Professional Documents

Culture Documents

Cost of Capital Concepts and Measurement

Uploaded by

rananavneet1Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cost of Capital Concepts and Measurement

Uploaded by

rananavneet1Copyright:

Available Formats

Dr.

Amit Gupta

Concept and Measurement

of Cost of Capital

Dr. Amit Gupta

Cost of Capital

In operational terms, it is defined as the weighted average cost of capital

(k

0

) of all long-term sources of finance. The major long-term sources of

funds are

1) Debt,

2) Preference shares,

3) Equity capital, and

4) Retained earnings.

Dr. Amit Gupta

Explicit and Implicit Costs

Dr. Amit Gupta

Measurement of Specific Costs

There are four types of specific costs

1) Cost of Debt

2) Cost of Preference Shares

3) Cost of Equity Capital

4) Cost of Retained Earnings

Dr. Amit Gupta

Cost of Debt

Cost of debt is the after tax cost of long-term funds

through borrowing. The debt carries a certain rate of

interest. Interest qualifies for tax deduction in

determining tax liability. Therefore, the effective cost

of debt is less than the actual interest payment made

by the firm by the amount of tax shield it provides.

The debt can be either

1) Perpetual/ irredeemable Debt

2) Redeemable Debt

Dr. Amit Gupta

Perpetual Debt

In the case of perpetual debt, it is computed dividing effective interest

payment, i.e., I (1 t) by the amount of debt/sale proceeds of debentures or

bonds (SV). Symbolically

k

i

= Before-tax cost of debt

k

d

= Tax-adjusted cost of debt

I = Annual interest payment

SV = Sale proceeds of the bond/debenture

t = Tax rate

) 4 (

SV

t 1 I

k

) 3 (

SV

1

k

d

t

Dr. Amit Gupta

Solution

(i) Debt issued at par

Before-tax cost, k

i

= (Rs 10,000 / Rs 1,00,000) = 10 per cent

After-tax cost, k

d

= k

i

(1 t) = 10% (1 0.35) = 6.5 per cent

(ii) Issued at discount

Before-tax cost, k

i

= (Rs 10,000 / Rs 90,000) = 11.11 per cent

After-tax cost, k

d

= 11.11% (1 0.35) = 7.22 per cent

(iii) Issued at premium

Before-tax cost, k

i

= (Rs 10,000 / Rs 1,10,000) = 9.09 per cent

After-tax cost, k

d

= 9.09% (1 0.35) = 5.91 per cent

Example

A company has 10 per cent perpetual debt of Rs 1,00,000.

The tax rate is 35 per cent. Determine the cost of capital

(before tax as well as after tax) assuming the debt is issued

at (i) par, (ii) 10 per cent discount, and (iii) 10 per cent

premium.

Dr. Amit Gupta

Redeemable Debt

Dr. Amit Gupta

where I = Annual interest payment

RV = Redeemable value of debentures/debt

SV = Net sales proceeds from the issue of debenture/debt

(face value of debt minus issue expenses)

N

m

= Term of debt

f = Flotation cost

d = Discount on issue of debentures

pi = Premium on issue of debentures

pr = Premium on redemption of debentures

t = Tax rate

/2 SV RV

m

/N pi pr d f t 1 I

d

k

Yield to Maturity

n Yield to maturity (YTM) is a rate of return that measures the

total return of a bond/debenture (coupon/interest payments

as well as capital gain or loss) from the time of purchase

until maturity. The calculation of YTM takes into account

the current market price, the par value, coupon interest rates

and the time to maturity. It is also assumed in yield to maturity that

all coupons are reinvested at the same rate.

Dr. Amit Gupta

Yield to Maturity (Contd)

In the formula,

P

0

= issue price of debt

I

t

= the interest paid on debt

P

n

= repayment of debt on maturity

Y = yield or return to maturity

Dr. Amit Gupta

Yield to Maturity (Contd)

We can also use the shortcut formula to calculate yield to maturity:

where YTM = yield to maturity

I

t

= interest paid on debt

M = par or maturity value of debt or redemption value

P

b

= debts issue price or its purchase price or net realized value

M P

b

= Debt premium

N = life of debt or number of years to maturity

Dr. Amit Gupta

Yield to Maturity: An Example

ABC Ltd issues bonds of par value INR 2000 at 12 per cent interest,

on 8 per cent discount for 10 years, calculate its yield to maturity.

