Professional Documents

Culture Documents

Exercise 9-5 No 9-20

Uploaded by

Kent Lumanas0 ratings0% found this document useful (0 votes)

44 views9 pagestax ampongan

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documenttax ampongan

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

44 views9 pagesExercise 9-5 No 9-20

Uploaded by

Kent Lumanastax ampongan

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 9

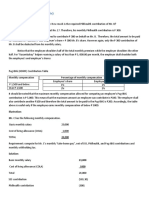

EXERCISE 9-5

9. The income tax payable for the 1st quarter

10. The income tax payable for the 2nd quarter

11. The income tax payable for the 3rd quarter

12. The annual income tax payable by Panday Corporation

13. Assuming that during the 4th quarter, the normal income and the

MCIT are 50,000 and 120,000, respectively, the annual income tax

payable

1st quarter 2nd Quarter 3rd Quarter Final Quarter #13

Income tax due 100,000 330,000 470,000 670,000 550,000

(higher) (NIT) (MCIT) (NIT) (NIT) (MCIT)

less: taxes withheld- 10,000 10,000 10,000 10,000 10,000

prior yr

Taxes withheld - 1st 20,000 20,000 20,000 20,000 20,000

quarter

Taxes withheld - 2nd 30,000 30,000 30,000 30,000

quarter

Taxes withheld - 3rd 40,000 40,000 40,000

quarter

Taxes withheld - 4th 35,000 35,000

quarter

Tax paid - 1st quarter 40,000 40,000 40,000 40,000

Tax paid - 2nd quarter 230,000 230,000 230,000

Tax paid - 3rd quarter 70,000 70,000

Excess MCIT prior year 30,000 30,000 30,000

Total

Net income tax due 40,000 230,000 70,000 165,000 75,000

(#9) (#10) (#11) (#12) (#13)

14. The income tax due if the cost of construction is treated as an

expense

15. The income tax due if the cost of construction is treated as a capital

expenditure

Gross Income 10,000,000

Less: Deductions

Operating Expense 6,400,000

Cost of Building 2,500,000 8,900,000

Taxable Income 1,100,000

Tax Rate 10%

Income Tax Due 110,000

Gross Income 10,000,000

Less: Deductions

Operating Expense 6,400,000

Depreciation (2500T/50x6/12) 25,000 6,425,000

Taxable Income 3,575,000

Tax Rate 10%

Income Tax Due 357,500

16. Letter B (The school building being rented by the school – from real

property tax)

17. Letter C ( A portion of the school building being leased to a fast

food chain – from real property tax)

18. How much is the income tax payable if the

taxpayer is a domestic corporation?

Gross Income, Philippines 740,000

Gross Income, USA 690,000

Royalties, USA 50,000

Total 1,480,000

Less: Deductions

Expenses, Philippines 425,000

Expenses, USA 450,000 875,000

Taxable Income 605,000

Rate of Tax 30%

Income Tax Due 181,500

19. How much is the income tax payable if the

taxpayer is a resident foreign corporation?

Gross Income, Philippines 740,000

Less: Expenses, Philippines 425,000

Taxable Income 315,000

Rate of Tax 30%

Income Tax Due 94,500

20. How much is the income tax payable if the

taxpayer is a nonresident foreign corporation?

Gross Income, Philippines 740,000

Interest on bank deposit with BDO 10,000

Total Gross Income 750,000

Rate of Tax 30%

Final Withholding Tax 225,000

You might also like

- Taxation - Corporation - Quizzer - 2018Document4 pagesTaxation - Corporation - Quizzer - 2018Kenneth Bryan Tegerero Tegio100% (4)

- HVAC Master Validation PlanDocument51 pagesHVAC Master Validation Plannavas197293% (30)

- ANSWERS Post Test Regular Income Taxation For PartnershipsDocument8 pagesANSWERS Post Test Regular Income Taxation For Partnershipslena cpa100% (1)

- History of Microfinance in NigeriaDocument9 pagesHistory of Microfinance in Nigeriahardmanperson100% (1)

- Flexible Regression and Smoothing - Using GAMLSS in RDocument572 pagesFlexible Regression and Smoothing - Using GAMLSS in RDavid50% (2)

