Professional Documents

Culture Documents

Completing The Audit: ©2006 Prentice Hall Business Publishing, Auditing 11/e, Arens/Beasley/Elder

Uploaded by

John BryanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Completing The Audit: ©2006 Prentice Hall Business Publishing, Auditing 11/e, Arens/Beasley/Elder

Uploaded by

John BryanCopyright:

Available Formats

Completing the Audit

Chapter 24

2006 Prentice Hall Business Publishing, Auditing 11/e, Arens/Beasley/Elder 24 - 1

Learning Objective 1

Conduct a review for contingent

liabilities and commitments.

2006 Prentice Hall Business Publishing, Auditing 11/e, Arens/Beasley/Elder 24 - 2

Summary of the Audit Process

Phase III

Phase I

Perform analytical

Plan and design an audit

procedures and tests

approach.

of details of balances.

Phase II

Phase IV

Perform tests of controls

Complete the audit and

and substantive tests

issue an audit report.

of transactions.

2006 Prentice Hall Business Publishing, Auditing 11/e, Arens/Beasley/Elder 24 - 3

Phase IV Completing the Audit

Review for contingent

Evaluate results.

liabilities.

Review for

Issue audit report.

subsequent events.

Communicate with

Accumulate final

audit committee

evidence.

and management.

2006 Prentice Hall Business Publishing, Auditing 11/e, Arens/Beasley/Elder 24 - 4

Contingent Liabilities

A contingent liability is a potential future

obligation to an outside party for an

unknown amount resulting from activities

that have already taken place.

2006 Prentice Hall Business Publishing, Auditing 11/e, Arens/Beasley/Elder 24 - 5

Likelihood of Occurrence and

Financial Statement Treatment

Likelihood of Financial statement

occurrence of event treatment

Remote No disclosure

(slight chance) necessary

Reasonably Footnote disclosure is

possible necessary

Probable Adjust financial statements

(likely to occur) or note disclosure

2006 Prentice Hall Business Publishing, Auditing 11/e, Arens/Beasley/Elder 24 - 6

Auditors Concerns

Pending litigation for patent infringement,

product liability, or other actions

Income tax disputes

Product warranties

Notes receivable discounted

Guarantees of obligations of others

Unused balances of outstanding letters of credit

2006 Prentice Hall Business Publishing, Auditing 11/e, Arens/Beasley/Elder 24 - 7

Audit Procedures for Finding

Contingencies

Inquire of management (orally and in

writing) about the possibility of

unrecorded contingencies.

Review current and previous years internal

revenue reports for income tax settlements.

Review the minutes of directors and

stockholders meetings for indications

of lawsuits or other contingencies.

2006 Prentice Hall Business Publishing, Auditing 11/e, Arens/Beasley/Elder 24 - 8

Audit Procedures for Finding

Contingencies

Analyze legal expenses and review invoices

and statements from legal counsel.

Obtain a letter from each major attorney of the

client as to the status of pending litigation.

Review audit documentation for any information

that may indicate a potential contingency.

Examine letters of credit in force.

2006 Prentice Hall Business Publishing, Auditing 11/e, Arens/Beasley/Elder 24 - 9

Learning Objective 2

Obtain and evaluate letters from

the clients attorneys.

2006 Prentice Hall Business Publishing, Auditing 11/e, Arens/Beasley/Elder 24 - 10

Inquiry of Clients Attorneys

A list including (1) pending threatened litigation

and (2) asserted or unasserted claims or

assessments with which the attorney

has had involvement.

A request that the attorney furnish information

or comment about the progress of each item listed.

2006 Prentice Hall Business Publishing, Auditing 11/e, Arens/Beasley/Elder 24 - 11

Inquiry of Clients Attorneys

A request for the identification of any unlisted

pending or threatened legal action or a

statement that the clients list is complete.

A statement informing the attorney of the attorneys

responsibility to inform management of legal matters

requiring disclosure in the financial statements

and to respond directly to the auditor.

2006 Prentice Hall Business Publishing, Auditing 11/e, Arens/Beasley/Elder 24 - 12

Sarbanes-Oxley Act

Congress included provisions in this act directing

the SEC to issue rules requiring attorneys serving

public companies to report material violations

by the company of federal securities laws.

The American Bar Association amended its

attorney-client confidentiality rules to permit

attorneys to breach confidentiality if a client

is committing a crime or fraud.

2006 Prentice Hall Business Publishing, Auditing 11/e, Arens/Beasley/Elder 24 - 13

Learning Objective 3

Conduct a post-balance-sheet

review for subsequent events.