Solution

Dr. Amit Gupta

Dr. Amit Gupta

Cost of Preference Shares

The cost of preference share (k

p

) is akin to k

d

.

However, unlike interest payment on debt, dividend

payable on preference shares is not tax deductible

from the point of view assessing tax liability. On the

contrary, tax (D

t

) may be required to be paid on the

payment of preference dividend.

n Irredeemable Preference Shares

n Redeemable Preference Shares

Dr. Amit Gupta

Irredeemable Preference Shares

The cost of preference shares in the case of irredeemable

preference shares is based on dividends payable on them and the

sale proceeds obtained by issuing such preference shares, P

0

(1

f ). In terms of equation:

where k

p

= Cost of preference capital

D

p

= Constant annual dividend payment

P

0

= Expected sales price of preference shares

f = Flotation costs as a percentage of sales price

D

t

= Tax on preference dividend

f P

D D

k

f P

D

K

t p

p

p

p

1

1

1

0

0

Dr. Amit Gupta

Example

A company issues 11 per cent irredeemable preference shares of the face

value of Rs 100 each. Flotation costs are estimated at 5 per cent of the

expected sale price. (a) What is the k

p

, if preference shares are issued at (i)

par value, (ii) 10 per cent premium, and (iii) 5 per cent discount? (b) Also,

compute k

p

in these situations assuming 13.125 per cent dividend tax

Solution

% 2 . 12

05 . 0 1 95 Rs

11 Rs

) iii (

% 5 . 10

05 . 0 1 110 Rs

11 Rs

) ii (

% 6 . 11

05 . 0 1 100 Rs

11 Rs

) i ( ) a (

p

p

p

k

Discount at Issued

k

Premium at Issued

k

par at Issued

% 8 . 13

25 . 90 Rs

44 . 12 Rs

) iii (

% 9 . 11

5 . 104 Rs

44 . 12 Rs

) ii (

% 1 . 13

95 Rs

44 . 12 Rs ) 13125 . 1 ( 11 Rs

) i ( ) b (

p

p

p

k

Discount at Issued

k

Premium at Issued

k

par at Issued

Cost of Redeemable Preference Shares

Where k

p

is the cost of preference share, D

t

is the dividend, P

0

is the

issue price of preference share, P

n

is the redemption price, n is the

maturity period.

Like redeemable debt we can also use the shortcut formula for

calculating cost of preference shares:

Dr. Amit Gupta

Cost of Redeemable Preference Shares

(Contd)

In the formula,

k

p

= cost of preference shares,

M = par or maturity value of preference shares or redemption value,

P

b

= preference shares issue price or its purchase price or net

realized value,

M - P

b

= share premium,

N = life of preference shares or no. of years to maturity

Dr. Amit Gupta

Dr. Amit Gupta

The computation of cost of equity capital (k

e

) is

conceptually more difficult as the return to the equity-

holders solely depends upon the discretion of the

company management. It is defined as the minimum

rate of return that a corporate must earn on the

equity-financed portion of an investment project in

order to leave unchanged the market price of the

shares. There are two approaches to measure k

e

:

1) Dividend Valuation Model Approach

2) Capital Asset Pricing Model (CAPM) Approach.

Cost of Equity Capital

Dr. Amit Gupta

As per the dividend approach, cost of equity capital is defined as the

discount rate that equates the present value of all expected future

dividends per share with the net proceeds of the sale (or the current

market price) of a share.

The cost of equity capital can be measured with the following equation:

(A) When dividends are expected to grow at a uniform rate perpetually:

where D

1

= Expected dividend per share

P

0

= Net proceeds per share/current market price

g = Growth in expected dividends

Dividend Valuation Approach

g

P

D

k

0

1

e

Dr. Amit Gupta

(B) Under different growth assumptions of dividends over the

years:

years later in growth Constant g

years earlier in growth of Rate whereg

k 1

g 1 D

k 1

g 1 D

P

c

b

n

1 t 1 n t

t

e

1 t

c n

t

e

1 t

b 0

0

Dr. Amit Gupta

Example 6

Suppose that dividend per share of a firm is expected to be Re 1 per share

next year and is expected to grow at 6 per cent per year perpetually.

Determine the cost of equity capital, assuming the market price per share is

Rs 25.

