Professional Documents

Culture Documents

CPI - Vs - IIP

Uploaded by

Supreet GuptaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CPI - Vs - IIP

Uploaded by

Supreet GuptaCopyright:

Available Formats

SUBMITTED BY:

GROUP 6

ASMITA SINHA

POOJA SARAF

PRATYUSH SAHU

RAJDEEP JAISWAL

SUPREET GUPTA

TRISHA KAUSHIK

WHAT IS INFLATION ?

In economics, inflation is a persistent increase in the

general price level of goods and services in

an economy over a period of time. When the general

price level rises, each unit of currency buys fewer

goods and services. Consequently, inflation reflects a

reduction in the purchasing power per unit of money

a loss of real value in the medium of exchange and

unit of account within the economy. A chief measure

of price inflation is the inflation rate, the annualized

percentage change in a general price index over time.

EFFECTS OF INFLATION

POSITIVE EFFECTS

Increase in the

opportunity cost of

holding money

Shortages of goods as

consumers

begin hoarding out of

concern that prices will

increase in the future

NEGATIVE EFFECTS

Ensuring that central

banks can adjust real

interest rates

Encouraging investment

in non-monetary capital

projects

WHAT IS CONSUMER PRICE INDEX

??

A consumer price index (CPI) measures changes in

the price level of a market basket goods and

services purchased by households.

The annual percentage change in a CPI is used as a

measure of inflation.

It can be used to index the real value of wages, salaries,

pensions for regulating prices and for deflating

monetary magnitudes to show changes in real values.

A consumer price index (CPI) in the United

States is defined by the Bureau of Labor

Statistics as "a measure of the average change over

time in the prices paid by urban consumers for

a market basket of consumer goods and services.

The CPI is a statistical estimate constructed using

the prices of a sample of representative items

whose prices are collected periodically

CURRENT MARKET SCENARIO

Current inflation India (CPI India) the inflation is

based upon the Indian consumer price index. The

index is a measure of the average price which

consumers spend on a market-based "basket" of goods

and services. Inflation based upon the consumer price

index (CPI) is the main inflation indicator in most

countries.

We suggest to use the links underneath the current

inflation rate, in case you are interested in more

extensive information on the development of the

current or historic inflation in India.

The Consumer Price Index (CPI-U) is compiled by the

Bureau of Labor Statistics and is based upon a 1982

Base of 100. Therefore, a Consumer Price Index of 158

would indicate 58% inflation since 1982.

The commonly quoted inflation rate of say 3% is

actually the change in the Consumer Price Index from

a year earlier. By looking at the change in the index we

can see that what cost an average of 9.9 cents in 1913

would cost about $1.82 in 2003 and $2.30 in August of

2012.

OBJECTIVES

It is a measure of the cost of living and reflects changes

in the general price level.

The CPI uses a basket of consumer goods to give goods

a weighting. Then price surveys find out how much the

prices have increased.

The CPI excludes housing costs and so tends to give a

lower inflation rate than the old method of calculating

inflation Retail Price Index.

The CPI can be used to report how prices that

households face have changed over time, that is, the

percentage change between different periods for each

class, subgroup, group, or for the overall CPI.

The CPI is used to help set monetary policy. The Policy

Targets Agreement between the Governor of the

Reserve Bank and the Minister of Finance.

What Is Index of industrial

production??

Index of Industrial Production (IIP) is

an index which details out the growth of various

sectors in an economy, e.g. Indian IIP will focus on

sectors like mining, electricity and manufacturing.

Index of Industrial Production (IIP) is an abstract

number, the magnitude of which represents the status

of production in the industrial sector for a given

period of time as compared to a reference period of

time.

The all India IIP is a composite indicator that

measures the short-term changes in the volume of

production of a basket of industrial products during a

given period with respect to that in a chosen base

period.

An industrial production index is an index covering

production in mining, manufacturing and public

utilities (electricity, gas and water), but excluding

construction.

The exact coverage, the weighting system and the

methods of calculation vary from country to country

but the divergences are less important than e.g. in the

case of the price and the wage indices.

CURRENT MARKET SCENARIO

The industry consumes a significant share (around

one-third) of its own production. The industry has a

14% weightage in the overall Index of Industrial

Production (IIP) which gives an indication of its

importance in the countrys industrial growth. A

robust chemical industry ushers in many economic

and strategic benefits for the nation. As on March 31,

2008, the size of the Indian chemical industry was

estimated at around USD 35 bn and 3% of Indias GDP.

