Professional Documents

Culture Documents

Corporate Governance

Uploaded by

Abhimanyu Verma0 ratings0% found this document useful (0 votes)

19 views28 pagesCorporate governance covers set of relationships between a company's management, its board, its shareholders and other stakeholders. It is a control measure that can result into overall economic growth and development of an economy plus will generate social justice, if implemented and executed correctly. The definition of corporate governance most widely used is "the system by which companies are directed and controlled"

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCorporate governance covers set of relationships between a company's management, its board, its shareholders and other stakeholders. It is a control measure that can result into overall economic growth and development of an economy plus will generate social justice, if implemented and executed correctly. The definition of corporate governance most widely used is "the system by which companies are directed and controlled"

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

19 views28 pagesCorporate Governance

Uploaded by

Abhimanyu VermaCorporate governance covers set of relationships between a company's management, its board, its shareholders and other stakeholders. It is a control measure that can result into overall economic growth and development of an economy plus will generate social justice, if implemented and executed correctly. The definition of corporate governance most widely used is "the system by which companies are directed and controlled"

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 28

Corporate governance includes the practices, principles and values

that guide a company and its business every day.

Corporate governance covers set of relationships between a

company's management, its board, its shareholders and other

stakeholders .

It is a control measure that can result into overall economic growth

and development of an economy plus will generate social justice, if

implemented and executed correctly.

The definition of corporate governance most widely used is "the

system by which companies are directed and controlled"

(Cadbury Committee, 1992) .

The OECD Principles of Corporate Governance states:

"Corporate governance involves a set of relationships between

a companys management, its board, its shareholders and other

stakeholders. Corporate governance also provides the structure

through which the objectives of the company are set, and the

means of attaining those objectives and monitoring

performance are determined."

Started as economic or financial concept

Involves lot of parties

Involves organizational & social objective

Guiding practices, process & principles

Used to motivate management to perform better

Universal approach (world wide acceptance)

framework of rules, relationships, systems, and processes

Implemented at all levels in an organization

Tool for benchmarking & controlling performance

Focuses on long term value addition (profitability, goodwill,

brand recognition etc.)

It creates a safe environment in front of the

small investors.

It promotes the in vestment habits of people

by securing better return on investment .

It make the management as responsible and

productive.

It ensures proper allocation of resources.

It focuses on the stakeholders betterment.

Economic development of the society through

investment etc..

1. Strengthen management oversight functions and accountability

2. Balance skills, experience and independence on the board

appropriate to the nature and extent of company operations

3. Establish a code to ensure integrity

4. Safeguard the integrity of company reporting

5. Risk management and internal control

6. Protection of minorities

7. Role of other stakeholders in management

8. System of reporting and accountability

9. Effective supervision and enforcement by regulators

10. To encourage Sustainable Development of the Company and its

stakeholders.

1. Board of directors

2. Managers

3. Workers

4. Shareholders or owners

5. Regulators

6. Customers

7. Suppliers

8. Community (people affected by the actions of the

organization)

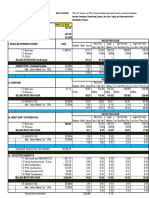

Owner

Directors

Independent

Directors

Board of

Directors

Management

Supervisory &

enforcement

authorities

Shareholders Creditors

Executive

Directors

Stakeholders

Corporate

Business

Corporate

Governance

CSR

Effective Resource Allocation

Ethical Behavior & Entrepreneurship

Economic Growth

Followings are the instruments of corporate governance

Codes

Laws

Principles

Standards

These instruments provide wider coverage and cover the following

areas:

Share holders rights and protection

Shareholders instruments

Employees and stakeholders right protection

Company board responsibility

Transparency of corporate structures and operations, and disclosure of it

on time.

There are four theories of corporate governance

The agency theory

The stewardship theory

The stakeholder theory

The political theory

The basis for the agency theory is the separation

of ownership and control.

Principal (shareholders) own the company but

the agents (managers) control it.

Managers must maximize the shareholders

wealth.

The main concern is to develop rules and

incentives, based on implicit explicit contracts, to

eliminate or at least, minimize the conflict of

interests between owners and managers.

Managers as stewards

Assumed to work efficiently and honestly in

the interests of company and owners.

Self directed and motivated by high

achievements and responsibility in discharging

the duties.

Managers are goal oriented

Feel constrained if they are controlled by

outside directors

Managers are responsible to maximize the

total wealth of all stakeholders of the firm ,

rather than only the shareholders wealth.

The government that decides the allocation of

control, rights, responsibility, profit, etc.

between owners, managers, employees and

other stakeholders.

