Professional Documents

Culture Documents

Modern Banking: Measures of The Money Supply, Functions and Types of Financial Institutions, and Modern E-Banking

Uploaded by

nripendunandy0 ratings0% found this document useful (0 votes)

89 views16 pagesOriginal Title

modern-banking-1233080372332022-3

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

89 views16 pagesModern Banking: Measures of The Money Supply, Functions and Types of Financial Institutions, and Modern E-Banking

Uploaded by

nripendunandyCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You are on page 1of 16

Modern Banking

Measures of the Money Supply,

Functions and Types of Financial Institutions,

And

Modern E-Banking

Measuring the Money Supply

To understand Modern Banking, an understanding of what constitutes

the Money Supply, the money available in the economy, is needed.

The Money Supply is divided into two distinct categories:

M1 – Assets that can be easily accessed and immediately used to

purchase goods and services. These are referred to as Liquid Assets.

Money deposited in Checking Accounts meets this criteria because

checks represent Demand Deposits, as they are paid “On Demand” for

the cash in the account.

M2 – All of M1 and assets that cannot be used directly as cash but can

easily be converted to cash.

Money Market Mutual Funds are examples of this because they can be

used as collateral against certain types of checks.

Savings accounts also fall into this category.

Functions of Financial Institutions

Financial Institutions utilize the Money Supply

to perform many roles including:

Storing Money

Saving Money

Loans

Mortgages

Credit Cards

Conveying Interest (Simple and Compound)

Earning a Profit

Storing Money

One of the basic

functions of a bank is to

provide a safe, and

convenient, storage

location for valuables,

chiefly money.

Vaults are generally

fireproof and nearly

impenetrable.

Banks are insured

against losses due to

theft.

Saving Money

Banks offer a variety of

means of saving money

such as:

Savings Accounts

Checking Accounts

Money Market Accounts

Certificates of Deposit

Banks generally pay interest,

an amount paid for the use

of your money, on these

accounts.

Loans

Banks offer loans, money

given out for a period of time

in exchange for fees and

interest charges.

Banks are limited in the total

amount of loans that they

issue because of the

Fractional Reserve System.

This is the idea that

banks must keep a

certain percentage of the

value of loans that they

issue on hand in the form

of deposits.

Mortgages

Mortgages are specific types

of loans used to buy real

estate.

They generally come in term

lengths of 15, 25, or 30

years.

A key determining factor in

determining the interest rate

and the term on the

mortgage is the borrowers

Creditworthiness.

That is a reflection of the

likelihood that the

borrower will be able to

repay the loan and not

default, or fail to repay

the loan.

Credit Cards

Credit Cards are cards that

allow their holders to make

purchases of goods and

services in exchange for the

credit card’s provider

immediately paying for the

good or service, and the

card holder promising to pay

back the amount of the

purchase to the card

provider over a period of

time, and with interest.

The amount of credit

available to a card holder is

often a reflection of their

creditworthiness.

Simple and Compound Interest

Banks earn income through the

interest that they charge on their

lending.

As we have already established,

Interest is the price paid to use

borrowed money.

In can take two forms:

Simple – Interest paid on an

annualized basis as a

percentage of the value of

the loan or deposit – know

as the Principal.

Compound – Interest paid

annually on the total

principal, and the

accumulated interest from

previous time periods.

Earning a Profit

Banks exist to earn

money the same as any

other business.

They do this through

charging interest on

their lending and

through charging

various fees for their

services.

Modern E-Commerce

Modern Banks utilize electronic formats to

complete many of their functions.

These electronic formats can include:

Automated Teller Machines (ATMs)

Debit Cards

Home Banking

Automatic Clearing Houses (ACHs)

Stored Value Cards

ATMs

ATMs replace human bank

tellers in performing basic

banking functions such as:

Deposits

Withdrawals

Account Inquiries

Key advantages of ATMs

include:

24 hour availability.

Elimination of labor

costs.

Convenience of location.

Debit Cards

Debit cards are used to

electronically withdraw

funds directly from the

cardholders accounts.

Most debit cards require

a Personal Identification

Number (PIN) to be

used to verify the

transaction.

