Professional Documents

Culture Documents

Portfolio Evaluation Tools For Insurance

Uploaded by

Aks Sinha0 ratings0% found this document useful (0 votes)

112 views12 pagesEVALUATION TOOLS

Original Title

Portfolio Evaluation Tools for Insurance

Copyright

© © All Rights Reserved

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentEVALUATION TOOLS

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

112 views12 pagesPortfolio Evaluation Tools For Insurance

Uploaded by

Aks SinhaEVALUATION TOOLS

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You are on page 1of 12

PORTFOLIO EVALUATION

TOOLS IN INSURANCE

Portfolios contain groups of securities that are selected

to achieve the highest return for a given level of risk.

How well this is achieved depends on how well the

portfolio manager or investor is able to forecast

economic conditions and the future prospects of

companies, and to accurately assess the risk of each

security under consideration.

Many investors and some portfolio managers adopt a

passive portfolio management strategy by simply

holding a basket of securities that is weighted to reflect

a market index, or by buying securities based on a

market index, such as most exchange traded funds.

Some investors and portfolio managers think they can

do better than the market, and so engage in active

portfolio management, buying and selling securities

as conditions change.

Investment Considerations for Portfolio

Decisions

Investment Objective

Capital Preservation

Moderate

Moderate Growth

Growth

Aggressive Growth

Time Horizon

Short term

Long term

Income desired

Income withdrawal

Fund generation

Risk Tolerance

Risk tolerance questionnaire

Risk tolerance profile preparation through score

Measuring Portfolio Returns

Portfolio returns come in the form of current

income and capital gains.

Current income includes dividends on stocks and

interest payments on bonds.

A capital gain or capital loss results when a

security is sold, and is equal to the amount of the

sale price minus the purchase price.

Portfolio Evaluation Tools

There are several Portfolio evaluation tools for

comparing portfolio returns with each other and

with the market in general.

There are 3 common tools that measure a

portfolios risk return tradeoff:

1. Sharpes ratio

2. Treynors ratio

3. Jensens Alpha.

The Sharpes ratio (or Sharpe's measure), developed

by William F. Sharpe, is the ratio of a portfolios total

return minus the risk free rate divided by the standard

deviation of the portfolio, which is a measure of its risk.

Sharpe Ratio = Risk Premium / Standard Deviation of

Portfolio

Where Risk Premium = Total Portfolio Return Riskfree Rate

Higher the Sharpe ratio, better the performance and the

greater the profits for taking on additional risk

For Example Portfolio return percentage- 10, risk free

rate-4, standard deviation-8

Sharpes Ratio= 10-4/8

= 75%

Treynors ratio, popularized by Jack L. Treynor,

compares the portfolio risk premium to the

systematic risk of the portfolio as measured by its

beta.

Treynor Ratio = Risk Premium / Portfolio Beta

Where Risk Premium = Total Portfolio Return Riskfree Rate

Note that since the beta of the general market is

defined to be 1, the Treynor Ratio of the market

would be equal to its return minus the risk free rate.

For Example Portfolio return percentage- 10, risk

free rate-4, Beta-1.2

Treynor Ratio = 10-4/1.2

= 5 times

Jensens alpha (or Jensens index), developed by

Michael C. Jensen, uses the excess return of a

portfolio over its required return, or its expected

return, for its expected risk as measured by its

beta.

Jensens Alpha = Total Portfolio Return RiskFree Rate

[Portfolio Beta (Market Return RiskFree Rate)]

Higher alphas are more desirable.

Example: Portfolio return = 12%, market return

rate = 8%, beta = 1.4, risk free rate = 2%

Jensen's alpha = 12 2 1.4 ( 8 2 ) = 10 1.4 6 = 10

8.4 = 1.6 times

RISK ADJUSTED PERFORMANCE

MEASURES

Risk adjusted performance measures compare the

return on capital to the risk taken to earn this

return i.e. some kind of risk-adjustment is adopted

It is measured either by absolute returns or by

relative returns

Such measures are important as Investors need an

effective tool to evaluate the respective performance

of the various funds compared to the risk taken by

the fund managers to choose the right option for

capital allocation

Risk-adjusted performance measures are

gradually replacing traditional performance

measures like Return on Equity (ROE) or Return

on Investment (ROI) when it comes to analyzing

performance in financial contexts as these

traditional measures do not take into account

risk.