Each stakeholder may try to enhance its

bargaining power to negotiate higher

allocation in its favor.

Corporate governance practiced in an

organization through the following manners

Board of directors

Audit committee

Shareholders or investors grievance committee

Remuneration committee

Management analysis

Communication

Auditors certificate on corporate governance

The board of directors constitute the top and strategic

decision body of a company.

It is composed of executive and non executive

directors.

The board should meet frequently and all pertinent

information affecting or relating to the functioning of

the company should be placed before the board.

Some of the significant maters are:

Review of annual operating plans of business , capital expenditure

budget and updates.

Quarterly result of the company.

Minutes of the meeting of Audit committee and other

committees

Materially important show causes, demands, prosecutions and

penalty notice etc

It is a powerful instrument of ensuring good corporate

governance in the financial matters.

The function of audit committee includes the following:

Overseeing the company's financial reporting process and

ensuring the correct , adequate and credible disclosure of

financial statements.

Reviewing the adequacy of the audit and compliance function ,

including their policies, procedures, techniques and other

regulatory requirements.

Recommending the appointment of statutory auditors.

To review the observation of internal and statutory auditors

about the findings during the audit of the company

Companies should form a shareholders/investors

grievance committee under the chairmanship of

a non executive independent director

The committee is responsible for attending to the

grievance of shareholders and investors relating

to transfer of shares and non receipt of dividend.

The company may appoint a remuneration

committee to decide the remuneration and

other perks etc. of the CEO and other senior

management officials as per the Companies

Act and other relevant provisions.

Management is required to make full

disclosure of all material information to

investors.

It should give detailed discussion and analysis

of the company's operations and financial

information.

The quarterly , half yearly and annual financial

results of the company must be send to the stock

exchange immediately after they have been

taken on record by the board

Some companies simultaneously post them on

their website.

Companies may also provide periodic event

based information to investors and the public at

large by way of press releases/intimation to the

stock exchange.

The external auditors are required to give a

certificate on the compliance of corporate

governance requirements.

In this certification they conclude the firm

initiatives in respect of the corporate

governance and they also advise the

management for better corporate governance

practices.

Contemporary discussions of corporate governance tend to refer to

principles raised in three documents released since 1990:

The Cadbury Report (UK, 1992),

The Principals of Corporate Governance (OECD, 1998 and

2004),

The Sarbanes-Oxley Act of 2002 (US, 2002).

The Cadbury and OECD (Organization for Economic Corporation and

Development) reports present general principals around which

businesses are expected to operate to assure proper governance.

The Sarbanes-Oxley Act, informally referred to as Sarbox or Sox, is

an attempt by the federal government in the United States to

legislate several of the principles recommended in the Cadbury and

OECD reports.

Rights and equitable treatment of shareholders : Organizations should

respect the rights of shareholders and help shareholders to exercise those

rights. They can help shareholders exercise their rights by openly and

effectively communicating information and by encouraging shareholders

to participate in general meetings.

Interests of other stakeholders : Organizations should recognize that they

have legal, contractual, social, and market driven obligations to non-

shareholder stakeholders, including employees, investors, creditors,

suppliers, local communities, customers, and policy makers.

Role and responsibilities of the board : The board needs sufficient

relevant skills and understanding to review and challenge management

performance. It also needs adequate size and appropriate levels of

independence and commitment to fulfill its responsibilities and duties.

Integrity and ethical behavior : Integrity should be a fundamental

requirement in choosing corporate officers and board members.

Organizations should develop a code of conduct for their directors

and executives that promotes ethical and responsible decision

making.

Disclosure and transparency :

Organizations should clarify and

make publicly known the roles and responsibilities of board and

management to provide stakeholders with a level of accountability.

They should also implement procedures to independently verify

and safeguard the integrity of the company's financial reporting.

Disclosure of material matters concerning the organization should

be timely and balanced to ensure that all investors have access to

clear, factual information.

In essence good corporate governance consists of a system of

structuring, operating and controlling a company such as to achieve

the following:

a culture based on a foundation of sound business ethics

fulfilling the long-term strategic goal of the owners while taking into

account the expectations of all the key stakeholders, and in particular:

consider and care for the interests of employees, past, present and

future

work to maintain excellent relations with both customers and

suppliers

take account of the needs of the environment and the local

community

maintaining proper compliance with all the applicable legal and

regulatory requirements under which the company is carrying out its

activities.

