies including all licensed companies in KSA

12

21

9

22

39

3

17

2

26

12

35

72

9

18

7

Africa

East Indian Sub-Continent

Far East

GCC

Levant

Middle East (Non Arab)

Others

2006 2007

Number of Islamic Operators 06/07

13

59.0%

30.0%

16.5%

33.0%

44%

30.0%

21.0%

16.0%

52.0%

25%

6.0%

11.0%

2.5%

6.0%

7%

5.0%

38.0%

65.0%

9.0%

23%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

Middle East (Non Arab) MENA Far East East Indian Sub-Continent Total

Motor Property & Accident Marine & Aviation Family & Medical

LOB per Region

14

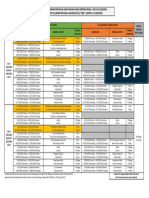

Islamic / Takaful markets growth

Country

Growth

2005 / 04 2006 / 05 2007 / 06

Egypt 28% 47% 28%

Mauritania 0% 0% 0%

Senegal -2% 19% 14%

Sudan 53% 18% 14%

Africa 50% 19% 14%

Bahrain 3% 125% 25%

Kuwait 55% 9% 6%

Qatar 36% 49% 4%

Saudi Arabia 112% 35% 24%

UAE 36% 57% 28%

GCC 101% 35% 23%

Jordan -25% 18% 25%

Lebanon 100% 20% 8%

Yemen 25% 50% 53%

Other Arab 7% 20% 23%

ME N- Arab 10% 21% 22%

Bangladesh 13% 20% 19%

Pakistan 100% 100% 50%

Sri Lanka 75% 62% 10%

Indian sub 42% 44% 14%

Brunei 20% 11% 7%

Indonesia 1% 8% 30%

Malaysia 20% 36% 27%

Singapore 100% 0% 0%

Thailand 5% 8% 8%

Far East 16% 30% 25%

Global 32% 27% 22%

Country

Growth

2005 / 06 2006 / 05 2007 / 06

Far East Middle East & N. Africa

15

Growth Rate Per Region

Region 2005/04 2006/05 2007/06

Africa 50% 19% 14%

East Indian Sub-Continent 42% 44% 14%

Far East 16% 30% 25%

GCC 101% 35% 23%

Levant 7% 20% 23%

Middle East (Non Arab) 10% 21% 22%

Grand Total 32% 27% 22%

* The % doesnt reflect always the growth, but the fact that more companies

are compiled or the market report become available

16

Growth Rate Per Region

50%

42%

16%

101%

7%

10%

19%

44%

30%

35%

20%

21%

14%

14%

25%

23%

23%

22%

0% 20% 40% 60% 80% 100% 120%

Af rica

East Indian Sub-Cont inent

Far East

GCC

Levant

Middle East (Non Arab)

2005/04 2006/05 2007/06

17

Global Growth Rate

31.7%

26.8%

22.2%

2005/04 2006/05 2007/06

* The average growth for the last three years is >22%

18

Middle East vs. Far East

Three models:

Hybrid Takaful model: Bahrain, DIFC

Sudanese full cooperative model

Saudi ccoperative model

Specific situation in Iran; the insurance

industry is not qualified as Takaful, however,

the whole system is Islamic by law

No specific regulation for Takaful in UAE,

Qatar, Oman, Syria, Lebanon, Iraq, Yemen or

Egypt

Except Bahrain and Sudan, no real political

support to Takaful

Lack of products innovation

Focus on industrial risks and Motor

Lack of Takaful mindset

Structured and mature Takaful market,

and substantial and increasing market

share in Malaysia (6%) and Brunei

Specific regulation in Malaysia

Support for Takaful on the political level

However, the Indonesian situation is

different, as the market is split between

two full fledged operators and a large

number of small windows, which are not

able to grow the Takaful market share

Focus on family Takaful and Personal lines

Islamic Finance / Takaful dedicated

educational system

Middle East Far East

19 19

Middle East vs. Far East Main Findings

MENA Far East

Contribution to the Global Takaful

Total

GCC 35

Levant 0

Iran 50

Africa 3 88

Far East 12

Indian Sub Cont 0

12

Number of companies

Total

GCC 72

Levant 9

Iran 18

Africa 26 125

Far East 35

Indian Sub Cont 12

47

Split by Line of business

Family & Medical

General

20

80

64

36

Growth

Total

GCC 23

Levant 23

Iran 22

Africa 14 22

Far East 25

Indian Sub Cont. 14

25

20

Takaful development Prospects

Middle East:

Increasing number in the recent years, which implies a

substantial growth in the years to come, as the companies will

fight for their market shares;

K.S.A. to convert progressively to a full fledged Sharia compliant

system, with SSB and fair surplus distribution.