It helps the management of financial institutions

to evaluate the risk-adjusted performance of their

business units, traders or investment portfolios.

Performance Measures based on Volatility

Sharpe Ratio

Adjusted Sharpe Ratio

Performance Measures based on Value-at-Risk

Excess Return on Value-at-Risk

Conditional Sharpe Ratio

Modified Sharpe Ratio

Performance Measures based on Lower Partial

Moments

Omega

Sortino Ratio

Kappa 3

Gain-Loss Ratio and Upside-Potential Ratio

Farinelli-Tibiletti Ratio

Performance Measures based on Drawdown

Calmar Ratio

Sterling Ratio

Burke Ratio

Performance Measures based on Valueat-Risk

Excess Return on Value-at-Risk: VaR measures the

worst expected loss over a given time horizon with a

certain confidence level (95%).

Conditional Sharpe Ratio: Overcome the

shortcoming of VaR, which does not consider losses

outside of the confidence interval. Tries to limit the

losses in 100% cases.

Modified Sharpe Ratio: Improvement over above two

methods. Adjust skewness and kurtosis of distribution

related to data collected in above mentioned ratio

calculation through empirical information.

You might also like

- Portfolio ManagementDocument36 pagesPortfolio Managementrajujaipur1234No ratings yet

- Techniques For Portfolio Management and EvaluationDocument27 pagesTechniques For Portfolio Management and Evaluationkelvinyessa906No ratings yet

- Performance Evaluation Measures of PortfolioDocument16 pagesPerformance Evaluation Measures of PortfolioMini JainNo ratings yet

- Chapter 6 - Portfolio Evaluation and RevisionDocument26 pagesChapter 6 - Portfolio Evaluation and RevisionShahrukh ShahjahanNo ratings yet

- TanviDocument16 pagesTanviHiren Choksi100% (1)

- Investment Analysis and Portfolio Management (ACFN 632) : Chapter 5 - Performance EvaluationDocument25 pagesInvestment Analysis and Portfolio Management (ACFN 632) : Chapter 5 - Performance EvaluationhabtamuNo ratings yet

- Portfolio Selection Using Sharpe, Treynor & Jensen Performance IndexDocument15 pagesPortfolio Selection Using Sharpe, Treynor & Jensen Performance Indexktkalai selviNo ratings yet

- Risk and Return FundamentalsDocument30 pagesRisk and Return FundamentalsVaidyanathan Ravichandran0% (1)

- Group-3: Presented byDocument21 pagesGroup-3: Presented byRajasekar MuthukrishnanNo ratings yet

- Comparison of The RatiosDocument3 pagesComparison of The RatiosChristopher KipsangNo ratings yet

- Mutual Funds OldDocument12 pagesMutual Funds OldNeha VarmaNo ratings yet

- Evaluation of Portfolio Performance: Presented By: Mba 2E University of Caloocan CityDocument26 pagesEvaluation of Portfolio Performance: Presented By: Mba 2E University of Caloocan CityCarlo Niño GedoriaNo ratings yet

- Stock Market Investment Course - 3Document64 pagesStock Market Investment Course - 3N RajasubaNo ratings yet

- UMN - Charles P Jones - Lecture 12 (20110927)Document7 pagesUMN - Charles P Jones - Lecture 12 (20110927)QwikRabbitNo ratings yet

- Presenting: Equity ManagementDocument44 pagesPresenting: Equity ManagementMohamed HammadNo ratings yet

- 6205 LectureDocument27 pages6205 Lectureapi-3699305No ratings yet

- Investment Management: Chapter 5 - Performance EvaluationDocument25 pagesInvestment Management: Chapter 5 - Performance EvaluationyebegashetNo ratings yet

- 05 Risk-Return and Asset Pricing ModelsDocument75 pages05 Risk-Return and Asset Pricing ModelsNailiah MacakilingNo ratings yet

- FM - Session - 13-15 Risk and ReturnDocument22 pagesFM - Session - 13-15 Risk and ReturnshilpeeNo ratings yet

- Portfolio Performance EvaluationDocument15 pagesPortfolio Performance EvaluationMohd NizamNo ratings yet