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Companies' Act, 2013Document70 pagesCompanies' Act, 2013Abhimanyu VermaNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Microsoft Office Practical QuestionsDocument112 pagesMicrosoft Office Practical QuestionsAbhimanyu VermaNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Excel What IF Analysis QNDocument2 pagesExcel What IF Analysis QNAbhimanyu Verma100% (1)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Special Contracts: Indemnity, Guarantee, Bailment, Pledge, AgencyDocument32 pagesSpecial Contracts: Indemnity, Guarantee, Bailment, Pledge, AgencyAbhimanyu VermaNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Sri Vishuddhanand PDFDocument27 pagesSri Vishuddhanand PDFNaren MukherjeeNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Positive and Negative Effects of Video GamesDocument5 pagesThe Positive and Negative Effects of Video GamesJohn DoeNo ratings yet

- Distribution CHANNELDocument73 pagesDistribution CHANNELAbhimanyu VermaNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Bharatha MuniDocument19 pagesBharatha MuniRohit Xavier100% (2)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Seeking Solitude: The Positive Effects of Being Alone: January 2019Document8 pagesSeeking Solitude: The Positive Effects of Being Alone: January 2019Abhimanyu VermaNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Econ Policies 2.0Document17 pagesEcon Policies 2.0Abhimanyu VermaNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Pan IIM Mag The Looking GlassDocument49 pagesPan IIM Mag The Looking GlassVishal MishraNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- International Marketing and The Country of Origin EffectDocument224 pagesInternational Marketing and The Country of Origin EffectAbhimanyu VermaNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Amul BCG Matrix Analysis: StarsDocument3 pagesAmul BCG Matrix Analysis: StarsAbhimanyu VermaNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- Jafeb TheEffectofCountry-of-OriginonCustomerPurchaseIntention-AStudyofFunctionalProductsinVietnam DOI1013106jafeb 2017 Vol4 No3 75 PDFDocument11 pagesJafeb TheEffectofCountry-of-OriginonCustomerPurchaseIntention-AStudyofFunctionalProductsinVietnam DOI1013106jafeb 2017 Vol4 No3 75 PDFAbhimanyu VermaNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Bharat MuniDocument1 pageBharat MuniAbhimanyu VermaNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Significant Cyber Events ListDocument45 pagesSignificant Cyber Events ListAbhimanyu VermaNo ratings yet

- UGC Guideline IQACsDocument8 pagesUGC Guideline IQACsdeepak4evolutionNo ratings yet

- International Marketing and The Country of Origin EffectDocument224 pagesInternational Marketing and The Country of Origin EffectAbhimanyu VermaNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Jafeb TheEffectofCountry-of-OriginonCustomerPurchaseIntention-AStudyofFunctionalProductsinVietnam DOI1013106jafeb 2017 Vol4 No3 75 PDFDocument11 pagesJafeb TheEffectofCountry-of-OriginonCustomerPurchaseIntention-AStudyofFunctionalProductsinVietnam DOI1013106jafeb 2017 Vol4 No3 75 PDFAbhimanyu VermaNo ratings yet

- Raw CaseDocument4 pagesRaw CaseAbhimanyu VermaNo ratings yet

- Bulletin For Admission in DuDocument154 pagesBulletin For Admission in DuAbhinav SharmaNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Bharatas Natyashastra PDFDocument8 pagesBharatas Natyashastra PDFClassical RevolutionaristNo ratings yet

- Corporate Sustainability, Social Responsibility and Environmental Management - An Introduction To Theory and Practice With Case Studies PDFDocument207 pagesCorporate Sustainability, Social Responsibility and Environmental Management - An Introduction To Theory and Practice With Case Studies PDFAbhimanyu Verma100% (3)

- Keral TripDocument1 pageKeral TripAbhimanyu VermaNo ratings yet

- Affiliated - UG PG - Colleges New 17dec19 PDFDocument185 pagesAffiliated - UG PG - Colleges New 17dec19 PDFDheepak GnanasekaranNo ratings yet

- Advertising Management Chapterwise Study PlanDocument3 pagesAdvertising Management Chapterwise Study PlanAbhimanyu VermaNo ratings yet

- Case StudyDocument2 pagesCase StudyAbhimanyu Verma0% (1)

- E-Commerce Systems ExplainedDocument112 pagesE-Commerce Systems ExplainedAbhimanyu VermaNo ratings yet

- Advertising and Consumerism in The Food IndustryDocument42 pagesAdvertising and Consumerism in The Food IndustryIoana GoiceaNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- (Brendan Brown) What Drives Global Capital FlowsDocument275 pages(Brendan Brown) What Drives Global Capital FlowserereredssdfsfdsfNo ratings yet