- 9.2 Assignment - Allowable DeductionsDocument5 pages9.2 Assignment - Allowable Deductionssam imperialNo ratings yet

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeFrom EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeNo ratings yet

- Gapped SentencesDocument8 pagesGapped SentencesKianujillaNo ratings yet

- Audio - Questions: Safety Equipment Reliability Handbook (SERH) 4th EditionDocument29 pagesAudio - Questions: Safety Equipment Reliability Handbook (SERH) 4th EditionLuc SchramNo ratings yet

- Income Tax Sample ProblemsDocument12 pagesIncome Tax Sample ProblemsYellow BelleNo ratings yet

- Excercise ProblemsDocument7 pagesExcercise ProblemsKatherine EderosasNo ratings yet

- Quiz 1 - StrataxDocument3 pagesQuiz 1 - Strataxspongebob SquarepantsNo ratings yet

- FUNDALES BTAX MidtermsDocument4 pagesFUNDALES BTAX MidtermsE. RobertNo ratings yet

- Final Activity Income TaxationDocument6 pagesFinal Activity Income TaxationPrincess MarianoNo ratings yet

- Answer 1Document5 pagesAnswer 1mayetteNo ratings yet

- Corporate Income TaxDocument8 pagesCorporate Income TaxClaire BarbaNo ratings yet

- Income Tax TableDocument6 pagesIncome Tax TableMarian's PreloveNo ratings yet

- Exercise CorporationDocument3 pagesExercise CorporationJefferson MañaleNo ratings yet

- Taxation 1-5Document6 pagesTaxation 1-5dimpy dNo ratings yet

- 8.2 Assignment - Regular Income Tax For Individuals (For Discussion)Document8 pages8.2 Assignment - Regular Income Tax For Individuals (For Discussion)Roselyn LumbaoNo ratings yet

- Taxation - Final ExamDocument4 pagesTaxation - Final ExamKenneth Bryan Tegerero Tegio100% (1)

- Philippine corporate income tax problems and solutionsDocument2 pagesPhilippine corporate income tax problems and solutionsRandy Manzano100% (1)

- Miscellaneous TopicsDocument93 pagesMiscellaneous Topicsgean eszekeilNo ratings yet

- Corporate Income Tax Computations Over 3 YearsDocument61 pagesCorporate Income Tax Computations Over 3 YearsMay Grethel Joy Perante100% (1)

- Special Liabilities - Income Taxes: Income Tax Rate Is 40% and Is Not Expected To Change in The FutureDocument4 pagesSpecial Liabilities - Income Taxes: Income Tax Rate Is 40% and Is Not Expected To Change in The FutureNoorodden50% (2)

- Deductions and Exclusions for Individual and Corporate TaxpayersDocument4 pagesDeductions and Exclusions for Individual and Corporate TaxpayersIvan AnaboNo ratings yet

- Tax ProblemsDocument14 pagesTax Problemsrav dano100% (1)

- Presented by Archana Gupta 0221031 Bharat Gaikwad 0221023Document12 pagesPresented by Archana Gupta 0221031 Bharat Gaikwad 0221023Bharat GaikwadNo ratings yet

- Assignment 1 Taxes On IndividualsDocument7 pagesAssignment 1 Taxes On IndividualsMarynissa CatibogNo ratings yet

- AEC-7 MIDTERM EXAMINATION SOLUTIONSDocument9 pagesAEC-7 MIDTERM EXAMINATION SOLUTIONSDaisy TañoteNo ratings yet

- Activity 13 May 2023 Key To CorrectionDocument1 pageActivity 13 May 2023 Key To CorrectionJohn Paul MagbitangNo ratings yet

- Solutions For Problem 1Document4 pagesSolutions For Problem 1spongebob SquarepantsNo ratings yet

- CORPORATE INCOME TAX (Answer Key)Document5 pagesCORPORATE INCOME TAX (Answer Key)Rujean Salar AltejarNo ratings yet

- Golpo 10 Task Performance 1.taxationDocument13 pagesGolpo 10 Task Performance 1.taxationNin JahNo ratings yet