Solution: This is a case of constant growth of expected dividends. The k

e

can

be calculated by using Equation

The dividend approach can be used to determine the expected

market value of a share in different years. The expected value of a

share of the hypothetical firm in Example 6 at the end of years 1 and

2 would be as follows

% 10 06 . 0

25 Rs

1 Rs

g

0

P

1

D

e

k

28 Rs

0.06 0.10

1.124 Rs

g

e

k

3

D

2

P (ii)

26.50 Rs

0.06 0.10

1.06 Rs

g

e

k

2

D

)

1

(P year first the of end the at Price (i)

Dr. Amit Gupta

Example 7

From the undermentioned facts determine the cost of equity shares of

company X:

(i) Current market price of a share = Rs 150.

(ii) Cost of floatation per share on new shares, Rs 3.

(iii) Dividend paid on the outstanding shares over the past five years:

Year Dividend per share

1

2

3

4

5

6

Rs 10.50

11.02

11.58

12.16

12.76

13.40

(iv) Assume a fixed dividend pay out ratio.

(v) Expected dividend on the new shares at the end of the current year is Rs

14.10 per share.

Dr. Amit Gupta

Solution

As a first step, we have to estimate the growth rate in

dividends. Using the compound interest table (Table A-1), the

annual growth rate of dividends would be approximately 5 per

cent. (During the five years the dividends have increased from

Rs 10.50 to Rs 13.40, giving a compound factor of 1.276, that is,

Rs 13.40/Rs 10.50. The sum of Re 1 would accumulate to Rs

1.276 in five years @ 5 per cent interest).

% 6 . 14 % 5

3 Rs 150 Rs 147 Rs

10 . 14 Rs

k

e

Dr. Amit Gupta

CAPITAL ASSET PRICING MODEL

(CAPM) APPROACH

The CAPM describes the relationship between the required rate of return or

the cost of equity capital and the non-diversifiable or relevant risk of the

firm as reflected in its index of non-diversifiable risk, that is, beta.

Symbolically,

K

e

= R

f

+ b (K

m

R

f

)

R

f

= Required rate of return on risk-free investment

b = Beta coefficient**, and

K

m

= Required rate of return on market portfolio, that is, the average rate or

return on all assets

Dr. Amit Gupta

Example 8

The Hypothetical Ltd wishes to calculate its cost of equity

capital using the capital asset pricing model approach. From

the information provided to the firm by its investment advisors

along with the firms own analysis, it is found that the risk-free

rate of return equals 10 per cent; the firms beta equals 1.50

and the return on the market portfolio equals 12.5 per cent.

Compute the cost of equity capital.

Solution

K

e

= 10% + [1.5 (12.5% 10%)] = 13.75 per cent

Dr. Amit Gupta

Example 9: As an investment manager you are given the following

information

Investment in equity

shares of

Initial

price

Dividends Year-end

market price

Beta risk

factor

A Cement Ltd

Steel Ltd

Liquor Ltd

B Government of India

Bonds

Risk-free return, 8 per cent

Rs 25

35

45

1,000

Rs 2

2

2

140

Rs 50

60

135

1,005

0.80

0.70

0.50

0.99

You are required to calculate (i) expected rate of returns of market portfolio,

and (ii) expected return in each security, using capital asset pricing model

Dr. Amit Gupta

Solution

(i) Expected Returns on Market Portfolio

Security Return Investment

Dividends Capital

Appreciation

Total

A Cement Ltd

Steel Ltd

Liquor Ltd

B Government

of India Bonds

Rs 2

2

2

140

146

Rs 25

25

90

5

145

Rs 27

27

92

145

291

Rs 25

35

45

1,000

1.105

Rate of return (expected) on market portfolio = Rs 291/Rs 1,105 = 26.33 per

cent

(ii) Expected Returns on Individual Security (in percent)

k

e

= R

f

+ b(k

m

R

f

)

Cement Ltd = 8% + 0.8 (26.33% 8%) 22.66

Steel Ltd = 8% + 0.7 (26.33% 8%) 20.83

Liquor Ltd = 8% + 0.5 (26.33% 8%) 17.16

Government of India Bonds = 8% + 0.99 (26.33% 8%) 26.15

Capital Asset Pricing Model

Assume that R

f

is 9 per cent and R

m

is 18 per cent. If a

security has a beta factor of: (a) 1.4, (b) 1.0 and (c) 2.3,

determine the expected return of the security.

