Professional Documents

Culture Documents

Five Bonus Share Companies: A Project Report ON

Uploaded by

Shubham agarwal0 ratings0% found this document useful (0 votes)

46 views11 pagesbonus shares

Original Title

Bonus Shares Final

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentbonus shares

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

46 views11 pagesFive Bonus Share Companies: A Project Report ON

Uploaded by

Shubham agarwalbonus shares

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 11

A

PROJECT REPORT

ON

FIVE BONUS SHARE COMPANIES

Submitted To: Prof. Komal Sidhnani

Submitted By: Urvi Ganatra(0042)

Mahendi Jobanputra(0065)

Shubham Patel(0121)

Dipak Tiwari(0182)

Maulik Thakkar(0178)

Shubham Agarwal(0001)

INTRODUCTION

Bonus shares

SEBI (Disclosure & Investor Protection) Guidelines, 2000

Increases the total number of shares issued and owned

It does not increase the value of the company

Earnings Per Share of the stock will drop in proportion to the

new issue

REASONS FOR THE ISSUE

To capitalize the accumulated profits

High declaration of cash dividends is prohibited by the

Government

Lack of cash balance to declare dividends

To depict more realistic earning capacity of the company

Larsen & Toubro is a major technology, engineering,

construction, manufacturing and financial services

conglomerate, with global operations.

Bonus ratio 1:2

Ex bonus Record date Date 12/07/2017 13/07/2017 14/07/2017

date

13/07/2017 14/07/2017 Price 1160.23 1176 1171

The Company is engaged in the business of refining of crude

oil and marketing of petroleum products.

Bonus ratio 1:2

Ex bonus Record Date 12/07/2017 13/07/2017 15/07/2017

date date

13/07/2017 15/07/2017 Price 456 458.30 468.95

The leading global information technology, consulting and

business process services company announced to issue bonus

share on 13th June 2017.

Bonus ratio 1:1

Ex bonus Record Date 12/06/2017 13/06/2017 14/06/2017

date date

13/06/2017 14/06/2017 Price 262.20 258.85 256.90

It is an Indian multinational banking and financial services

company headquartered in Mumbai, Maharashtra, India.

Bonus ratio 1:10.

Ex bonus Record Date 19/06/2017 20/06/2017 21/06/2017

date date

20/06/2017 21/06/2017 Price 291.59 292.30 291

Gas (India) Limited (GAIL) (formerly known as Gas

Authority of India Limited) is the largest state-owned natural

gas processing and distribution company in India.

Bonus ratio 1:3.

Ex bonus Record date Date 08/03/2017 09/03/2017 11/03/2017

date

09/03/2017 11/03/2017 Price 394.20 378 376.50

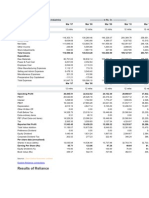

EFFECT OF BONUS ON EPS &

SHARE PRICE

COMPANY STOCK STOCK EPS BAF ADJUSTED EPS

PRICE ON PRICE (EARNING PER (BONUS (EPS*BAF)

THE DAY AFTER SHARE) ADJUSTED

OF BONUS BONUS FACTOR)

ISSUE ISSUE

L&T 1175.10 1171.20 58.46 0.33 19.49

BPCL 458.55 456.80 61.31 0.33 20.44

WIPRO 259.00 256.10 33.57 0.5 16.79

ICICI BANK 292.45 291.10 16.83 0.09 1.53

GAIL 379.25 378.25 20.71 0.25 5.18

EFFECT OF BONUS ISSUE

Share capital gets increased according to the bonus issue ratio.

Liquidity in the stock increases.

Effective Earnings per share, Book Value and other per share

values stand reduced.

Markets take the action usually as a favourable act.

Accumulated profits get reduced.

A bonus issue is taken as a sign of the good health of the

company

THANK YOU

You might also like

- Cusip Identifier PDFDocument7 pagesCusip Identifier PDFJeromeKmt100% (1)

- Volume Spread Analysis ExamplesDocument55 pagesVolume Spread Analysis Examplesthinkscripter82% (11)

- United States District Court Southern District of New YorkDocument19 pagesUnited States District Court Southern District of New YorkCNBC.com0% (1)

- Thom Hartle - Active Trader Magazine - Trading Strategies Analysis Collection Vol1Document74 pagesThom Hartle - Active Trader Magazine - Trading Strategies Analysis Collection Vol1Miroslav ZaporozhanovNo ratings yet

- JPM Intro To Credit DerivativesDocument88 pagesJPM Intro To Credit DerivativesJackTaNo ratings yet

- Curing Corporate Short-Termism: Future Growth vs. Current EarningsFrom EverandCuring Corporate Short-Termism: Future Growth vs. Current EarningsNo ratings yet