- Individual Taxation ExercisesDocument3 pagesIndividual Taxation ExercisesMargaux CornetaNo ratings yet

- Income Tax Pointers for Finals TAX 301Document4 pagesIncome Tax Pointers for Finals TAX 301Jana RamosNo ratings yet

- Taxable Income and Income Tax - Foreign Tax Credit - AdministrDocument52 pagesTaxable Income and Income Tax - Foreign Tax Credit - AdministrCharlotte MalgapoNo ratings yet

- ST ND RDDocument6 pagesST ND RDCarlos Miguel MendozaNo ratings yet

- Module 6 - Income Tax On Corporations - Part 2Document5 pagesModule 6 - Income Tax On Corporations - Part 2Never Letting GoNo ratings yet

- CpaDocument37 pagesCparav danoNo ratings yet

- TaxationDocument2 pagesTaxationMesdame Jane TubalinalNo ratings yet

- Ass&Sa Claro Bac07-18Document28 pagesAss&Sa Claro Bac07-18Steffi Anne D. ClaroNo ratings yet

- 11.25.2017 Accounting For Income TaxDocument5 pages11.25.2017 Accounting For Income TaxPatOcampo0% (1)

- He Is Not Subject To Basic Income Tax. However, His 13th Month Pay Exceeds 90,000. ThereforeDocument15 pagesHe Is Not Subject To Basic Income Tax. However, His 13th Month Pay Exceeds 90,000. ThereforeEarl Daniel RemorozaNo ratings yet

- Chapter 5Document5 pagesChapter 5Kristine Jhoy Nolasco SecopitoNo ratings yet

- Philhealth and Pag-IBIG contribution tables explainedDocument5 pagesPhilhealth and Pag-IBIG contribution tables explainedMaraiah InciongNo ratings yet

- 10 Task PerformanceDocument5 pages10 Task Performancejeffersam31No ratings yet

- Manny Company: Required: Compute For The Balances of The Following On December 31, 2X14Document4 pagesManny Company: Required: Compute For The Balances of The Following On December 31, 2X14MauiNo ratings yet

- Illustration: The Following Data Were Reported For 200A Business Activities of Western UniversitiesDocument3 pagesIllustration: The Following Data Were Reported For 200A Business Activities of Western UniversitiesCarlo QuiambaoNo ratings yet

- Interim Financial Reporting and Operating Segment Discussion Problems and Answer KeyDocument4 pagesInterim Financial Reporting and Operating Segment Discussion Problems and Answer Keyprincess QNo ratings yet

- q17 Iaetrfcnrfc AnsDocument2 pagesq17 Iaetrfcnrfc AnsIan De DiosNo ratings yet

- TAX Preweek Lecture (B42) - December 2021 CPALEDocument16 pagesTAX Preweek Lecture (B42) - December 2021 CPALEkdltcalderon102No ratings yet

- Assignment E & L Env 4 BusiDocument9 pagesAssignment E & L Env 4 BusiSyed Hamza RasheedNo ratings yet

- Chapter 9 Taxation of CorporationsDocument4 pagesChapter 9 Taxation of CorporationsElizabethNo ratings yet

- Individuals Assign3Document7 pagesIndividuals Assign3jdNo ratings yet

- 8.6 Assignment - Regular Income Tax On CorporationsDocument3 pages8.6 Assignment - Regular Income Tax On CorporationsRoselyn LumbaoNo ratings yet

- Taxation Situational ProblemsDocument32 pagesTaxation Situational ProblemsMilo MilkNo ratings yet

- Synthesis - Problem Solving QuizDocument3 pagesSynthesis - Problem Solving QuizEren CuestaNo ratings yet

- TAX ANSWER-R4Tanyag KeyDocument5 pagesTAX ANSWER-R4Tanyag KeyCheska JaplosNo ratings yet

- Cases On Taxation For Individualss AnswersDocument11 pagesCases On Taxation For Individualss AnswersMitchie Faustino100% (2)