Solution

Dr. Amit Gupta

Capital Asset Pricing Model

Using the information in the table below, calculate the market

portfolio return and the expected return on security using CAPM.

The risk-free return is 14 per cent.

Dr. Amit Gupta

Capital Asset Pricing Model

Solution

The table below shows the returns on the portfolio:

Dr. Amit Gupta

Capital Asset Pricing Model

Dr. Amit Gupta

Dr. Amit Gupta

The capital assets pricing model (CAPM) approach to calculate the

cost of equity capital is different from the dividend valuation

approach in some respects. In the first place, the CAPM approach

directly considers the risk as reflected in beta in order to determine

the K

e

. The valuation model does not consider the risk; it rather uses

the market price as a reflection of the expected risk-return preference

of investors in the market.

Secondly, the dividend model can be adjusted for flotation cost to

estimate the cost of the new equity shares. The CAPM approach is

incapable of such adjustment as the model does not include the

market price which has to be adjusted.

Both the dividend and CAPM approaches are theoretically sound. But

major problems are encountered in the practical application of the

CAPM approach in collecting datawhich may not be readily

available or in a country like India may be altogether absent

regarding expected future returns, the most appropriate estimate of

the risk-free rate and the best estimates of the securitys beta.

Cost of Retained Earnings

n Cost of retained earnings is the required rate of return on

equity.

n Retained earnings is the earnings left after deducting

dividend payments and other provisions from profit after tax

(PAT).

n The cost of retained earnings (internal funds) is similar to the

cost of equity.

n Because shareholders forego their current income when they

allow the company to use the retained earnings in profitable

investments

Dr. Amit Gupta

Cost of Retained Earnings (Contd)

Generally, the cost of retained earnings is slightly less than the cost of

equity since no issuance costs are incurred. Floatation cost is

considered when determining the cost of equity. Retained earnings is

the residual earnings of a firm.

where k

e

is cost of equity, k

re

is the cost of retained earnings and

f is the floatation cost.

Dr. Amit Gupta

Weighted Average Cost of

Capital (WACC)

n The capital that a company procures is derived from

various sources.

n Each source of capital has a distinct cost attached

to it.

n The overall cost of capital is termed as weighted

average cost of capital (WACC).

Dr. Amit Gupta

Weighted Average Cost of Capital (Contd)

WACC is calculated by multiplying the cost of each capital

component by its proportional weighting and then

summing them.

Thus,

WACC = w

d

(cost of debt) + w

s

(cost of equity) + w

p

(cost

of preferred stock)+ w

re

(cost of retained earnings)

Where w

d

is weight of debt, w

s

is weight of equity, w

p

is

weight of preference shares, w

re

is weight of retained

earnings.

Dr. Amit Gupta

Weighted Average Cost of

Capital: An Example

Calculate the weighted average cost of capital from the figures

shown in the table below:

Dr. Amit Gupta

Weighted Average Cost of

Capital: An Example (Contd)

Solution

Market prices are INR 1,050 for bonds, INR 65.00 for common stock and

INR 35.00 for preferred stock. Total market values are calculated as follows:

Long-term debt = 5,000 INR 1,050 INR 5,250,000

Common stock = 62,500 INR 65.00 INR 4,062,500

Preferred stock = 20,000 INR 35.00 INR 7,00,000

Since retained earnings have a market value closely tied to the common

stock, we will allocate the common stock market value between the

common stock and the retained earnings based on the book values.

Common stock = INR 40,62,500 (INR 2,500,000/INR 3,250,000)

= INR 3,125,000

Retained earnings = INR 40,62,500 (INR 7,50,000/INR 3,250,000)

= INR 9,37,500

Dr. Amit Gupta

Weighted Average Cost of

Capital: An Example (Contd)

The weighted average cost of capital is calculated as shown in the

table below:

Dr. Amit Gupta

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Corporate Law - Case Comment On Rupak Gupta v. UP Hotels Ltd.Document12 pagesCorporate Law - Case Comment On Rupak Gupta v. UP Hotels Ltd.Harsh Gautam100% (1)

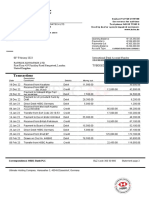

- HSBC Bank StatemeDocument1 pageHSBC Bank StatemeHamad Falah100% (1)