Home Banking

Home banking is the process

of completing financial

transactions from your own

home as opposed to utilizing

a branch of a bank.

Actions can include:

Make Account Inquiries

Transfer Money

Pay Bills

Apply for Loans

Direct Deposit

Automatic Clearing Houses (ACHs)

ACHs facilitate the payment

of bills without the need to

write a check.

An ACH can be used to

create automatic monthly bill

payments so that the payer

does not have to initiate the

payment of the bill.

Benefits Include:

Postal Savings

No Forgotten Payments

Time Savings

Stored Value Cards

Stored Value Cards are used

in a manner very similar to a

Debit Card.

The card is Loaded, or

credited, with a set value.

That value can then be used

to make purchases.

Examples of this concept

include:

Prepaid Calling Cards

Store Gift Cards

ACCESS Cards

You might also like

- Banking Awareness - IBPSGuideDocument89 pagesBanking Awareness - IBPSGuidegNo ratings yet

- Amrit Summer Report 000Document68 pagesAmrit Summer Report 000RPSinghNo ratings yet

- What Is A Bank?Document6 pagesWhat Is A Bank?Bhabani Sankar DashNo ratings yet

- Consumer CreditDocument33 pagesConsumer CreditNeeraj KumarNo ratings yet

- Banking U5Document4 pagesBanking U5alemayehuNo ratings yet

- 0 - Retail Banking Doc2Document8 pages0 - Retail Banking Doc2Niyati BagweNo ratings yet

- Bank loans and accounts overviewDocument6 pagesBank loans and accounts overviewwalterNo ratings yet

- Asgment BankingDocument7 pagesAsgment Bankingkiena1991No ratings yet

- Tutorial 2 AnswersDocument6 pagesTutorial 2 AnswersBee LNo ratings yet

- Commercial Bank Balance SheetsDocument21 pagesCommercial Bank Balance SheetsEunice VillanuevaNo ratings yet

- What Is A BankDocument5 pagesWhat Is A BankmanojdunnhumbyNo ratings yet

- Financial Institutions and MarketsDocument4 pagesFinancial Institutions and MarketsAnjaliNo ratings yet

- Credit Types and InstitutionsDocument4 pagesCredit Types and InstitutionsHoney GubalaneNo ratings yet

- FIN 2024 Banks Beyond BasicsDocument6 pagesFIN 2024 Banks Beyond BasicsBee LNo ratings yet

- Banking ServicesDocument3 pagesBanking ServicesWilliNo ratings yet

- Credit and Collection FinalsDocument2 pagesCredit and Collection FinalsPipito FportNo ratings yet

- Banking RelationshipsDocument9 pagesBanking RelationshipsNageshwar SinghNo ratings yet

- Financial ServicesDocument3 pagesFinancial ServicesakhilalakshmiNo ratings yet

- Cash Flow CorrelationDocument18 pagesCash Flow CorrelationopulencefinservNo ratings yet

- Banking ServicesDocument11 pagesBanking ServicesSwarna GuptaNo ratings yet

- Chapter 1Document98 pagesChapter 1Om Prakash SinghNo ratings yet

- Examen Parcial de InglesDocument18 pagesExamen Parcial de InglesIshaid Raul Reymundo AmesNo ratings yet

- Chapter 7Document12 pagesChapter 7Muskan KumariNo ratings yet

- Banking Terms 2021Document48 pagesBanking Terms 2021Sammar AbbasNo ratings yet

- Indian BankDocument94 pagesIndian BankManzuhonnur100% (2)

- Financial Analysis at Indian BankDocument93 pagesFinancial Analysis at Indian BankAbhay JainNo ratings yet

- Bank Accounts and DepositsDocument45 pagesBank Accounts and Depositsmirna tayehNo ratings yet

- Miscellaneous Banking ActivitiesDocument20 pagesMiscellaneous Banking ActivitiessaktipadhiNo ratings yet

- Chapter 01 Introduction To Bank (Law & Practice)Document9 pagesChapter 01 Introduction To Bank (Law & Practice)Rayyah AminNo ratings yet