- 1.1 Introduction To PartnershipDocument5 pages1.1 Introduction To PartnershipXyril MañagoNo ratings yet

- Calculate Market Price and Amortization of Bonds Issued at a DiscountDocument5 pagesCalculate Market Price and Amortization of Bonds Issued at a DiscountKris Hazel RentonNo ratings yet

- City Gas Distribution Projects: 8 Petro IndiaDocument22 pagesCity Gas Distribution Projects: 8 Petro Indiavijay240483No ratings yet

- Policy On Prohibition of Child LaborDocument2 pagesPolicy On Prohibition of Child LaborkkyuvarajNo ratings yet

- Case Study GuidelinesDocument4 pagesCase Study GuidelinesKhothi BhosNo ratings yet

- Who Owns The Ice House Eight Life-1Document131 pagesWho Owns The Ice House Eight Life-1Justin ElijahNo ratings yet

- HBO - Change Process, Managing ConflictDocument12 pagesHBO - Change Process, Managing ConflictHazel JumaquioNo ratings yet

- Shareholder Vs Stakeholder Approach - RSM South Africa Shareholders Vs Stakeholders - Legal Insights - RSM South AfricaDocument3 pagesShareholder Vs Stakeholder Approach - RSM South Africa Shareholders Vs Stakeholders - Legal Insights - RSM South AfricaCasper MaungaNo ratings yet

- Your Life Your LegacyDocument23 pagesYour Life Your LegacyMightyOakNo ratings yet

- Invoice: Telecom Equipment Pte LTDDocument1 pageInvoice: Telecom Equipment Pte LTDRiff MarshalNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Distributor Agreement CleanDocument16 pagesDistributor Agreement CleanMd. Akmal HossainNo ratings yet

- Export Manager or Latin America Sales ManagerDocument3 pagesExport Manager or Latin America Sales Managerapi-77675289No ratings yet

- North America Equity ResearchDocument8 pagesNorth America Equity ResearchshamashmNo ratings yet

- Security agency cost report for NCRDocument25 pagesSecurity agency cost report for NCRRicardo DelacruzNo ratings yet

- Model Trading Standard ExplainedDocument12 pagesModel Trading Standard ExplainedVinca Grace SihombingNo ratings yet

- JACKSON V AEG Transcripts Michael Joseph Jackson JR (Prince) June 26th 2013 'They're Going To Kill Me,' Michael Jackson Told SonDocument96 pagesJACKSON V AEG Transcripts Michael Joseph Jackson JR (Prince) June 26th 2013 'They're Going To Kill Me,' Michael Jackson Told SonTeamMichael100% (2)

- Scope and Methods of EconomicsDocument4 pagesScope and Methods of EconomicsBalasingam PrahalathanNo ratings yet

- Exploring Supply Chain Collaboration of Manufacturing Firms in ChinaDocument220 pagesExploring Supply Chain Collaboration of Manufacturing Firms in Chinajuan cota maodNo ratings yet

- Aparna Singh 19021141023Document2 pagesAparna Singh 19021141023Aparna SinghNo ratings yet

- Understanding The Retailer Rule Qualifier - RR / RRM : Quick ReferenceDocument9 pagesUnderstanding The Retailer Rule Qualifier - RR / RRM : Quick ReferenceSeba311No ratings yet

- 15 Golden Tips 2 Bluid ResumeDocument3 pages15 Golden Tips 2 Bluid ResumeDeepak KumarNo ratings yet

- You Exec - Sales Process FreeDocument13 pagesYou Exec - Sales Process FreeMariana Dominguez AlvesNo ratings yet

- Management Development ProgrammeDocument4 pagesManagement Development ProgrammeDebi GhoshNo ratings yet

- Isaca Cisa CoursewareDocument223 pagesIsaca Cisa Coursewareer_bhargeshNo ratings yet

- MGT602 Finalterm Subjective-By KamranDocument12 pagesMGT602 Finalterm Subjective-By KamranKifayat Ullah ToheediNo ratings yet

- Del Monte Philippines, Inc. vs. AragoneDocument1 pageDel Monte Philippines, Inc. vs. AragoneLeizle Funa-FernandezNo ratings yet

- Franchising Expansion Benefits Through Franchisee Capital and Motivated ManagementDocument13 pagesFranchising Expansion Benefits Through Franchisee Capital and Motivated ManagementTirsolito SalvadorNo ratings yet

- Kwality WallsDocument18 pagesKwality WallsKanak Gehlot0% (2)