Professional Documents

Culture Documents

Week1-Overview of Financial Institutions

Uploaded by

Huma Shahzadi0 ratings0% found this document useful (0 votes)

35 views16 pagesThe document discusses Pakistan's financial institutions. It outlines the traditional financial sector as comprising banks, insurance companies, investment companies, modarabas, leasing companies, mutual funds, and exchange companies. It then provides further details on banks, e-banking, privatization, Islamic banking, insurance companies, leasing companies, financial markets, bank finance for small- and medium-sized enterprises, and postscripts on agriculture credit, consumer loans, and non-bank financial institutions. The overall summary is that Pakistan's financial sector has grown in recent decades but still lags peers in financial deepening and needs further development.

Original Description:

Banking n finance first chapter

Copyright

© © All Rights Reserved

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document discusses Pakistan's financial institutions. It outlines the traditional financial sector as comprising banks, insurance companies, investment companies, modarabas, leasing companies, mutual funds, and exchange companies. It then provides further details on banks, e-banking, privatization, Islamic banking, insurance companies, leasing companies, financial markets, bank finance for small- and medium-sized enterprises, and postscripts on agriculture credit, consumer loans, and non-bank financial institutions. The overall summary is that Pakistan's financial sector has grown in recent decades but still lags peers in financial deepening and needs further development.

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

35 views16 pagesWeek1-Overview of Financial Institutions

Uploaded by

Huma ShahzadiThe document discusses Pakistan's financial institutions. It outlines the traditional financial sector as comprising banks, insurance companies, investment companies, modarabas, leasing companies, mutual funds, and exchange companies. It then provides further details on banks, e-banking, privatization, Islamic banking, insurance companies, leasing companies, financial markets, bank finance for small- and medium-sized enterprises, and postscripts on agriculture credit, consumer loans, and non-bank financial institutions. The overall summary is that Pakistan's financial sector has grown in recent decades but still lags peers in financial deepening and needs further development.

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You are on page 1of 16

Banking & Finance

An Overview

of

Financial

Institutions

By. Prof Riaz Ahmed Mian

An Overview of Financial Institutions

The traditional Pakistani financial sector comprises

of

Banks

Insurance Companies

Investment Companies

Modaraba

Leasing

Mutual Funds

Exchange Companies.

Prof. Riaz Ahmed Mian, HCBF, University of the Punjab

1

An Overview of Financial Institutions

Banks

Two types of banks i.e. foreign and privately

owned local banks dominated Pakistani banking

scene.

In terms of institutional composition, the

dominance of scheduled banks in the financial

sector strengthened the economy.

Prof. Riaz Ahmed Mian, HCBF, University of the Punjab 2

An Overview of Financial Institutions

E-banking:

In terms of E-banking, Pakistan is doing fairly

well, specially keeping in view the progress of the

last five years.

The Government is very receptive and

supportive on E-banking initiatives. Cyber laws are

already at a very advanced stage of approval with

the Government. Further, GOP is also collaborating

with the IT industry and private sector to adopt E-

Commerce business methodologies.

Prof. Riaz Ahmed Mian, HCBF, University of the Punjab

3

An Overview of Financial Institutions

Privatization:

A number of financial institutions including

MCB, HBL, ABL, UBL and ICP and some other

banks have been privatized since the year 2000. As

a result of these reforms, the share of the private

sector ownership of the banking assets has

increased to 80 percent.

Privatization contributes to economic growth

through productivity gains, efficient utilization of

resources, better governance and expansion in

output and employment. Profit making enterprises 4

An Overview of Financial Institutions

Islamic Banking:

The establishment of Islamic Banking is one

of the major highlights in Pakistans financial

sector development in recent years.

The Islamic Commercial Banking in Pakistan

will flourish most when the norms in the society

are fully in conformity with the Islamic teachings.

Their share in total banking sector is rapidly

increasing.

5

An Overview of Financial Institutions

Insurance Companies

Insurance can be divided into two categories:

one is life insurance, essentially a long term

business, and other is non-life or general insurance

which relates to insurance of property and

pecuniary interest etc.