2006 Prentice Hall Business Publishing, Auditing 11/e, Arens/Beasley/Elder 24 - 14

Period Covered by Subsequent

Events Review

Clients ending Audit Date client

balance sheet report issues financial

date date statements

12-31-05 3-11-06 3-26-06

Period to which review for Period for

subsequent events applies processing

the financial

statements

2006 Prentice Hall Business Publishing, Auditing 11/e, Arens/Beasley/Elder 24 - 15

Types of Subsequent Events

Those that have a direct effect

1 on the financial statements

and require adjustment

Those that have no direct effect

2 on the financial statements but

for which disclosure is advisable

2006 Prentice Hall Business Publishing, Auditing 11/e, Arens/Beasley/Elder 24 - 16

Requiring Adjustment

Declaration of bankruptcy by a customer

with an accounts receivable balance

Settlement of a litigation at an amount

different from the amount recorded

on the books

Disposal of equipment not being used in

operations at a price below the current

book value

Sale of investments at a price below

recorded cost

2006 Prentice Hall Business Publishing, Auditing 11/e, Arens/Beasley/Elder 24 - 17

Advisability of Disclosure

Decline in the market value of securities

held for temporary investment or resale

Issuance of bonds or equity securities

Decline in the market value of inventory

as a consequence of government action

barring further sale of a product

Uninsured loss of inventories as a result

of fire

A merger or an acquisition

2006 Prentice Hall Business Publishing, Auditing 11/e, Arens/Beasley/Elder 24 - 18

Audit Tests

Procedures normally integrated as

a part of the verification of year-end

account balances

Procedures performed specifically for

the purpose of discovering events or

transactions that must be recognized

as subsequent events

2006 Prentice Hall Business Publishing, Auditing 11/e, Arens/Beasley/Elder 24 - 19

Audit Tests

Inquire of management.

Correspond with attorneys.

Review internal statements prepared

subsequent to the balance sheet date.

Review records prepared subsequent

to the balance sheet date.

Examine minutes issued subsequent

to the balance sheet date.

Obtain a letter of representation,

2006 Prentice Hall Business Publishing, Auditing 11/e, Arens/Beasley/Elder 24 - 20

Dual Dating

The first date is the date for the

completion of field work except

for a specific exception.

The second date, which is

always later, deals with

the exception.

2006 Prentice Hall Business Publishing, Auditing 11/e, Arens/Beasley/Elder 24 - 21

Learning Objective 4

Design and perform the final steps

in the evidence-accumulation

segment of the audit.

2006 Prentice Hall Business Publishing, Auditing 11/e, Arens/Beasley/Elder 24 - 22

Final Evidence Accumulation

1. Perform final analytical procedures.

2. Evaluate the going-concern assumption.

3. Obtain a management representation letter.

4. Consider information accompanying the

basic financial statements.

5. Read other information in the annual report.

2006 Prentice Hall Business Publishing, Auditing 11/e, Arens/Beasley/Elder 24 - 23

Management Representation

Letter

To impress upon management its responsibility

for the assertions in the financial statements

To document the responses from management

to inquiries about various aspects of the audit

2006 Prentice Hall Business Publishing, Auditing 11/e, Arens/Beasley/Elder 24 - 24

Management Representation

Letter

1. Financial statements

2. Completeness of information

3. Recognition, measurement, and disclosure

4. Subsequent events

5. Internal control

2006 Prentice Hall Business Publishing, Auditing 11/e, Arens/Beasley/Elder 24 - 25

Management Representation

Letter: Internal Control

1. Managements acknowledgment of its

responsibility for establishing and

maintaining effective internal control

over financial reporting

2. Managements conclusion about the

effectiveness of internal control over

financial reporting as of the end of

the fiscal period

3. Disclosure of all deficiencies

4. Managements knowledge of any fraud

2006 Prentice Hall Business Publishing, Auditing 11/e, Arens/Beasley/Elder 24 - 26

Information Accompanying Basic

Financial Statements

Balance sheet

Income statement Basic Standard

financial auditors

Statement of statements report

cash flows

Footnotes

Detailed comparative Information

statements accompanying

basic financial

Statistical data statements

Schedule of

insurance coverage Separate paragraph

unqualified, qualified,

or disclaimer

2006 Prentice Hall Business Publishing, Auditing 11/e, Arens/Beasley/Elder 24 - 27

Learning Objective 5

Integrate the audit evidence

gathered, and evaluate the

overall audit results.