- SS 07 Quiz 1 - Answers PDFDocument130 pagesSS 07 Quiz 1 - Answers PDFjusNo ratings yet

- BW Resources Stock ManipulationDocument4 pagesBW Resources Stock ManipulationFrFlordian100% (1)

- Structuring Introduction To Luxembourg Alternative Investment Vehicles (PWC)Document21 pagesStructuring Introduction To Luxembourg Alternative Investment Vehicles (PWC)pierrefranc100% (1)

- Shares of Stock, Subscription Agreement, Stock Certificate A. Subscription Consideration Watered Stock Trust Fund DoctrineDocument26 pagesShares of Stock, Subscription Agreement, Stock Certificate A. Subscription Consideration Watered Stock Trust Fund Doctrinenik_aNo ratings yet

- 202 824 1 PBDocument12 pages202 824 1 PBZihr EllerycNo ratings yet

- Apply Loan RHBDocument13 pagesApply Loan RHBaida_faisal81No ratings yet

- Sample 2307Document4 pagesSample 2307kaysNo ratings yet

- Annual Report 2019-20 FRLDocument179 pagesAnnual Report 2019-20 FRLBhavin KariaNo ratings yet

- Terms and Condition: 1. Sharing of Data With IBLDocument3 pagesTerms and Condition: 1. Sharing of Data With IBLChannaNo ratings yet

- IFRS17 Replaces IFRS4Document10 pagesIFRS17 Replaces IFRS4Micaella DanoNo ratings yet

- Business Analysis AssignmentDocument27 pagesBusiness Analysis AssignmentMavlonbek SolievNo ratings yet

- Financial Management Project AnalysisDocument10 pagesFinancial Management Project AnalysisAlisha Shaw0% (1)

- Lecture 1A - Introduction, Agency and Financial MarketsDocument54 pagesLecture 1A - Introduction, Agency and Financial MarketsJackieNo ratings yet

- TSPC Q4 2021 FSDocument91 pagesTSPC Q4 2021 FSPanama TreasureNo ratings yet

- Walter's Model Formula: Unit - Iv Part - C Problems and SolutionsDocument3 pagesWalter's Model Formula: Unit - Iv Part - C Problems and SolutionsHarihara PuthiranNo ratings yet

- Corporate Governance and The Small and Medium Enterprises Sector Theory and ImplicationsDocument15 pagesCorporate Governance and The Small and Medium Enterprises Sector Theory and ImplicationsHassan ZareenNo ratings yet

- Tutorial Letter 103/0/2021: International Group and Financial AccountingDocument45 pagesTutorial Letter 103/0/2021: International Group and Financial AccountingMilton MakhubelaNo ratings yet

- Public DepositDocument9 pagesPublic DepositHeavy Gunner100% (3)

- 15 LasherIM Ch15Document14 pages15 LasherIM Ch15advaniamrita67% (3)

- Installment Sales 1Document2 pagesInstallment Sales 1Jamie RamosNo ratings yet

- E 191 Annual Report 2017-2018Document224 pagesE 191 Annual Report 2017-2018Malvin TanNo ratings yet

- 2020 Partnership Tax ReturnDocument18 pages2020 Partnership Tax ReturnEdwin Altamiranda100% (2)

- Total P 1,200,000: Refer PDF Problem 1Document2 pagesTotal P 1,200,000: Refer PDF Problem 1Joanna Rose DeciarNo ratings yet

- Options ProblemsDocument11 pagesOptions Problemsbts trashNo ratings yet

- Universitas Gajayana Malang. IndonesiaDocument11 pagesUniversitas Gajayana Malang. IndonesiaSri wahyuniNo ratings yet

- 12sYFXIAO5OpbOO6X9JBXSLDSypIiR8ZC (1) - 230314 - 112123 PDFDocument57 pages12sYFXIAO5OpbOO6X9JBXSLDSypIiR8ZC (1) - 230314 - 112123 PDFNitu YadavNo ratings yet

- Gross Profit Method Estimates InventoryDocument18 pagesGross Profit Method Estimates InventoryRigine Pobe MorgadezNo ratings yet

- Determine and Dispose of Underapplied or Overapplied Overhead - Principles of Accounting, Volume 2 - Managerial AccountingDocument9 pagesDetermine and Dispose of Underapplied or Overapplied Overhead - Principles of Accounting, Volume 2 - Managerial AccountingAllur Sai Vijay KumarNo ratings yet