Prof. Riaz Ahmed Mian, HCBF, University of the Punjab 6

An Overview of Financial Institutions

Leasing Companies

The main bread and butter business of these

companies in the last decade was the machinery

and automobile leasing business segment. In fact

leasing companies can be considered as the pioneer

of car financing business in Pakistan. The main

advantage of leasing companies used to be their

lower overheads that allowed them to compete, but

as the banks started to encourage their consumer

financing (i.e. car leasing) operation, we saw stiff

competition during the last years.

7

An Overview of Financial Institutions

Financial Markets:

As the overall financial sector has registered

phenomenal progress, financial markets, including money,

forex, and capital market further developed during the early

years of last decade. The money market witnessed

improvement in the efficiency and increase in-depth of both

primary and secondary markets. Improved macroeconomic

environment and the stability in the exchange rate have led

to considerable progress in external account. Moreover, the

foreign currency loans have strengthened the connection

between the foreign exchange market and the money market

but the terrorism has destroyed our economy in every angle.

Prof. Riaz Ahmed Mian, HCBF, University of the Punjab 8

An Overview of Financial Institutions

Bank Finance and SMEs:

Through the Finance Act, 2006, the Government

has made a few amendments in the MFIs

Ordinance to expand the business of microfinance

banks in the country. A new SME policy was

announced by the Government that has made

several recommendations to improve the SMEs

access to bank finance. It is expected that by

following these recommendations, the banking

industry would be able to improve financial

products and services to SME sector.

Prof. Riaz Ahmed Mian, HCBF, University of the Punjab 9

An Overview of Financial Institutions

Postscript:

Agriculture credit, SME financing, consumer loans

and micro-credit have become mainstream products

of the banking industry and the borrower base of

the banking system has multiplied from 1 million

to 4 million households.

(contd)

Prof. Riaz Ahmed Mian, HCBF, University of the Punjab 10

An Overview of Financial Institutions

Postscript:

The NBFIs sector, which comprises modarabas,

mutual funds and DFIs has gone through a

comprehensive transformation under the increased

regulatory and supervisory role of the SECP.

SECPs regulatory policies, which focused on

consolidating weak institutions by strengthening

their capital base, have led to a large number of

mergers and acquisitions within and across sectors.

(contd)

Prof. Riaz Ahmed Mian, HCBF, University of the Punjab 11

An Overview of Financial Institutions

Postscript:

However, despite the financial sector development

during the last five years, Pakistan is still well

behind the peer countries in terms of financial

deepening and intermediation. Therefore, for

further financial sector development in Pakistan, it

is imperative to sustain the continuing strong

growth path with low inflation; increasing

documentation of the large undocumented sector;

expanding outreach of formal financial sector;

improving literacy; etc.

-----------The End-------- 12

thank U

Best of Luck

You might also like

- Overview of Comparative Financial SystemDocument16 pagesOverview of Comparative Financial Systemarafat alamNo ratings yet

- 1.4 Market Failure: Section 1: MicroeconomicsDocument19 pages1.4 Market Failure: Section 1: MicroeconomicsCalvin ManNo ratings yet

- Role or Importance of State Bank of Pakistan in Economic Development of PakistanDocument3 pagesRole or Importance of State Bank of Pakistan in Economic Development of PakistanMohammad Hasan100% (1)

- Assignment: Banking Zubair Ameer KhanDocument5 pagesAssignment: Banking Zubair Ameer KhanZubair KhanNo ratings yet

- EconomicReview 38 2 CentrespreadDocument1 pageEconomicReview 38 2 CentrespreadNayaan BahlNo ratings yet

- EconRev 32 2 PosterexternalitiesDocument1 pageEconRev 32 2 PosterexternalitiesSumedha SunayaNo ratings yet

- Microsoft PowerPoint - Financial Institution and Banking PPT (Compatibility Mode)Document27 pagesMicrosoft PowerPoint - Financial Institution and Banking PPT (Compatibility Mode)Tarun MalhotraNo ratings yet

- Externalidades de La ProducciónDocument17 pagesExternalidades de La ProducciónPABLO LÓPEZ BACA FERNÁNDEZNo ratings yet

- Activity Based Costing in ABB Drives: Team MembersDocument18 pagesActivity Based Costing in ABB Drives: Team MembersGeorge BabuNo ratings yet