Far East:

Malaysia: 10% market share achievable in the coming 3 years;

Indonesia: as the largest Muslim country lacks a clear strategy

for Takaful;

Brunei: market dominated by Takaful, especially for Motor and

personal lines;

It is obvious that financial crisis will not encourage

investors to start new companies and the recession will

affect all operators (conventional and Takaful)

21

What are the key issues impacting the Takaful

industry? (*)

1. Lack of awareness, e.g. no clear public education of Takaful and Insurance concepts. Different

markets have different awareness levels, e.g. Pakistan - awareness of Takaful as Shari'a compliant

alternative, Indonesia general awareness and affordability

2. Lack of specialized skills and capabilities, at different levels:

Board and Management levels,

Operational levels and Technical skills, e.g. in product development,

Distribution Management, and

Regulatory capabilities and management

3. Difficult to compete with Conventional players, who has:

much longer history of establishment,

better capacity,

better skills, products and infrastructure.

better investments, hence able to price their products lower

4. Need to change existing mindset, that

Takaful is a product only for the Muslim population, and

Takaful is copying what the Conventional players are doing.

Rather

1. Position Takaful as an Ethical Product, and

2. Define clear and distinct Takaful value proposition in products

or services

(*) Extract from Global Takaful Group brainstorming session findings

22

What are the opportunities available for the

Takaful today?(*)

1. Further and accelerated growth, especially in Family Takaful/ Retail & Individual

products

2. Further development of the ecosystem of Islamic financial industry, incl. asset

management for Takaful, Retro-Retakaful, etc

3. Untapped markets in some countries for Takaful, e.g. in Europe, Africa, China/

Asia Minor

4. Increasing opportunities to sell Takaful to non-Muslim population, i.e. Takaful for

all

5. The strong growth of Takaful also created demands,

Increased demands for Takaful professional training and certification

Increased needs for Takaful databases and statistics

Increased demands for clear Shari'a authority/ views/ opinions/ decisions on Takaful

matters

6. Multiple spokesperson for Takaful, e.g. at ISFB, AAOIFI

(*) Extract from Global Takaful Group brainstorming session findings

23

Thank you,

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Summary BMKT 525 Marketing ManagementDocument112 pagesSummary BMKT 525 Marketing ManagementSobhi BraidyNo ratings yet

- Chapter 2 EOQ MODELDocument24 pagesChapter 2 EOQ MODELHamdan Hassin100% (2)

- Human Resource Management (UST AY 2013-2014)Document3 pagesHuman Resource Management (UST AY 2013-2014)Jie Lim Jareta100% (1)

- Sigma4 2015 enDocument48 pagesSigma4 2015 enOsamaNo ratings yet

- Malmq For Efficiency in StataDocument9 pagesMalmq For Efficiency in StataSaad Ullah KhanNo ratings yet

- 369 Chrisparsons Insurance and The Financial Crisis 2Document36 pages369 Chrisparsons Insurance and The Financial Crisis 2Saad Ullah KhanNo ratings yet

- Criteria For Lecturer in All DisciplinesDocument1 pageCriteria For Lecturer in All DisciplinesAsad SohailNo ratings yet

- Regime Dependent Risk ThresholdDocument41 pagesRegime Dependent Risk ThresholdSaad Ullah KhanNo ratings yet

- 17 HandonDocument19 pages17 HandonSaad Ullah KhanNo ratings yet

- Shariah Compliance and Islamic Banking in BangladeshDocument18 pagesShariah Compliance and Islamic Banking in BangladeshSaad Ullah KhanNo ratings yet

- Key Financial Data 2009Document2 pagesKey Financial Data 2009Imran AliNo ratings yet

- May DebtCapitalMarketReportDocument54 pagesMay DebtCapitalMarketReportSaad Ullah KhanNo ratings yet

- 1 ASGHAR Financial Development Trade Openness and EconomicDocument28 pages1 ASGHAR Financial Development Trade Openness and EconomicSaad Ullah KhanNo ratings yet

- Key Financial Data 2010 (Life Members)Document1 pageKey Financial Data 2010 (Life Members)Saad Ullah KhanNo ratings yet

- Dea in Stata (Draft) by Choonjoo LeeDocument13 pagesDea in Stata (Draft) by Choonjoo LeeChoonjoo LeeNo ratings yet

- 1 ASGHAR Financial Development Trade Openness and EconomicDocument28 pages1 ASGHAR Financial Development Trade Openness and EconomicSaad Ullah KhanNo ratings yet

- Economic Growth and Financial Markets RelationshipDocument15 pagesEconomic Growth and Financial Markets RelationshipSaad Ullah KhanNo ratings yet

- Key Financial Data 2010 (Life Members)Document1 pageKey Financial Data 2010 (Life Members)Saad Ullah KhanNo ratings yet

- Pakistan's Financial Sector MergersDocument11 pagesPakistan's Financial Sector MergersSaad Ullah KhanNo ratings yet

- Islamic Takaful Insurance 2 Ok FienalDocument346 pagesIslamic Takaful Insurance 2 Ok FienalSaad Ullah KhanNo ratings yet

- 2010 How Islamic Is Islamic Banking - ElsvierDocument16 pages2010 How Islamic Is Islamic Banking - ElsvierSaad Ullah KhanNo ratings yet

- Definitions-M & AsDocument18 pagesDefinitions-M & AsSaad Ullah KhanNo ratings yet