2006 Prentice Hall Business Publishing, Auditing 11/e, Arens/Beasley/Elder 24 - 28

Evaluate Results

Sufficiency of evidence

Evidence supports auditors opinion

Financial statement disclosures

2006 Prentice Hall Business Publishing, Auditing 11/e, Arens/Beasley/Elder 24 - 29

Evaluate Results

Audit documentation review

Independent review

Summary of evidence evaluation

2006 Prentice Hall Business Publishing, Auditing 11/e, Arens/Beasley/Elder 24 - 30

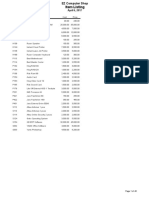

Completing the Engagement

Checklist

YES NO

1. Examination of prior years audit

documentation

a. Were last years audit files examined

for areas of emphasis in the

current-year audit?

b. Was the permanent file reviewed for

items that affect the current year?

2006 Prentice Hall Business Publishing, Auditing 11/e, Arens/Beasley/Elder 24 - 31

Completing the Engagement

Checklist

YES NO

2. Internal control

a. Has internal control been adequately

understood?

b. Is the scope of the audit adequate in

light of the assessed control risk?

c. Have all major weaknesses been

included as reportable conditions in

a letter to the audit committee or to

senior management?

2006 Prentice Hall Business Publishing, Auditing 11/e, Arens/Beasley/Elder 24 - 32

Completing the Engagement

Checklist

YES NO

3. General documents

a. Were all current-year minutes and

resolutions reviewed, abstracted,

and followed up?

b. Has the permanent file been

updated?

c. Have all major contracts and

agreements been reviewed and

abstracted and copied with all

existing legal requirements?

2006 Prentice Hall Business Publishing, Auditing 11/e, Arens/Beasley/Elder 24 - 33

Evaluating Results and Reaching

Conclusions

Actual audit evidence

(by cycle, account, Evaluate results

and objective) (by account and cycle)

Audit procedures Estimated misstatement

Sample size (by account)

Items to select Achieved audit risk

Timing (by account and cycle)

2006 Prentice Hall Business Publishing, Auditing 11/e, Arens/Beasley/Elder 24 - 34

Evaluating Results and Reaching

Conclusions

Evaluate overall

financial statements

Issue

audit

Estimated misstatement

report

(overall statements)

Achieved audit risk

(overall statements)

2006 Prentice Hall Business Publishing, Auditing 11/e, Arens/Beasley/Elder 24 - 35

Issue the Audit Report

The audit report is the only thing that most

users see in the audit process, and the

consequences of issuing an inappropriate

report can be severe.

2006 Prentice Hall Business Publishing, Auditing 11/e, Arens/Beasley/Elder 24 - 36

Learning Objective 6

Communicate effectively with the

audit committee and management.

2006 Prentice Hall Business Publishing, Auditing 11/e, Arens/Beasley/Elder 24 - 37

Communicate with the Audit

Committee and Management

Communicate fraud and illegal acts

Communicate internal control deficiencies

Other communication with audit committee

Management letters

2006 Prentice Hall Business Publishing, Auditing 11/e, Arens/Beasley/Elder 24 - 38

Learning Objective 7

Identify the auditors

responsibilities when facts

affecting the audit report are

discovered after its issuance.

2006 Prentice Hall Business Publishing, Auditing 11/e, Arens/Beasley/Elder 24 - 39

Period Covered by Subsequent

Events Review

Clients ending Audit Date client

balance sheet report issues financial

date date statements

12-31-05 3-11-06 3-26-06

Period to which Period for Period in which

review for processing subsequent

subsequent the financial discovery of

events applies statements facts is made

2006 Prentice Hall Business Publishing, Auditing 11/e, Arens/Beasley/Elder 24 - 40

End of Chapter 24

2006 Prentice Hall Business Publishing, Auditing 11/e, Arens/Beasley/Elder 24 - 41

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- CPA Review School of the Philippines Final Pre-board ExaminationDocument67 pagesCPA Review School of the Philippines Final Pre-board ExaminationCeasar John Caintic Nicart100% (2)

- 4.1A. Satoshi Nakamoto and PeopleDocument58 pages4.1A. Satoshi Nakamoto and PeopleEman100% (1)

- R.A 8293 (Intellectual Property Codes of The Philippines)Document9 pagesR.A 8293 (Intellectual Property Codes of The Philippines)cwdcivil100% (1)