- Dalal Street Investment Journal May 28 2017Document69 pagesDalal Street Investment Journal May 28 2017sharkl123No ratings yet

- FIN524A Options and FuturesDocument260 pagesFIN524A Options and FuturesgzsdjyNo ratings yet

- Technical Perspectives: Louise Yamada Technical Research Advisors, LLCDocument8 pagesTechnical Perspectives: Louise Yamada Technical Research Advisors, LLCanalyst_anil14No ratings yet

- Summer Internship Training at Sharekhan Stock Broking LimitedDocument65 pagesSummer Internship Training at Sharekhan Stock Broking Limitedbharanipriya8890% (10)

- PL M17 Financial ManagementDocument9 pagesPL M17 Financial ManagementIQBAL MAHMUDNo ratings yet

- Boc Annual Report 2008Document70 pagesBoc Annual Report 2008luv_y_kush3575No ratings yet

- Các yếu tố ảnh hưởng đến tỷ lệ sở hữu (tiếng anh)Document12 pagesCác yếu tố ảnh hưởng đến tỷ lệ sở hữu (tiếng anh)Nguyễn Ngọc NhiênNo ratings yet

- Hindustan Petroleum Corporation LTDDocument14 pagesHindustan Petroleum Corporation LTDHoney DarjiNo ratings yet

- CF FinalDocument9 pagesCF FinalRaniNo ratings yet

- SBI Life Insurance Company ProfileDocument14 pagesSBI Life Insurance Company ProfilePiyush RohitNo ratings yet

- J-STREET Volume 349Document10 pagesJ-STREET Volume 349JhaveritradeNo ratings yet

- Working Capital Management TruthbehindcurtainDocument8 pagesWorking Capital Management Truthbehindcurtainrinkubhoi98319No ratings yet

- Corporate Action Ananlysis of Tata SteelDocument6 pagesCorporate Action Ananlysis of Tata SteelSumit JhaNo ratings yet

- IL&FS Defaults Due to Over-Leveraging on Infrastructure ProjectsDocument9 pagesIL&FS Defaults Due to Over-Leveraging on Infrastructure ProjectsAkhil ChawlaNo ratings yet

- Dividend PolicyDocument8 pagesDividend PolicySumit PandeyNo ratings yet

- Sahrudaya HealthcareDocument6 pagesSahrudaya HealthcareAakash Singh BJ22162No ratings yet

- MKCL Ar 2018Document108 pagesMKCL Ar 2018swapnagandha.dange1988No ratings yet

- JSTREET Volume 333Document10 pagesJSTREET Volume 333Jhaveritrade100% (1)

- JSTREET Volume 328Document10 pagesJSTREET Volume 328JhaveritradeNo ratings yet

- Module1-Assignment 1 - 2017ABPS1332HDocument7 pagesModule1-Assignment 1 - 2017ABPS1332HNamitNo ratings yet

- Strategy Modelling for PT. HERO Supermarket TbkDocument23 pagesStrategy Modelling for PT. HERO Supermarket TbkAndrew Cokro PutraNo ratings yet

- Rationale Behind The Issue of Bonus SharesDocument31 pagesRationale Behind The Issue of Bonus SharesSandeep ReddyNo ratings yet

- Project Report ON Infosys Technologies LTD.: Ms. Sandhya PrakashDocument8 pagesProject Report ON Infosys Technologies LTD.: Ms. Sandhya PrakashRavindra ChauhanNo ratings yet

- Birla Sun Life Frontline Equity Fund: Investment ObjectiveDocument1 pageBirla Sun Life Frontline Equity Fund: Investment ObjectivehnarwalNo ratings yet

- ACC 423 Final Exam GuideDocument11 pagesACC 423 Final Exam Guideapjk510No ratings yet

- Portfolio Management for Moderate Risk Investment of ₹50,000Document10 pagesPortfolio Management for Moderate Risk Investment of ₹50,000Aniruddh Singh ThakurNo ratings yet

- 20160809_SRF_EarningsCall_SRF_IN_2017-01-03T14_46_58_EARNINGDocument22 pages20160809_SRF_EarningsCall_SRF_IN_2017-01-03T14_46_58_EARNINGgeniusmeetNo ratings yet

- Reliance Industries profit and loss analysisDocument10 pagesReliance Industries profit and loss analysisJack MartinNo ratings yet

- Welspun Enterprises Investor Presentation HighlightsDocument36 pagesWelspun Enterprises Investor Presentation HighlightsDwijendra ChanumoluNo ratings yet

- Financial Statement Analysesof TataDocument12 pagesFinancial Statement Analysesof TataSwati soniNo ratings yet