- Rodel's 2020 Income Tax Computation with Itemized DeductionsTITLE Mulry's 2020 Taxable Income and Tax Payable TITLE Sharon's Various 2020 Tax Computations as Resident, Non-Resident ETB and NETBDocument5 pagesRodel's 2020 Income Tax Computation with Itemized DeductionsTITLE Mulry's 2020 Taxable Income and Tax Payable TITLE Sharon's Various 2020 Tax Computations as Resident, Non-Resident ETB and NETByezaquera100% (1)

- Allowable Deductions Part 1Document3 pagesAllowable Deductions Part 1John Rich GamasNo ratings yet

- Basic Principles of TaxationDocument18 pagesBasic Principles of TaxationAlexandra Nicole IsaacNo ratings yet

- Physics Derived Units and Unit Prefixes Derived UnitDocument15 pagesPhysics Derived Units and Unit Prefixes Derived UnitJohnRenzoMolinarNo ratings yet

- Advantages of Using Mobile ApplicationsDocument30 pagesAdvantages of Using Mobile ApplicationsGian Carlo LajarcaNo ratings yet

- AtlasConcorde NashDocument35 pagesAtlasConcorde NashMadalinaNo ratings yet

- Busbar sizing recommendations for Masterpact circuit breakersDocument1 pageBusbar sizing recommendations for Masterpact circuit breakersVikram SinghNo ratings yet

- DOE Tank Safety Workshop Presentation on Hydrogen Tank TestingDocument36 pagesDOE Tank Safety Workshop Presentation on Hydrogen Tank TestingAlex AbakumovNo ratings yet

- Nagina Cotton Mills Annual Report 2007Document44 pagesNagina Cotton Mills Annual Report 2007Sonia MukhtarNo ratings yet

- WWW - Commonsensemedia - OrgDocument3 pagesWWW - Commonsensemedia - Orgkbeik001No ratings yet

- Dance Appreciation and CompositionDocument1 pageDance Appreciation and CompositionFretz Ael100% (1)

- EIRA v0.8.1 Beta OverviewDocument33 pagesEIRA v0.8.1 Beta OverviewAlexQuiñonesNietoNo ratings yet

- Hipotension 6Document16 pagesHipotension 6arturo castilloNo ratings yet

- Problem Set SolutionsDocument16 pagesProblem Set SolutionsKunal SharmaNo ratings yet

- Wheeled Loader L953F Specifications and DimensionsDocument1 pageWheeled Loader L953F Specifications and Dimensionssds khanhNo ratings yet

- Human Rights Alert: Corrective Actions in Re: Litigation Involving Financial InstitutionsDocument3 pagesHuman Rights Alert: Corrective Actions in Re: Litigation Involving Financial InstitutionsHuman Rights Alert - NGO (RA)No ratings yet

- Consensus Building e Progettazione Partecipata - Marianella SclaviDocument7 pagesConsensus Building e Progettazione Partecipata - Marianella SclaviWilma MassuccoNo ratings yet

- Masteringphys 14Document20 pagesMasteringphys 14CarlosGomez0% (3)

- SNC 2p1 Course Overview 2015Document2 pagesSNC 2p1 Course Overview 2015api-212901753No ratings yet

- Form 4 Additional Mathematics Revision PatDocument7 pagesForm 4 Additional Mathematics Revision PatJiajia LauNo ratings yet

- !!!Логос - конференц10.12.21 копіяDocument141 pages!!!Логос - конференц10.12.21 копіяНаталія БондарNo ratings yet

- AA ActivitiesDocument4 pagesAA ActivitiesSalim Amazir100% (1)

- Committee History 50yearsDocument156 pagesCommittee History 50yearsd_maassNo ratings yet

- Bala Graha AfflictionDocument2 pagesBala Graha AfflictionNeeraj VermaNo ratings yet

- Evaluative Research DesignDocument17 pagesEvaluative Research DesignMary Grace BroquezaNo ratings yet

- GFS Tank Quotation C20210514Document4 pagesGFS Tank Quotation C20210514Francisco ManriquezNo ratings yet

- Pulse Width ModulationDocument13 pagesPulse Width Modulationhimanshu jainNo ratings yet

- Guidelines - MIDA (Haulage)Document3 pagesGuidelines - MIDA (Haulage)Yasushi Charles TeoNo ratings yet