- Moduel 4Document4 pagesModuel 4sarojkumardasbsetNo ratings yet

- Investment Analysis and Portfolio Management: Eighth Edition by Frank K. Reilly & Keith C. BrownDocument56 pagesInvestment Analysis and Portfolio Management: Eighth Edition by Frank K. Reilly & Keith C. BrownPayal MehtaNo ratings yet

- Risk and ReturnsDocument35 pagesRisk and ReturnsNo ElNo ratings yet

- Investment Decision and Portfolio Management (ACFN 524: Chapter 5 - Performance EvaluationDocument25 pagesInvestment Decision and Portfolio Management (ACFN 524: Chapter 5 - Performance EvaluationSnn News TubeNo ratings yet

- Chapter 7Document11 pagesChapter 7Seid KassawNo ratings yet

- PortfolioDocument25 pagesPortfoliosahilNo ratings yet

- Chapter 15 (Equity Portfolio Management Strategies)Document24 pagesChapter 15 (Equity Portfolio Management Strategies)Abuzafar Abdullah100% (1)

- Portfolio ManagementDocument33 pagesPortfolio ManagementNigus AberaNo ratings yet

- Portfolio Management: An Overview: Diversification RatioDocument17 pagesPortfolio Management: An Overview: Diversification RatioMayura Kataria100% (1)

- CH 2 Concept of Return and RiskDocument48 pagesCH 2 Concept of Return and RiskRanjeet sawNo ratings yet

- Portfolio Performance Appraisal: Ahtisham Zargar 1801cukmr05Document7 pagesPortfolio Performance Appraisal: Ahtisham Zargar 1801cukmr05ahtisham zargarNo ratings yet

- Portfolio Management 2023 Students' VersionDocument40 pagesPortfolio Management 2023 Students' VersionAram Shaban FATTAHNo ratings yet

- Session1 - Risk and ReturnNewDocument16 pagesSession1 - Risk and ReturnNewUtsav ThakkarNo ratings yet

- Chapter 9. Portfolio Revisionand EvaluationDocument21 pagesChapter 9. Portfolio Revisionand Evaluationnguyen tungNo ratings yet

- Portfolio EvaluationDocument19 pagesPortfolio EvaluationAKHIL SAVIOUR URK18COM039No ratings yet

- Portfolio ConstructionAnd AnalysisDocument74 pagesPortfolio ConstructionAnd AnalysisAbhishek KarekarNo ratings yet

- Borisagarharsh 62Document24 pagesBorisagarharsh 62Borisagar HarshNo ratings yet

- Investment Analysis and Portfolio Management: Evaluation of Portfolio PerformanceDocument45 pagesInvestment Analysis and Portfolio Management: Evaluation of Portfolio PerformanceJang WonyoungNo ratings yet

- Objective of A FirmDocument35 pagesObjective of A FirmShibin PaulNo ratings yet

- Ratio AnalysisDocument37 pagesRatio AnalysisKaydawala Saifuddin 20No ratings yet

- Chapter 6 - Portfolio Evaluation and Revision - KeyDocument26 pagesChapter 6 - Portfolio Evaluation and Revision - KeyShahrukh ShahjahanNo ratings yet

- BAF 462 Investment AnalysisDocument37 pagesBAF 462 Investment AnalysisLaston MilanziNo ratings yet

- Mbaasset Allocation - 2Document36 pagesMbaasset Allocation - 2Masirah Muhammed ZernaNo ratings yet

- Risk-Adjusted PerformanceDocument30 pagesRisk-Adjusted PerformanceVaidyanathan RavichandranNo ratings yet

- RiskDocument16 pagesRiskSujan SanjayNo ratings yet

- Portfolio Management Anshu, Jagriti, Mahima, DheryaDocument15 pagesPortfolio Management Anshu, Jagriti, Mahima, DheryaMahima BhatnagarNo ratings yet

- Portfolio Assignmen LastDocument8 pagesPortfolio Assignmen LastTilaye AleneNo ratings yet

- Personal FinanceDocument9 pagesPersonal FinanceAnubhav SoodNo ratings yet

- Portfoliomanagementppt 190401103934Document16 pagesPortfoliomanagementppt 190401103934Aparna MahapatraNo ratings yet

- Investment Analysis and Portfolio Management: Mutual FundsDocument32 pagesInvestment Analysis and Portfolio Management: Mutual FundsAsim JavedNo ratings yet

