Professional Documents

Culture Documents

Pension PROCRSS (Revised)

Uploaded by

Yasir ZahoorOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

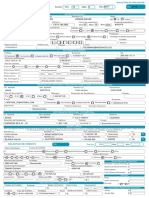

Pension PROCRSS (Revised)

Uploaded by

Yasir ZahoorCopyright:

Available Formats

Pension Commutation

Retiring benefits of employees

consist of two elements.

Pension

Commutation/Gratuity

Pension is paid monthly while

commutation is one time lump sum

payment at the time of retirement.

What is Commutation

Commutationof Pension means

payment of lump sum amount in lieu

of a portion of pension

surrenderedvoluntarily by the

pensioner based on a duration of

period in relation to the age

After attaining the age of 73 / 75, the

commuted portion is restored and

added in the current Pension amount.

2

Basis of Pension and Commutation Calculation

Pension Calculation Formula

Gross Pension = 70 % of Pensionable Emoluments x No. of Qualifying

Service years* /30

*(No. Of Qualifying Service taken 10 to 30 years maximum)

e.g. If Pensionable Emoluments = Rs 9240 ,Service Period=23yrs then

Gross Pension

=70% x 9240 x 23 / 30

= 4959

Commutation Calculation Formula

Commutation = Commutation Rate x Gross Pension x Rate as per Age

Next Birthday x 12

Commutation Rate as Per Scale Adopted

SCALES

01-07-2008

01-122001

01-07-1986

BEFORE

1986

COMMUTATIO

N

35 %

40 %

50 %

25 %

Gratuity

(Compulsory

)

NET PENSION

65 %

60 %

50 %

25 %

Commutatio

n (Optional)

NOTE : Restoration of Commuted portion of Pension had been

discontinued with effect from 01-12-2001

Calculation of Net Pension & Commutation (1986 Scale)

In the given example Pensioner adopted 1986 Scales and Gross Pension is 4959

and Age next to Birthday is 58 years

Therefore :

Net Pension

=

=

Commutation =

=

50% of Gross Pension

50% x 4959 = 2479.5

50% of Gross Pension

50% x 4959 = 2479.5

Commutation Rate (1986 Scale)

Commutation Calculation Formula

Commutation = Commutation Rate x Gross Pension x Rate as

per Age Next Birthday x 12

= 50% x 4959 x 16.7925 x 12

= Rs 499644/-

Calculation of Net Pension & Commutation (2001 Scale)

In the given example Pensioner adopted 2001 Scales and Gross Pension is 4959

and Age next to Birthday is 58 years

Therefore :

Net Pension

=

=

Commutation =

=

60% of Gross Pension

60% x 4959 = 2975.4

40% of Gross Pension

40% x 4959 = 1983.6

Commutation Rate Table (2001 Scale)

Commutation Calculation Formula

Commutation = Commutation Rate x Gross Pension x Rate as

per Age Next Birthday x 12

= 40% x 4959 x 13.434 x 12

= Rs 319,772/-

10

11

Present Practice

After attaining the age of 75 years, the

pensioners retired before December 2, 2001 are

entitled to receive the commuted portion of the

pension along with their existing Pension e.g. If

Pension at the time of retirement was Rs.65 and

commuted portion was Rs.35 then at the age of

75, if Pension becomes with annual pension

increases Rs.200, the commuted portion of Rs.35

becomes part of Pension which means now

Pensioner will be getting Rs.235 per month.

12

Commutation Issue

A Government Pensioner filed writ petition in Lahore High Court to apply

Pension

increases on commuted portion and add it to existing pension.

Petition decided in Pensioners favor despite the ICA filed by Deputy

accountant

General and appeal from Federation of Pakistan.

PTET pensioners also filed petition in Lahore high court.

LHC decided PTET Pensioners appeal in the light of already decided case and

mentioned

that this petition is allowed strictly in terms of the aforesaid reported

judgment.