Industrial shipments grow at a 3.0% annual rate over

the first 10 years of the projection and then slow to

1.6% annual growth for the rest of the projection. Bulk

chemicals and metals-based durables account for

much of the increased growth in industrial shipments

in AEO2014. Industrial shipments of bulk chemicals,

which benefit from an increased supply of natural gas

liquids, grow by 3.4% per year from 2012 to 2025

in AEO2014, as compared with 1.9% in the Annual

Energy Outlook 2013

OBJECTIVES

To provide precise, reliable information, in the

shortest time possible, on the main structural and

activity characteristics of the different sectors that

comprise the industrial activity of the economy, in

such a way that they may satisfy the national and

international needs for information on the subject.

To measure the monthly evolution of the

production activity of the industrial branches,

excluding construction.

To measure the evolution of the prices of the

industrial products sold in the foreign market,

and of those originating in the rest of the world.

COMPARISION

Index of industrial production (IIP) and the consumer

price index (CPI), it appears that a new principle is in

place. If the news is good, announce it during market

hours. If it is bad, wait until the market is closed.

The IIP and CPI numbers certainly warranted this

caution. Together, they suggest that even as growth is

decelerating, inflation is actually accelerating.

The recent economic data makes things worse. CPI

inflation comes at 11.24% and IIP at -1.8%.

IIP 1.6 per cent relative to May 2012 which were

anticipating a small positive number, the growth in

which slowed to a mere 14.3 per cent during May, still

putting the April-May growth rate at a rather striking

50.6 per cent.

CPI reading is the highest so far, expanding the index

by a marginal %, we see CPI averaging 10.5-11.5% for

the remaining part of the year. Only a flat base keeps

inflation around 9%. There is no base effect either.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Tetfund Annexxure 1 FormDocument2 pagesTetfund Annexxure 1 FormOluwasegun Modupe89% (9)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- NEW Handbook On Debt RecoveryDocument173 pagesNEW Handbook On Debt RecoveryRAJALAKSHMI HARIHARAN100% (5)

- New Products and Brand ExtensionsDocument17 pagesNew Products and Brand ExtensionsSupreet GuptaNo ratings yet

- Customer Expectations ReportDocument29 pagesCustomer Expectations ReportSupreet GuptaNo ratings yet

- Strategy Analysis of ABC Consultants Pvt. LTD.: by Group - 4Document15 pagesStrategy Analysis of ABC Consultants Pvt. LTD.: by Group - 4Supreet GuptaNo ratings yet

- Introduction To Investing and ValuationDocument44 pagesIntroduction To Investing and ValuationSupreet GuptaNo ratings yet

- IMC MixDocument21 pagesIMC MixSupreet GuptaNo ratings yet

- Capital Investments: Importance and DifficultiesDocument13 pagesCapital Investments: Importance and DifficultiesSupreet Gupta57% (7)

- Hotel MarketingDocument61 pagesHotel MarketingSupreet GuptaNo ratings yet

- Gateforum Test Series 2Document18 pagesGateforum Test Series 2Supreet GuptaNo ratings yet

- Managing Bank CapitalDocument14 pagesManaging Bank CapitalSupreet GuptaNo ratings yet

- Gateforum Test SeriesDocument22 pagesGateforum Test SeriesSupreet GuptaNo ratings yet

- Services Marketing The Plaza Hotel NyDocument19 pagesServices Marketing The Plaza Hotel NySupreet GuptaNo ratings yet

- Managing Bank CapitalDocument14 pagesManaging Bank CapitalSupreet GuptaNo ratings yet

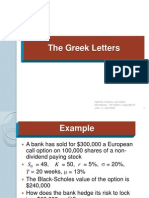

- The Greek LettersDocument18 pagesThe Greek LettersSupreet GuptaNo ratings yet

- Presented by Group 9Document13 pagesPresented by Group 9Supreet GuptaNo ratings yet

- PrefaceDocument2 pagesPrefaceSupreet GuptaNo ratings yet

- Summer Intership Presentation ON State Bank of India: Presented By: Supreet Gupta PGFB1354Document14 pagesSummer Intership Presentation ON State Bank of India: Presented By: Supreet Gupta PGFB1354Supreet GuptaNo ratings yet