- Topic 6 WACCDocument43 pagesTopic 6 WACCsimfukwepascal812No ratings yet

- Must Business School: Mirpur University of Science and Technology (Must), Azad KashmirDocument48 pagesMust Business School: Mirpur University of Science and Technology (Must), Azad KashmirSadia KhanNo ratings yet

- Drawdown Analysis in Portfolio AnalysisDocument2 pagesDrawdown Analysis in Portfolio AnalysisShubhamNo ratings yet

- Portfolio Performance EvaluationDocument20 pagesPortfolio Performance Evaluationrajin_rammsteinNo ratings yet

- Asset Allocation Prof: Vinod Agarwal Ibs, MumbaiDocument29 pagesAsset Allocation Prof: Vinod Agarwal Ibs, Mumbaisanky23No ratings yet

- Portfolio RevisionDocument28 pagesPortfolio RevisionRaj YadavNo ratings yet

- Portfolio MGTDocument13 pagesPortfolio MGTmaddy_muksNo ratings yet

- Research Equity-Portfolio-Management-StrategiesDocument10 pagesResearch Equity-Portfolio-Management-StrategiesOla AtefNo ratings yet

- Bogdan Bilaus - PM For Institutional Investors PDFDocument22 pagesBogdan Bilaus - PM For Institutional Investors PDFAbhimanyuBhardwajNo ratings yet

- Tax Planning MergerDocument4 pagesTax Planning MergerAks SinhaNo ratings yet

- Benefits of Sunder KandDocument1 pageBenefits of Sunder KandAks SinhaNo ratings yet

- Cost and Management AccountingDocument18 pagesCost and Management AccountingAks SinhaNo ratings yet

- CMA Unit3Document17 pagesCMA Unit3Aks SinhaNo ratings yet

- Tax CLASS NOTESDocument17 pagesTax CLASS NOTESAks SinhaNo ratings yet

- Cost ManagementDocument13 pagesCost ManagementAks SinhaNo ratings yet

- Cost and Management AccountingDocument18 pagesCost and Management AccountingAks SinhaNo ratings yet

- Target Costing PresentationDocument14 pagesTarget Costing PresentationAks SinhaNo ratings yet

- Life Cycle CostingDocument9 pagesLife Cycle CostingAks SinhaNo ratings yet

- Cost and Management AccountingDocument29 pagesCost and Management AccountingAks SinhaNo ratings yet

- Methods of CostingDocument20 pagesMethods of CostingAks SinhaNo ratings yet

- Instant Food ReportDocument85 pagesInstant Food ReportAks SinhaNo ratings yet

- Indirect Tax Reforms in India and A Way Ahead For GSTDocument18 pagesIndirect Tax Reforms in India and A Way Ahead For GSTAks SinhaNo ratings yet

- Corporate Tax PlanningDocument10 pagesCorporate Tax PlanningAks Sinha100% (3)

- International Business EnvironmentDocument32 pagesInternational Business EnvironmentAks Sinha100% (1)

- Tax Planning and ManagementDocument23 pagesTax Planning and ManagementAks Sinha100% (2)

- Mr. Rakesh Kumar Mittal, IAS (Retd.) at SMS VaranasiDocument1 pageMr. Rakesh Kumar Mittal, IAS (Retd.) at SMS VaranasiAks SinhaNo ratings yet

- Naure and Scope of Consumer BehaviourDocument13 pagesNaure and Scope of Consumer BehaviourChandeshwar PaikraNo ratings yet

- Call Option Agreement Free SampleDocument2 pagesCall Option Agreement Free Sampleapi-235666177No ratings yet

- Walmart Assignment1Document13 pagesWalmart Assignment1kingkammyNo ratings yet

- Chap 9 Special Rules of Court On ADR Ver 1 PDFDocument8 pagesChap 9 Special Rules of Court On ADR Ver 1 PDFambahomoNo ratings yet

- Projectile Motion PhysicsDocument3 pagesProjectile Motion Physicsapi-325274340No ratings yet

- Semi-Detailed Lesson Plan in Tle (Cookery) Mhaylani O. Otanes-Flores 1 February 16, 2022 (Wednesday) 7 TLE-Cookery 1 10Document4 pagesSemi-Detailed Lesson Plan in Tle (Cookery) Mhaylani O. Otanes-Flores 1 February 16, 2022 (Wednesday) 7 TLE-Cookery 1 10Mhaylani Otanes100% (1)