PTET filed Intra Court Appeal in Lahore High court and the matter is subjudice

13

Commutation Restoration Impact

Total Pensioners11,718

=

14

Double Pension Calculation

Example

15

Thanks

16

You might also like

- Stakeholder Analysis FromMichelleDocument5 pagesStakeholder Analysis FromMichelleYasir ZahoorNo ratings yet

- Project Manager OPSDocument1 pageProject Manager OPSYasir ZahoorNo ratings yet

- UAN - Islamabad 051-111-999-333 UAN - Lahore 042-111-999-333Document5 pagesUAN - Islamabad 051-111-999-333 UAN - Lahore 042-111-999-333Yasir ZahoorNo ratings yet

- ViriSys ServicesDocument4 pagesViriSys ServicesYasir ZahoorNo ratings yet

- Doc00-14 Doc CNTL - MGTDocument11 pagesDoc00-14 Doc CNTL - MGTYasir ZahoorNo ratings yet

- SairaDocument2 pagesSairaYasir ZahoorNo ratings yet

- Faysal Bank installment calculation sheet for auto loanDocument1 pageFaysal Bank installment calculation sheet for auto loanYasir ZahoorNo ratings yet

- Ptet Re Org Act 1996Document41 pagesPtet Re Org Act 1996Yasir ZahoorNo ratings yet

- UNDERTAKING Regarding ConfidentialityDocument1 pageUNDERTAKING Regarding ConfidentialityYasir ZahoorNo ratings yet

- Learn MS ExcelDocument61 pagesLearn MS ExcelAnushree ChatterjeeNo ratings yet

- Ji Sommer ResumeDocument8 pagesJi Sommer ResumeYasir ZahoorNo ratings yet

- InstallDocument1 pageInstallYasir ZahoorNo ratings yet

- HR Emp Move Jan 13 To Dec 14Document1 pageHR Emp Move Jan 13 To Dec 14Yasir ZahoorNo ratings yet

- FTP server status checks and commandsDocument1 pageFTP server status checks and commandsYasir ZahoorNo ratings yet

- Doc00-14 Doc CNTL - MGTDocument11 pagesDoc00-14 Doc CNTL - MGTYasir ZahoorNo ratings yet

- Surf Excel Short ReportDocument13 pagesSurf Excel Short ReportTEJU100% (2)

- Animation Production FacilityDocument17 pagesAnimation Production FacilityFaizan AhmedNo ratings yet

- Surf Excel Short ReportDocument9 pagesSurf Excel Short ReportYasir ZahoorNo ratings yet

- Building A Knowledge and Innovation Society: Prof - Atta-ur-Rahman, FRSDocument50 pagesBuilding A Knowledge and Innovation Society: Prof - Atta-ur-Rahman, FRSYasir ZahoorNo ratings yet

- Challenges Migrating Forms 10gDocument6 pagesChallenges Migrating Forms 10gmarif97No ratings yet

- Federal Health IT Strategic Plan, 2011 - 2015Document80 pagesFederal Health IT Strategic Plan, 2011 - 2015ONC for Health Information TechnologyNo ratings yet

- SummaryDocument1 pageSummaryYasir ZahoorNo ratings yet

- Oracle DBA Scripts One in AllDocument143 pagesOracle DBA Scripts One in AllYasir Zahoor92% (12)

- Oracle DBA Scripts One in AllDocument143 pagesOracle DBA Scripts One in AllYasir Zahoor92% (12)

- Software Requirements SpecificationDocument24 pagesSoftware Requirements SpecificationYasir ZahoorNo ratings yet

- 09.Project-Hospital Management SystemDocument50 pages09.Project-Hospital Management SystemRajeev Ranjan89% (91)

- Process Modeling: N. L. Sarda I.I.T. BombayDocument33 pagesProcess Modeling: N. L. Sarda I.I.T. BombayYasir ZahoorNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5783)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Chapter 1: Introduction BackgroundDocument19 pagesChapter 1: Introduction BackgroundUtsav MehtaNo ratings yet

- 12 PensionDocument4 pages12 PensionMichael BongalontaNo ratings yet

- RETIREMENT BENEFITS EXPLAINEDDocument5 pagesRETIREMENT BENEFITS EXPLAINEDYusufNo ratings yet