- C6 BankingDocument16 pagesC6 BankingKavyansh SharmaNo ratings yet

- Functions of Commercial BanksDocument19 pagesFunctions of Commercial BanksAravind Kumar G100% (1)

- Banking Products and Services - Course PresentationDocument171 pagesBanking Products and Services - Course Presentationnimitjain10No ratings yet

- FinanceDocument5 pagesFinancecrist.jahnskieNo ratings yet

- Money and BankingpptDocument19 pagesMoney and BankingpptSania ZaheerNo ratings yet

- Loans and AdvancesDocument18 pagesLoans and AdvancesAnupam RoyNo ratings yet

- Consumer CreditDocument41 pagesConsumer CreditRup HunkNo ratings yet

- Banking Products: and ServicesDocument171 pagesBanking Products: and ServicesJagriti SinghNo ratings yet

- Module 11 Compiled PptsDocument46 pagesModule 11 Compiled PptsNashebah A. BatuganNo ratings yet

- Banking & Finance Interview QuestionsDocument6 pagesBanking & Finance Interview Questionskhanarif16No ratings yet

- Types of Accounts, Bank Guarantee, LC, Line of CreditDocument44 pagesTypes of Accounts, Bank Guarantee, LC, Line of Creditkaren sunilNo ratings yet

- The Role of Commercial BanksDocument29 pagesThe Role of Commercial BanksGeorge Cristinel RotaruNo ratings yet

- Banking Products and ServicesDocument13 pagesBanking Products and ServicesDharmeshParikhNo ratings yet

- Banking: Banks Are Financial Institutions That Provide Customers With A Variety of ValuableDocument2 pagesBanking: Banks Are Financial Institutions That Provide Customers With A Variety of ValuableYayaNo ratings yet

- Investopedia explains key financial termsDocument4 pagesInvestopedia explains key financial termsDu JonNo ratings yet

- Role of Commercial Bank-1Document9 pagesRole of Commercial Bank-1TanzeemNo ratings yet

- Presentation 1Document15 pagesPresentation 1Nithyananda PatelNo ratings yet

- Important Functions of Bank: What Is A Bank?Document3 pagesImportant Functions of Bank: What Is A Bank?Samiksha PawarNo ratings yet

- Banking Basics - Savings, Investment, Commercial BanksDocument16 pagesBanking Basics - Savings, Investment, Commercial Bankslinda zyongweNo ratings yet

- Top 50 Banking Interview Questions & Answers: 1) What Is Bank? What Are The Types of Banks?Document10 pagesTop 50 Banking Interview Questions & Answers: 1) What Is Bank? What Are The Types of Banks?FaizNo ratings yet

- Banking Products and Services GuideDocument15 pagesBanking Products and Services GuideAbhayVarunKesharwaniNo ratings yet

- Banking TermsDocument20 pagesBanking Termsdeepakgarg1No ratings yet

- Commercial Banking 2Document5 pagesCommercial Banking 2polmulitriNo ratings yet

- RETAIL BANKING PRODUCTS AND SERVICESDocument17 pagesRETAIL BANKING PRODUCTS AND SERVICESAneesha AkhilNo ratings yet

- Dipali Project ReportDocument58 pagesDipali Project ReportAshish MOHARENo ratings yet

- Banking and Marketing TermsDocument17 pagesBanking and Marketing TermsVigya JindalNo ratings yet

- Bank Fundamentals: An Introduction to the World of Finance and BankingFrom EverandBank Fundamentals: An Introduction to the World of Finance and BankingRating: 4.5 out of 5 stars4.5/5 (4)

- Credit Secrets: Learn the concepts of Credit Scores, How to Boost them and Take Advantages from Your Credit CardsFrom EverandCredit Secrets: Learn the concepts of Credit Scores, How to Boost them and Take Advantages from Your Credit CardsNo ratings yet

- Chennai: Hr@bafn ApharmaDocument10 pagesChennai: Hr@bafn Apharmakbogeshwaran100% (1)

- BSBMGT517 Assessment Templates V2.0420Document37 pagesBSBMGT517 Assessment Templates V2.0420SosNo ratings yet