- Home First Finance Company India Limited: Issue HighlightsDocument16 pagesHome First Finance Company India Limited: Issue HighlightstempvjNo ratings yet

- DownloadDocument33 pagesDownloadrdhNo ratings yet

- Annual Report 07 08Document142 pagesAnnual Report 07 08jagat_sabatNo ratings yet

- VIP Financial Overview and AnalysisDocument14 pagesVIP Financial Overview and AnalysisVatsal SharmaNo ratings yet

- JSTREET Volume 347Document10 pagesJSTREET Volume 347Jhaveritrade100% (1)

- Uflex Research ReportDocument4 pagesUflex Research ReportshahavNo ratings yet

- Business CommunicationDocument16 pagesBusiness CommunicationHarsh ManralNo ratings yet

- Assignment - 2: Akshita Shekhawat Division: E Roll No.: 05 PRN: 20020441032Document15 pagesAssignment - 2: Akshita Shekhawat Division: E Roll No.: 05 PRN: 20020441032Mandira PantNo ratings yet

- Lanka BanglaDocument9 pagesLanka BanglaAnonymous qzifvLzoy0No ratings yet

- JSTREET Volume 353Document10 pagesJSTREET Volume 353JhaveritradeNo ratings yet

- Britannia Industries: Key Takeaways From Analyst MeetDocument4 pagesBritannia Industries: Key Takeaways From Analyst Meetshrutijayaprakash883No ratings yet

- Financial Statement Analysesof TataDocument10 pagesFinancial Statement Analysesof Tataganesh kNo ratings yet

- FM CiaDocument20 pagesFM CiaN SUDEEP 2120283No ratings yet

- JSTREET Volume 338Document10 pagesJSTREET Volume 338JhaveritradeNo ratings yet

- SpritzerDocument7 pagesSpritzerapi-361474281100% (1)

- JSW Steel Financial AssessmentDocument32 pagesJSW Steel Financial AssessmentMAHIPAL CHANDANNo ratings yet

- ITC Financial Statement AnalysisDocument19 pagesITC Financial Statement Analysisanks0909No ratings yet

- Tutorial 7 FAT SolutionDocument13 pagesTutorial 7 FAT SolutionAhmad FarisNo ratings yet

- News Flash 17.11.2017Document1 pageNews Flash 17.11.2017Prabhat SingalNo ratings yet

- Nuvoco 070821Document10 pagesNuvoco 070821upsahuNo ratings yet

- Ultratech Cement 1. Overview of Ultratech Cement: Chart TitleDocument5 pagesUltratech Cement 1. Overview of Ultratech Cement: Chart TitleashuuuNo ratings yet

- Fiinancial Analysis of Reckitt BenckiserDocument10 pagesFiinancial Analysis of Reckitt BenckiserKhaled Mahmud ArifNo ratings yet

- Abbot Pakistan AssignmentDocument9 pagesAbbot Pakistan AssignmentNADIA BUKHARINo ratings yet

- JK Tyre Industries LTDDocument15 pagesJK Tyre Industries LTDAlex KuruvillaNo ratings yet

- Banking Sector ReportDocument21 pagesBanking Sector ReportsukeshNo ratings yet

- NBFC Role in Wealth Managment: Nimisha Rai Parth Mehta Pooja Verma Pargya Dwivedi Pratik TanwaniDocument21 pagesNBFC Role in Wealth Managment: Nimisha Rai Parth Mehta Pooja Verma Pargya Dwivedi Pratik TanwaniNimisha RaiNo ratings yet

- Aditya Birla Sun Life Amc Limited: All You Need To Know AboutDocument7 pagesAditya Birla Sun Life Amc Limited: All You Need To Know AboutSarfarazNo ratings yet

- BY Sapna Under The Guidance of Prof. Uma SharmaDocument22 pagesBY Sapna Under The Guidance of Prof. Uma SharmaEmmanuel MelvinNo ratings yet

- HDFC Equity Analysis InsightsDocument7 pagesHDFC Equity Analysis Insightsmanoj guptaNo ratings yet

- 189-Article Text-2632-1-10-20220626Document14 pages189-Article Text-2632-1-10-20220626BaekkichanNo ratings yet

- Bata Shoe Company Financial AnalysisDocument14 pagesBata Shoe Company Financial AnalysisMahmud TuhinNo ratings yet

- 960-Article Text-4617-2-10-20220710Document9 pages960-Article Text-4617-2-10-20220710Dicky AdityaNo ratings yet

- Bajaj Finserv LimitedDocument31 pagesBajaj Finserv LimitedDinesh Gehi DGNo ratings yet