- Budgeting For Housekeeping Expenses: Budget & Budgetary Control Prepared By: Neha Bengale Arpita AnvekarDocument21 pagesBudgeting For Housekeeping Expenses: Budget & Budgetary Control Prepared By: Neha Bengale Arpita AnvekarTina Tahilyani�No ratings yet

- Colegio Parroquial Santa Rosa de Lima letterDocument13 pagesColegio Parroquial Santa Rosa de Lima letterAlexander AquijeNo ratings yet

- Gri g4 Worksheet Envirocip v1 3Document120 pagesGri g4 Worksheet Envirocip v1 3huyen1988No ratings yet

- Pension Papers ProformaDocument12 pagesPension Papers Proformasajidnazir56No ratings yet

- Sss - Gsis TableDocument4 pagesSss - Gsis Tablemark_somNo ratings yet

- Handout 3.0 ACC 226 Sample Problems Employee BenefitsDocument12 pagesHandout 3.0 ACC 226 Sample Problems Employee BenefitsLyncee BallescasNo ratings yet

- Financial Ombudsman Claim DRN7791511Document12 pagesFinancial Ombudsman Claim DRN7791511hyenadogNo ratings yet

- Code of ConductDocument35 pagesCode of ConductBolawole BaiyewuNo ratings yet

- Three categories of unclaimed moneys under Unclaimed Moneys Act 1965Document3 pagesThree categories of unclaimed moneys under Unclaimed Moneys Act 1965Syazwani RazakNo ratings yet

- Man and SocietyDocument2 pagesMan and SocietyAnett Szegleti100% (4)

- Amendments To A.P. Treasury Code Volume-I - Orders-GO.214-Dt.21!11!2014Document5 pagesAmendments To A.P. Treasury Code Volume-I - Orders-GO.214-Dt.21!11!2014Bg Ha100% (3)

- West Bengal Services Death-cum-Retirement Benefit Rules-1971 PDFDocument127 pagesWest Bengal Services Death-cum-Retirement Benefit Rules-1971 PDFচক্রকূট ভট্টাচার্যNo ratings yet

- National Pensions Scheme Authority ACT ZambiaDocument41 pagesNational Pensions Scheme Authority ACT Zambiaachikungu2225100% (1)

- Credito Edwin GuzmanDocument2 pagesCredito Edwin GuzmanCarol Milena Arias MontoyaNo ratings yet

- Pay SlipDocument1 pagePay SlipAnonymous QrLiISmpF100% (1)

- Women, Business and The Law 2022Document158 pagesWomen, Business and The Law 2022macarenaNo ratings yet

- Memorandum to Seventh Central Pay CommissionDocument266 pagesMemorandum to Seventh Central Pay CommissionTvs ReddyNo ratings yet

- LIC Pension Rules SummaryDocument37 pagesLIC Pension Rules SummarysheetalNo ratings yet

- M10 Employee BenefitsDocument51 pagesM10 Employee BenefitsbelijobNo ratings yet

- DTC Agreement Between Netherlands and TurkeyDocument29 pagesDTC Agreement Between Netherlands and TurkeyOECD: Organisation for Economic Co-operation and DevelopmentNo ratings yet

- Permanent Negotiating MachineryDocument17 pagesPermanent Negotiating MachineryscrlesectionNo ratings yet

- R06-Financial Planning Practice: Case Studies - April 2012Document2 pagesR06-Financial Planning Practice: Case Studies - April 2012VeronicaNo ratings yet

- Taxation Important Q's CAtestseriesDocument358 pagesTaxation Important Q's CAtestseriessarvan kumarNo ratings yet

- G.O. Relating To Revised Pay On 7th Pay Commission PDFDocument13 pagesG.O. Relating To Revised Pay On 7th Pay Commission PDFDeepak StallioneNo ratings yet

- Pension PlanDocument49 pagesPension PlanPriscilla TranNo ratings yet

- Benefits of SocsoDocument4 pagesBenefits of SocsoAdam HafizNo ratings yet

- Panta budget schedules for production, materials, laborDocument10 pagesPanta budget schedules for production, materials, laborFiles OrganizedNo ratings yet