- This Study Resource Was: Preliminary Examination in MANACO1Document7 pagesThis Study Resource Was: Preliminary Examination in MANACO1Sadile May KayeNo ratings yet

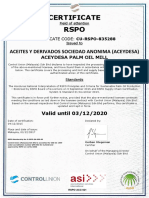

- RSPO-certified Honduran palm oil mill certificateDocument4 pagesRSPO-certified Honduran palm oil mill certificateJaz MarNo ratings yet

- Oxy 4 Q 21 Conference Call SlidesDocument48 pagesOxy 4 Q 21 Conference Call SlidesAmol AminNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, BengaluruKokila Sham100% (1)

- Chapter 6Document19 pagesChapter 6PavanNo ratings yet

- ACCO 20033 - Quiz 2Document2 pagesACCO 20033 - Quiz 2DRUMMER DROIDNo ratings yet

- How To Play Monopoly in Real Life DONEDocument265 pagesHow To Play Monopoly in Real Life DONEDhruv Thakkar67% (3)

- Aparna Viswanathan - Interim Report-1585Document27 pagesAparna Viswanathan - Interim Report-1585Aparna Viswanathan IBS HYDERABADNo ratings yet

- SWOT Analysis:: StrengthsDocument5 pagesSWOT Analysis:: Strengthsaq GreaterNo ratings yet

- Partnership OperationsDocument20 pagesPartnership OperationsRujean Salar AltejarNo ratings yet

- PRO-RATION Individual Vs IndividualDocument16 pagesPRO-RATION Individual Vs IndividualLicardo, Marc PauloNo ratings yet

- MRF Tyres Brand Expansion StrategyDocument87 pagesMRF Tyres Brand Expansion StrategyMohit BansalNo ratings yet

- Contract To SellDocument3 pagesContract To SellMary JustineNo ratings yet

- Effect of Bioenergy Demands and Supply Response On Markets, Carbon, and Land UseDocument17 pagesEffect of Bioenergy Demands and Supply Response On Markets, Carbon, and Land UseNovi RamadhiniNo ratings yet

- Introduction To Business ImplementationDocument25 pagesIntroduction To Business Implementationsannsann100% (1)

- Enron ScandalDocument3 pagesEnron ScandaltehreemNo ratings yet

- Financial Table Analysis of ZaraDocument9 pagesFinancial Table Analysis of ZaraCeren75% (4)

- Advocates of Truth V BSPDocument2 pagesAdvocates of Truth V BSPAhmed GakuseiNo ratings yet

- View your monthly fiber statementDocument2 pagesView your monthly fiber statementghanshyam sidhdhapuraNo ratings yet

- IAS-8 Accounting Policies, Change in Accounting Estimates and Errors ObjectiveDocument6 pagesIAS-8 Accounting Policies, Change in Accounting Estimates and Errors ObjectiveAbdullah Al Amin MubinNo ratings yet

- Introduction To Finance - The Ba - Gies College of Business at TheDocument360 pagesIntroduction To Finance - The Ba - Gies College of Business at ThemartintutkoNo ratings yet

- Parts list for lifting slings and insertsDocument1 pageParts list for lifting slings and insertsAdrian CantaragiuNo ratings yet

- JACKLINE NEW RESEARCH (Recovered)Document57 pagesJACKLINE NEW RESEARCH (Recovered)jupiter stationeryNo ratings yet

- Chapter 81 - BankingDocument5 pagesChapter 81 - BankingWill CNo ratings yet

- Theory of Accounts: Module 2 Financial Statement PresentationDocument33 pagesTheory of Accounts: Module 2 Financial Statement PresentationRHEA CYBELE OSARIONo ratings yet

- Fundraising Internship GuideDocument8 pagesFundraising Internship GuideAkshat SoniNo ratings yet

- Only Thing You Need To Have BiasDocument8 pagesOnly Thing You Need To Have BiasagathfutureNo ratings yet

- Northern Motors, Inc. v. HerreraDocument6 pagesNorthern Motors, Inc. v. HerreraCassie GacottNo ratings yet