- S. No. Company Name Address: 1 Nationwide Business CentreDocument10 pagesS. No. Company Name Address: 1 Nationwide Business CentreAyesha NasirNo ratings yet

- School Calendar Version 2Document1 pageSchool Calendar Version 2scituatemarinerNo ratings yet

- Comprehensive Study of Digital Forensics Branches and ToolsDocument7 pagesComprehensive Study of Digital Forensics Branches and ToolsDwiki MaulanaNo ratings yet

- Scope PED 97 23 EGDocument54 pagesScope PED 97 23 EGpham hoang quanNo ratings yet

- Knowledge Work Systems and Ofice Automated SystemsDocument21 pagesKnowledge Work Systems and Ofice Automated SystemsAnirudh JainNo ratings yet

- 2018耗材展 会刊 RemaxWorldDocument240 pages2018耗材展 会刊 RemaxWorldankit.patelNo ratings yet

- Incoterms For Beginners 1Document4 pagesIncoterms For Beginners 1Timur OrlovNo ratings yet

- Judicial Plans of CornwallisDocument23 pagesJudicial Plans of CornwallisHarshitha EddalaNo ratings yet

- Universidad Autónoma de Nuevo Léon Preparatoria 15, Unidad MaderoDocument4 pagesUniversidad Autónoma de Nuevo Léon Preparatoria 15, Unidad MaderoCarlos Lopez cortezNo ratings yet

- WORKING CAPITAL MANAGEMENT of The Ultra Light Technology. VidishaDocument49 pagesWORKING CAPITAL MANAGEMENT of The Ultra Light Technology. Vidishasai projectNo ratings yet

- A Summer Internship Report On Online ResearchDocument58 pagesA Summer Internship Report On Online ResearchSaurav Kumar0% (1)

- Accessing Resources For Growth From External SourcesDocument14 pagesAccessing Resources For Growth From External SourcesHamza AdilNo ratings yet

- Money of Georgia & OmanDocument18 pagesMoney of Georgia & OmanHana Danische ElliotNo ratings yet

- Synopsis Movie Ticket BookingDocument18 pagesSynopsis Movie Ticket BookingRaj Bangalore17% (6)

- Crim SPLDocument202 pagesCrim SPLRoyalhighness18No ratings yet

- Project Report On Comparative Analysis of 4-Stroke BikesDocument72 pagesProject Report On Comparative Analysis of 4-Stroke BikesvinnetTNo ratings yet

- Entrep 3Document28 pagesEntrep 3nhentainetloverNo ratings yet

- Quo Vadis PhilippinesDocument26 pagesQuo Vadis PhilippineskleomarloNo ratings yet

- Voting Methods and Apportionment AssessmentDocument3 pagesVoting Methods and Apportionment AssessmentJune DungoNo ratings yet

- Jurisprudence Renaissance Law College NotesDocument49 pagesJurisprudence Renaissance Law College Notesdivam jainNo ratings yet

- Executive SummaryDocument3 pagesExecutive SummaryyogeshramachandraNo ratings yet

- Spear v. Place, 52 U.S. 522 (1851)Document7 pagesSpear v. Place, 52 U.S. 522 (1851)Scribd Government DocsNo ratings yet

- Dubai Mall Landside Metro Bus - Dubai Design District Zõ - DC Ó% Ó? - V - C FO Ó% Eï (Ð ( @ (Document1 pageDubai Mall Landside Metro Bus - Dubai Design District Zõ - DC Ó% Ó? - V - C FO Ó% Eï (Ð ( @ (Dubai Q&ANo ratings yet

- Master Nilai RDM Semseter Gasal 2020 Kelas 1Document50 pagesMaster Nilai RDM Semseter Gasal 2020 Kelas 1Ahmad Syaihul HNo ratings yet

- LESSON 1-3 HistoryDocument13 pagesLESSON 1-3 HistoryFLORIVEN MONTELLANONo ratings yet

- 1968 Hypogene Texture and Mineral Zoning in A Copper Granodiorite Porphyry Stock NielsenDocument14 pages1968 Hypogene Texture and Mineral Zoning in A Copper Granodiorite Porphyry Stock NielsenKevin Hiram Torres Montana100% (1)

- Cabuyao Zoning Ordinance No. 2019-562 S. 2019Document55 pagesCabuyao Zoning Ordinance No. 2019-562 S. 2019melvin.francisco1078No ratings yet

- CN Lab 3Document7 pagesCN Lab 3hira NawazNo ratings yet