- Assignment 3Document10 pagesAssignment 3Saad Ullah KhanNo ratings yet

- Definitions-M & AsDocument18 pagesDefinitions-M & AsSaad Ullah KhanNo ratings yet

- Assignment 4Document15 pagesAssignment 4Saad Ullah KhanNo ratings yet

- BusinessDocument9 pagesBusinessSaad Ullah KhanNo ratings yet

- Eco 404 SubjshezDocument10 pagesEco 404 SubjshezSaad Ullah KhanNo ratings yet

- Five Steps Towards International Success by Nerella CampigottoDocument4 pagesFive Steps Towards International Success by Nerella CampigottoSaad Ullah KhanNo ratings yet

- Assignment InsuranceDocument6 pagesAssignment InsuranceSaad Ullah KhanNo ratings yet

- StatDocument8 pagesStatSaad Ullah KhanNo ratings yet

- Indian Insurance Sector An Overview: K.Ashwin Kumar Agent-General Insurance National Insurance Company LimitedDocument28 pagesIndian Insurance Sector An Overview: K.Ashwin Kumar Agent-General Insurance National Insurance Company LimitedSaad Ullah KhanNo ratings yet

- Takwim Akademik Diploma Ism FT 2023 2024 Pindaan 1Document1 pageTakwim Akademik Diploma Ism FT 2023 2024 Pindaan 1Raihana AzmanNo ratings yet

- Sub Contract AgreementDocument15 pagesSub Contract AgreementJenifer Londeka NgcoboNo ratings yet

- Etrade 1.5M 21082020Document3 pagesEtrade 1.5M 21082020zayar ooNo ratings yet

- Sample FS PDFDocument20 pagesSample FS PDFCjls KthyNo ratings yet

- Ismail Ab - WahabDocument57 pagesIsmail Ab - WahabNida RidzuanNo ratings yet

- SAP - Customizing Guide: Printed by Ahmad RizkiDocument11 pagesSAP - Customizing Guide: Printed by Ahmad RizkiJosé FaiaNo ratings yet

- HCLT108 1 Jul Dec2023 FA2 IM V.2 29052023Document7 pagesHCLT108 1 Jul Dec2023 FA2 IM V.2 29052023sylvesterNo ratings yet

- CMS Introduction To Measures ManagementDocument27 pagesCMS Introduction To Measures ManagementiggybauNo ratings yet

- Learning Objectives - VAT (FINAL)Document2 pagesLearning Objectives - VAT (FINAL)Pranay GovenderNo ratings yet

- HDFC Prudence Fund PDFDocument21 pagesHDFC Prudence Fund PDFaadhil1992No ratings yet

- Bain Asian LubricantsDocument7 pagesBain Asian LubricantsVeda DhageNo ratings yet

- w27 UpdatesDocument9 pagesw27 UpdatesRafayNo ratings yet

- Wepik Ethics in Business Navigating Challenges and Implementing Solutions 20230707055224HMaODocument8 pagesWepik Ethics in Business Navigating Challenges and Implementing Solutions 20230707055224HMaOSakthiNo ratings yet

- Feature Article: Value Analysis/Value Engineering: The Forgotten Lean TechniqueDocument37 pagesFeature Article: Value Analysis/Value Engineering: The Forgotten Lean Techniquekish007rdNo ratings yet

- GFR Chapter 6,7,8Document19 pagesGFR Chapter 6,7,8asteeshNo ratings yet

- Marketing Management - TruEarth Health Foods CaseDocument6 pagesMarketing Management - TruEarth Health Foods Casesmithmelina100% (2)

- To Study The Customer Satisfaction Level Towards Coca-Cola Products in LucknowDocument5 pagesTo Study The Customer Satisfaction Level Towards Coca-Cola Products in LucknowChandan SrivastavaNo ratings yet

- Business Strategies Marketing Programs at 3MDocument3 pagesBusiness Strategies Marketing Programs at 3MHarshNo ratings yet

- PsuDocument2 pagesPsuManas KapoorNo ratings yet

- Background of The StudyDocument8 pagesBackground of The StudyGeraldine Morales BiasongNo ratings yet

- Senior Project Engineering Manager in Chicago IL Resume Richard PrischingDocument2 pagesSenior Project Engineering Manager in Chicago IL Resume Richard PrischingRichardPrischingNo ratings yet

- Advanced Product Quality Planning (APQP)Document22 pagesAdvanced Product Quality Planning (APQP)mjapmgNo ratings yet

- MIT Student ResumesDocument26 pagesMIT Student ResumesIvan Vargas100% (1)

- Hapter 10: © 2008 Prentice Hall Business Publishing Accounting Information Systems, 11/e Romney/SteinbartDocument134 pagesHapter 10: © 2008 Prentice Hall Business Publishing Accounting Information Systems, 11/e Romney/SteinbartRoristua PandianganNo ratings yet

- Tourism Market ResearchDocument14 pagesTourism Market ResearchLoping Lee100% (1)

- 10.4324 9780203116098 PreviewpdfDocument32 pages10.4324 9780203116098 PreviewpdfAhmed HonestNo ratings yet