- C ExternalitiesDocument19 pagesC Externalitiesikus8648No ratings yet

- CA IPCC Costing & FM Quick Revision NotesDocument21 pagesCA IPCC Costing & FM Quick Revision NotesChandreshNo ratings yet

- ExternalitiesDocument42 pagesExternalitiesBolWolNo ratings yet

- Mixed ExternalitiesDocument14 pagesMixed ExternalitiesAnthony JohnNo ratings yet

- Introduction To Islamic Financial SystemDocument41 pagesIntroduction To Islamic Financial Systembojot_12100% (4)

- Banking Sector in PakistanDocument30 pagesBanking Sector in PakistanUmair NadeemNo ratings yet

- Chapter 6 International Banking and Money Market 4017Document23 pagesChapter 6 International Banking and Money Market 4017jdahiya_1No ratings yet

- Model Paper Business FinanceDocument7 pagesModel Paper Business FinanceMuhammad Tahir NawazNo ratings yet

- Consumer Behaviour: by Kirtish Bhavsar JanviDocument7 pagesConsumer Behaviour: by Kirtish Bhavsar Janvikirtissh bhavsaarNo ratings yet

- Meezan BankDocument16 pagesMeezan BankSaifullahMakenNo ratings yet

- 3353 TVM Lecture 3Document31 pages3353 TVM Lecture 3herueuxNo ratings yet

- Financial MarketDocument10 pagesFinancial MarketLinganagouda PatilNo ratings yet

- Capital Budgeting TechniquesDocument30 pagesCapital Budgeting TechniquesAnasChihabNo ratings yet

- Management Accounting-Nature and ScopeDocument13 pagesManagement Accounting-Nature and ScopePraveen SinghNo ratings yet

- HW 6Document2 pagesHW 6feenNo ratings yet

- CF B21 TVDocument33 pagesCF B21 TVSoumya KhatuaNo ratings yet

- Unit 3 Capital StructureDocument31 pagesUnit 3 Capital StructureShreya DikshitNo ratings yet

- RFM Lecture 1-Introduction To Fin Mkts-CompleteDocument55 pagesRFM Lecture 1-Introduction To Fin Mkts-CompleteUmme HaniNo ratings yet

- Production and Function FinalDocument15 pagesProduction and Function FinalAzad HannanNo ratings yet

- Advanced Bond ConceptsDocument8 pagesAdvanced Bond ConceptsEllaine OlimberioNo ratings yet

- Cost Behavior AnalysisDocument5 pagesCost Behavior AnalysisMuhammad Umer Qureshi100% (1)

- Recall The Flows of Funds and Decisions Important To The Financial ManagerDocument27 pagesRecall The Flows of Funds and Decisions Important To The Financial ManagerAyaz MahmoodNo ratings yet

- Chap 1 - Portfolio Risk and Return Part1Document91 pagesChap 1 - Portfolio Risk and Return Part1eya feguiriNo ratings yet

- State Bank of PakistanDocument72 pagesState Bank of PakistanIlyas Ansari100% (2)

- Financial MArkets in PakistanDocument26 pagesFinancial MArkets in PakistanAamir Inam BhuttaNo ratings yet

- Formation of A CompanyDocument17 pagesFormation of A CompanySyed Adnan Hussain ZaidiNo ratings yet

- Balance Sheet: United Spirits Limited Annual ReportDocument4 pagesBalance Sheet: United Spirits Limited Annual ReportUppiliappan GopalanNo ratings yet

- Nedbank Investment Statement - 28 Oct 2021Document2 pagesNedbank Investment Statement - 28 Oct 2021Janice MkhizeNo ratings yet

- Introduction To EconomicsDocument88 pagesIntroduction To EconomicsdoomNo ratings yet

- Process Costing PresentationDocument50 pagesProcess Costing PresentationKhadija AlkebsiNo ratings yet

- Overhead ControlDocument6 pagesOverhead ControlbelladoNo ratings yet

- Valuation Measurement and Creation - September 04Document40 pagesValuation Measurement and Creation - September 04goldi0172No ratings yet