- Dictums of Famous ArchitectsDocument3 pagesDictums of Famous ArchitectsErwin Ariola100% (2)

- Deborah Schiffrin .Tense Variation in NarrativeDocument19 pagesDeborah Schiffrin .Tense Variation in Narrativealwan61No ratings yet

- ) Mark Scheme (Results) January 2019: Pearson Edexcel International GCSE in Mathematics A (4MA1) Higher Tier Paper 1HRDocument22 pages) Mark Scheme (Results) January 2019: Pearson Edexcel International GCSE in Mathematics A (4MA1) Higher Tier Paper 1HRNewtonNo ratings yet

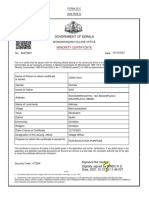

- Government of Kerala: Minority CertificateDocument1 pageGovernment of Kerala: Minority CertificateBI185824125 Personal AccountingNo ratings yet

- Consti II Case ListDocument44 pagesConsti II Case ListGeron Gabriell SisonNo ratings yet

- Edu 536 - Task A2 - pld5Document3 pagesEdu 536 - Task A2 - pld5api-281740174No ratings yet

- Lsp404 How To Write An Argumentative Essay NewDocument52 pagesLsp404 How To Write An Argumentative Essay Newagegae aegaegNo ratings yet

- Conspicuous Consumption-A Literature ReviewDocument15 pagesConspicuous Consumption-A Literature Reviewlieu_hyacinthNo ratings yet

- Allusions and References - 5Document3 pagesAllusions and References - 5Matthew HallingNo ratings yet

- English SutffDocument12 pagesEnglish SutffVictor AlmeidaNo ratings yet

- Health Assessment Finals Review Flashcards - QuizletDocument92 pagesHealth Assessment Finals Review Flashcards - QuizletViea Pacaco SivaNo ratings yet

- Live Leak - SSC CGL Tier II English Model Question Paper (Based On Predicted Pattern 2016)Document44 pagesLive Leak - SSC CGL Tier II English Model Question Paper (Based On Predicted Pattern 2016)Testbook BlogNo ratings yet

- Practice Test 12 Use of English I. Choose The Best AnswerDocument6 pagesPractice Test 12 Use of English I. Choose The Best AnswerJack NguyễnNo ratings yet

- Wallen Et Al-2006-Australian Occupational Therapy JournalDocument1 pageWallen Et Al-2006-Australian Occupational Therapy Journal胡知行No ratings yet

- 10 Proven GPAT Preparation Tips To Top PDFDocument7 pages10 Proven GPAT Preparation Tips To Top PDFALINo ratings yet

- People Vs GonaDocument2 pagesPeople Vs GonaM Azeneth JJ100% (1)

- Detailed Lesson Plan in Tle Grade 8Document7 pagesDetailed Lesson Plan in Tle Grade 8Hanna MikangcrzNo ratings yet

- Ansys Flu - BatDocument30 pagesAnsys Flu - BatNikola BoskovicNo ratings yet

- High Court Judgment On Ex Party DecreeDocument2 pagesHigh Court Judgment On Ex Party Decreeprashant pathakNo ratings yet

- 145class 7 Integers CH 1Document2 pages145class 7 Integers CH 17A04Aditya MayankNo ratings yet

- The Court of Heaven 1Document2 pagesThe Court of Heaven 1Rhoda Collins100% (7)

- ENVSOCTY 1HA3 - Lecture 01 - Introduction & Course Overview - Skeletal NotesDocument28 pagesENVSOCTY 1HA3 - Lecture 01 - Introduction & Course Overview - Skeletal NotesluxsunNo ratings yet

- Schedule Risk AnalysisDocument14 pagesSchedule Risk AnalysisPatricio Alejandro Vargas FuenzalidaNo ratings yet

- Math 209: Numerical AnalysisDocument31 pagesMath 209: Numerical AnalysisKish NvsNo ratings yet

- Karaf-Usermanual-2 2 2Document147 pagesKaraf-Usermanual-2 2 2aaaeeeiiioooNo ratings yet