- KelloggsDocument5 pagesKelloggsShubham agarwalNo ratings yet

- Overview To Cost and Management AccountingDocument22 pagesOverview To Cost and Management AccountingShubham agarwalNo ratings yet

- Chapter 06 Final NewDocument10 pagesChapter 06 Final NewShubham agarwalNo ratings yet

- CMAT Score Card PDFDocument2 pagesCMAT Score Card PDFShubham agarwalNo ratings yet

- CMAT Score Card PDFDocument2 pagesCMAT Score Card PDFShubham agarwalNo ratings yet

- A Fly Coming Soon Kushal Sadhwan As Samar SinghaniaDocument1 pageA Fly Coming Soon Kushal Sadhwan As Samar SinghaniaShubham agarwalNo ratings yet

- ArticlesDocument11 pagesArticlesShubham agarwalNo ratings yet

- Assignment On Currency Profiling: Euro Vs INR: Prof. Yasmeen PathanDocument13 pagesAssignment On Currency Profiling: Euro Vs INR: Prof. Yasmeen PathanShubham agarwalNo ratings yet

- Maruti UdhyogDocument18 pagesMaruti UdhyogShubham agarwalNo ratings yet

- OB BankDocument3 pagesOB BankShubham agarwalNo ratings yet

- Mother DairyDocument30 pagesMother DairyShubham agarwalNo ratings yet

- A Study Report On Virtual Reality Headset.: in The Partial Fulfilment of MBA Program 2016-18Document4 pagesA Study Report On Virtual Reality Headset.: in The Partial Fulfilment of MBA Program 2016-18Shubham agarwalNo ratings yet

- Chapter 8 - Portfolio ManagementDocument81 pagesChapter 8 - Portfolio ManagementTRANG NGUYỄN THUNo ratings yet

- Fundamentals of Investing 13th Edition Smart Test BankDocument41 pagesFundamentals of Investing 13th Edition Smart Test Bankericduzhpfv7100% (28)

- Zerodha Account OpeningDocument8 pagesZerodha Account OpeningDeerajKumarNo ratings yet

- Stock Market Prediction and Investment Portfolio Selection Using Computational ApproachDocument10 pagesStock Market Prediction and Investment Portfolio Selection Using Computational ApproachIOSRjournalNo ratings yet

- Market Analysis April 2022Document19 pagesMarket Analysis April 2022Penguin DadNo ratings yet

- Tenets of Behavioral FinanceDocument3 pagesTenets of Behavioral FinanceAnubhavNo ratings yet

- «Восхождение денег» Ниал ФергюсонDocument71 pages«Восхождение денег» Ниал ФергюсонАндрей ШубаNo ratings yet

- Day Trading With Stochastics: by John F. KepkaDocument4 pagesDay Trading With Stochastics: by John F. KepkaVahidNo ratings yet

- Cpa Review School of The Philippines ManilaDocument3 pagesCpa Review School of The Philippines ManilaAljur Salameda100% (1)

- Tech Analysis Presentation by Jose VistanDocument62 pagesTech Analysis Presentation by Jose VistanDaniel ValerianoNo ratings yet

- Research Paper On FCIDocument12 pagesResearch Paper On FCIAnkit RastogiNo ratings yet

- Case Study - Harshad MehtaDocument5 pagesCase Study - Harshad MehtaMudit AgarwalNo ratings yet

- Mutual Fund:: Asset Management CompanyDocument43 pagesMutual Fund:: Asset Management CompanymalaynvNo ratings yet

- Noarbitrage Eq To Risk Neutral ExistanceDocument46 pagesNoarbitrage Eq To Risk Neutral ExistanceJack SmithNo ratings yet

- Technical Analysis Handbook for Stock BangladeshPrDocument33 pagesTechnical Analysis Handbook for Stock BangladeshPrparirNo ratings yet

- Comp-XM - Inquirer ReportDocument29 pagesComp-XM - Inquirer ReportOmprakash PandeyNo ratings yet

- Efficient Market HypothesisDocument4 pagesEfficient Market HypothesisRabia KhanNo ratings yet

- Group 8 Verkkokauppa - Com Business AnalysisDocument20 pagesGroup 8 Verkkokauppa - Com Business AnalysisnujhatpromyNo ratings yet

- AQR (2015) Capital Market Assumptions For Major Asset ClassesDocument14 pagesAQR (2015) Capital Market Assumptions For Major Asset ClassesQONo ratings yet

- Contract Specification For Gold Options With Gold (1 KG) Futures As UnderlyingDocument5 pagesContract Specification For Gold Options With Gold (1 KG) Futures As UnderlyingKumarasamyNo ratings yet

- Cost of Capital: F.M Isb & MDocument2 pagesCost of Capital: F.M Isb & MAkshay ShettyNo ratings yet