- Allied Bank Ltd. Financial Statements AnalysisDocument22 pagesAllied Bank Ltd. Financial Statements Analysisbilal_jutttt100% (1)

- Debt Service Coverage Ratio Formula Excel TemplateDocument3 pagesDebt Service Coverage Ratio Formula Excel TemplateAntonNo ratings yet

- Managerial Economics: Activity # 7Document9 pagesManagerial Economics: Activity # 7Vienna MamarilNo ratings yet

- Consumer Finance in Context of BangladeshDocument26 pagesConsumer Finance in Context of BangladeshAshis Debnath50% (2)

- Internship Report On Credit Policy of Brac Bank LTDDocument54 pagesInternship Report On Credit Policy of Brac Bank LTDwpushpa23No ratings yet

- By: Anjali KulshresthaDocument18 pagesBy: Anjali KulshresthaAnjali KulshresthaNo ratings yet

- Joint Stock CompanyDocument2 pagesJoint Stock CompanybijuNo ratings yet

- Introduction To Economics: Choices, Choices, Choices, - .Document68 pagesIntroduction To Economics: Choices, Choices, Choices, - .shahumang11No ratings yet

- CVP Analysis Final 1Document92 pagesCVP Analysis Final 1Utsav ChoudhuryNo ratings yet

- Consumer EquilibriumDocument11 pagesConsumer EquilibriumTanya AroraNo ratings yet

- Internship ReportDocument19 pagesInternship ReportAnamul HaqueNo ratings yet

- Case Studies in Islamic Banking and FinanceDocument2 pagesCase Studies in Islamic Banking and FinanceMahfuz An-NurNo ratings yet

- Ratio Analysis: R K MohantyDocument30 pagesRatio Analysis: R K Mohantybgowda_erp1438No ratings yet

- Efficiencies of Pakistani Banking Sector: A Comparative StudyDocument20 pagesEfficiencies of Pakistani Banking Sector: A Comparative StudyZohaib HayatNo ratings yet

- Universal BankingDocument13 pagesUniversal BankingShrutikaKadamNo ratings yet

- Economic Performance Review of Commercial and Investment Banking in PakistanDocument16 pagesEconomic Performance Review of Commercial and Investment Banking in PakistanNayab NoumanNo ratings yet

- Pakistan Banks' Association (PBA) Represents The Pakistan Banking IndustryDocument16 pagesPakistan Banks' Association (PBA) Represents The Pakistan Banking IndustrymuhammadaahmadNo ratings yet

- SMFISF270412 - Strengthening Governance in Micro Finance Institutions (MFIs) - Some Random ThoughtsDocument17 pagesSMFISF270412 - Strengthening Governance in Micro Finance Institutions (MFIs) - Some Random ThoughtsKhushboo KarnNo ratings yet

- A Project Report ON "Indian Banking System"Document34 pagesA Project Report ON "Indian Banking System"Prasant SamantarayNo ratings yet

- LG Ratio Analysis FinanceDocument70 pagesLG Ratio Analysis Financeanamika prasadNo ratings yet

- 2015 Lgar EngDocument23 pages2015 Lgar EngHuma ShahzadiNo ratings yet

- HBLDocument69 pagesHBLHuma ShahzadiNo ratings yet

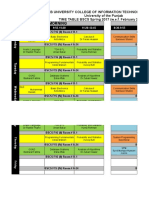

- BS Time Table Spring 2017 - PUCIT New CampusDocument15 pagesBS Time Table Spring 2017 - PUCIT New CampusHuma ShahzadiNo ratings yet

- 2 Eco Sys in WorldDocument10 pages2 Eco Sys in WorldHuma ShahzadiNo ratings yet

- Situation Vacant: Sr. No. Name of Posts & Pay Scales Minimum Qualification / RequirementDocument4 pagesSituation Vacant: Sr. No. Name of Posts & Pay Scales Minimum Qualification / RequirementHuma ShahzadiNo ratings yet

- Lailipad.: Ii) Exjevaice Mun Vélenkly Cúnd 3.mah) NG/ O9436Document5 pagesLailipad.: Ii) Exjevaice Mun Vélenkly Cúnd 3.mah) NG/ O9436Abhijeet BedagkarNo ratings yet