- RA MEWP 0003 Dec 2011Document3 pagesRA MEWP 0003 Dec 2011Anup George Thomas100% (1)

- Qualitative StudyDocument63 pagesQualitative StudyJohn Bryan100% (2)

- Decsion Analysis Printing Hock ExamsuccessDocument92 pagesDecsion Analysis Printing Hock ExamsuccessJane Michelle EmanNo ratings yet

- Vat PDFDocument16 pagesVat PDFKathleen Jane SolmayorNo ratings yet

- Dilg MC 2013-61Document14 pagesDilg MC 2013-61florianjuniorNo ratings yet

- Encyclopædia Americana - Vol II PDFDocument620 pagesEncyclopædia Americana - Vol II PDFRodrigo SilvaNo ratings yet

- CIA AirlinesLaosDocument36 pagesCIA AirlinesLaosMey SamedyNo ratings yet

- IPR and Outer Spaces Activities FinalDocument25 pagesIPR and Outer Spaces Activities FinalKarthickNo ratings yet

- RFBTDocument35 pagesRFBTJohn Bryan100% (2)

- Garsuta - Copernicus - Moule 2 - Activity 1 - Chemical Formula and Molecular StructureDocument2 pagesGarsuta - Copernicus - Moule 2 - Activity 1 - Chemical Formula and Molecular StructureJohn Bryan100% (1)

- Barangay Magugpo EastDocument1 pageBarangay Magugpo EastJohn BryanNo ratings yet

- Accounting principles for branches and agenciesDocument4 pagesAccounting principles for branches and agenciesJohn Bryan100% (1)

- Foreign Currency TransactionsDocument55 pagesForeign Currency TransactionsJohn BryanNo ratings yet

- Nfjpia1819 - National Mid Year Convention Non-Academic League - IrrDocument33 pagesNfjpia1819 - National Mid Year Convention Non-Academic League - IrrJohn BryanNo ratings yet

- J Marketing S Inventory Cost ListDocument1 pageJ Marketing S Inventory Cost ListJohn BryanNo ratings yet

- Nfjpia1819 - National Mid Year Conventon Academic LeagueDocument27 pagesNfjpia1819 - National Mid Year Conventon Academic LeagueJohn BryanNo ratings yet

- Responsibility Acctg Transfer Pricing GP Analysis 1Document21 pagesResponsibility Acctg Transfer Pricing GP Analysis 1John Bryan100% (1)

- Negotiable Instruments Law Notes Atty Zarah Villanueva Castro PDFDocument16 pagesNegotiable Instruments Law Notes Atty Zarah Villanueva Castro PDFAenacia ReyeaNo ratings yet

- Partnership Prof. Jon D. Inocentes, Cpa: UM Tagum College Arellano Street, Tagum City, 8100 PhilippinesDocument2 pagesPartnership Prof. Jon D. Inocentes, Cpa: UM Tagum College Arellano Street, Tagum City, 8100 PhilippinesJohn BryanNo ratings yet

- J Marketing S Inventory GLDocument44 pagesJ Marketing S Inventory GLJohn BryanNo ratings yet

- EZ InventoryDocument45 pagesEZ InventoryJohn BryanNo ratings yet

- JMarketing Stock CardDocument34 pagesJMarketing Stock CardJohn BryanNo ratings yet

- SRC Guide to Zero-Rated VAT SuppliesDocument2 pagesSRC Guide to Zero-Rated VAT SuppliesPrecy B BinwagNo ratings yet

- J Marketing S Inventory Cost ListDocument1 pageJ Marketing S Inventory Cost ListJohn BryanNo ratings yet

- Mabini Street, Tagum City Davao Del Norte Telefax: (084) 655-9591Document2 pagesMabini Street, Tagum City Davao Del Norte Telefax: (084) 655-9591John BryanNo ratings yet

- Letter 2Document1 pageLetter 2John BryanNo ratings yet

- Transcript of Participant "Cenro"Document3 pagesTranscript of Participant "Cenro"John BryanNo ratings yet

- Transcript of Participant "Cenro"Document3 pagesTranscript of Participant "Cenro"John BryanNo ratings yet

- New Text DocumentDocument1 pageNew Text DocumentJohn BryanNo ratings yet

- Mabini Street, Tagum City Davao Del Norte Telefax: (084) 655-9591Document1 pageMabini Street, Tagum City Davao Del Norte Telefax: (084) 655-9591John BryanNo ratings yet