- Business EthicsDocument24 pagesBusiness EthicsDeepak SarojNo ratings yet

- IVS Profile PDFDocument11 pagesIVS Profile PDFMohan RamalingamNo ratings yet

- Summer Internship ReportDocument3 pagesSummer Internship ReportAyush TiwariNo ratings yet

- Agile Product Owner Training OnlineDocument24 pagesAgile Product Owner Training OnlineAnthonyEcrabtree100% (2)

- Components of An ERPDocument8 pagesComponents of An ERPemNo ratings yet

- MIS Formats Used in GarmentDocument10 pagesMIS Formats Used in GarmentEsubalew gebrieNo ratings yet

- Maintenance Planning and SchedullingDocument3 pagesMaintenance Planning and SchedullingAnnisa MarlinNo ratings yet

- Ratri 29110313 - Erika 29110310 Akbar 29110319 - Deru 29110301 Shopan 29110395 - Harvid 29110413Document12 pagesRatri 29110313 - Erika 29110310 Akbar 29110319 - Deru 29110301 Shopan 29110395 - Harvid 29110413Shopan J. EndrawanNo ratings yet

- Actulux en 12101-10Document2 pagesActulux en 12101-10giuseppegelsominoNo ratings yet

- Accounting 1 (SHS) - Week 7 - BOOK OF ACCOUNTSDocument11 pagesAccounting 1 (SHS) - Week 7 - BOOK OF ACCOUNTSAustin Capal Dela CruzNo ratings yet

- BIZ202CRN1151 - NAYAK - A - Micro Environment ReportDocument8 pagesBIZ202CRN1151 - NAYAK - A - Micro Environment ReportLegendary NinjaNo ratings yet

- Suggested Answers: QuestionsDocument104 pagesSuggested Answers: QuestionsabhishekkgargNo ratings yet

- Tutorial Questions Spring 2014Document13 pagesTutorial Questions Spring 2014lalaran123No ratings yet

- Ms Important Questions For Final ExamDocument2 pagesMs Important Questions For Final ExamChiran RavaniNo ratings yet

- Example of Batch CostingDocument3 pagesExample of Batch CostingUsaid Khan100% (3)

- Piyush KushwahaDocument3 pagesPiyush KushwahaPiyush KushwahaNo ratings yet

- T1-Legal Entity of A CompanyDocument14 pagesT1-Legal Entity of A CompanykityanNo ratings yet

- Saudi Arabia Food MarketDocument73 pagesSaudi Arabia Food MarketViktor BisovetskyiNo ratings yet

- Interest Rate Parity: 1. A Covered Interest ArbitrageDocument4 pagesInterest Rate Parity: 1. A Covered Interest ArbitrageRockyLagishettyNo ratings yet

- The Markets of Pyongyang, by John EverardDocument8 pagesThe Markets of Pyongyang, by John EverardKorea Economic Institute of America (KEI)No ratings yet

- Boat 235V2 Fast Charging Bluetooth Headset: Grand Total 1199.00Document1 pageBoat 235V2 Fast Charging Bluetooth Headset: Grand Total 1199.00AjayNo ratings yet

- MIT Sloan Additional Document - Madan SomasundaramDocument5 pagesMIT Sloan Additional Document - Madan SomasundarammadansomasundaramNo ratings yet

- Cir v. Cebu HoldingsDocument4 pagesCir v. Cebu HoldingsAudrey50% (2)

- INSAT: Inside Southern African Trade - October 2008 (USAID - 2008)Document20 pagesINSAT: Inside Southern African Trade - October 2008 (USAID - 2008)HayZara MadagascarNo ratings yet

- BL Racingas PDFDocument2 pagesBL Racingas PDFMarcoAntonioGilIturreguiNo ratings yet

- Group 1 Case: The Exotic MelonsDocument6 pagesGroup 1 Case: The Exotic MelonsakhilNo ratings yet

- SCMDocument41 pagesSCMumeshd_9114923No ratings yet

- HSBC v. Peoples BankDocument2 pagesHSBC v. Peoples BankTon RiveraNo ratings yet

- Important Tables in SAP AADocument2 pagesImportant Tables in SAP AAJose Luis Becerril BurgosNo ratings yet