- Letter 1Document1 pageLetter 1John BryanNo ratings yet

- Transcript Purok LeaderDocument2 pagesTranscript Purok LeaderJohn BryanNo ratings yet

- PMT Machines LTD Inspection and Test Plan For Bogie Frame FabricationDocument6 pagesPMT Machines LTD Inspection and Test Plan For Bogie Frame FabricationAMIT SHAHNo ratings yet

- Taxation of XYZ Ltd for 2020Document2 pagesTaxation of XYZ Ltd for 2020zhart1921No ratings yet

- Cruise LetterDocument23 pagesCruise LetterSimon AlvarezNo ratings yet

- Introduction To Contemporary World: Alan C. Denate Maed Social Science, LPTDocument19 pagesIntroduction To Contemporary World: Alan C. Denate Maed Social Science, LPTLorlie GolezNo ratings yet

- The Art of War: Chapter Overview - Give A Brief Summary of The ChapterDocument3 pagesThe Art of War: Chapter Overview - Give A Brief Summary of The ChapterBienne JaldoNo ratings yet

- Human Resource Management in HealthDocument7 pagesHuman Resource Management in HealthMark MadridanoNo ratings yet

- Legal Notice: Submitted By: Amit Grover Bba L.LB (H) Section B A3221515130Document9 pagesLegal Notice: Submitted By: Amit Grover Bba L.LB (H) Section B A3221515130Amit GroverNo ratings yet

- 0500 w16 Ms 13Document9 pages0500 w16 Ms 13Mohammed MaGdyNo ratings yet

- Schneider ACB 2500 amp MVS25 N - Get Best Price from Mehta Enterprise AhmedabadDocument7 pagesSchneider ACB 2500 amp MVS25 N - Get Best Price from Mehta Enterprise AhmedabadahmedcoNo ratings yet

- Notice WritingDocument2 pagesNotice WritingMeghana ChaudhariNo ratings yet

- AN ORDINANCE ESTABLISHING THE BARANGAY SPECIAL BENEFIT AND SERVICE IMPROVEMENT SYSTEMDocument7 pagesAN ORDINANCE ESTABLISHING THE BARANGAY SPECIAL BENEFIT AND SERVICE IMPROVEMENT SYSTEMRomel VillanuevaNo ratings yet

- Employee Separation Types and ReasonsDocument39 pagesEmployee Separation Types and ReasonsHarsh GargNo ratings yet

- LTD NotesDocument2 pagesLTD NotesDenis Andrew T. FloresNo ratings yet

- Agreement For Consulting Services Template SampleDocument6 pagesAgreement For Consulting Services Template SampleLegal ZebraNo ratings yet

- Quiz 2Document2 pagesQuiz 2claire juarezNo ratings yet

- English The Salem Witchcraft Trials ReportDocument4 pagesEnglish The Salem Witchcraft Trials ReportThomas TranNo ratings yet

- Qustion 2020-Man QB MCQ - MAN-22509 - VI SEME 2019-20Document15 pagesQustion 2020-Man QB MCQ - MAN-22509 - VI SEME 2019-20Raees JamadarNo ratings yet

- Summary of Kamban's RamayanaDocument4 pagesSummary of Kamban's RamayanaRaj VenugopalNo ratings yet

- Vdkte: LA-9869P Schematic REV 1.0Document52 pagesVdkte: LA-9869P Schematic REV 1.0Analia Madeled Tovar JimenezNo ratings yet

- Controlled Chaos in Joseph Heller's Catch-22Document5 pagesControlled Chaos in Joseph Heller's Catch-22OliverNo ratings yet

- Property Accountant Manager in Kelowna BC Resume Frank OhlinDocument3 pagesProperty Accountant Manager in Kelowna BC Resume Frank OhlinFrankOhlinNo ratings yet

- The Emergence of Provincial PoliticsDocument367 pagesThe Emergence of Provincial PoliticsHari Madhavan Krishna KumarNo ratings yet

- Problematika Pengembangan Kurikulum Di Lembaga Pendidikan Islam: Tinjauan EpistimologiDocument11 pagesProblematika Pengembangan Kurikulum Di Lembaga Pendidikan Islam: Tinjauan EpistimologiAhdanzulNo ratings yet

- Key Concepts in Marketing: Maureen Castillo Dyna Enad Carelle Trisha Espital Ethel SilvaDocument35 pagesKey Concepts in Marketing: Maureen Castillo Dyna Enad Carelle Trisha Espital Ethel Silvasosoheart90No ratings yet