Professional Documents

Culture Documents

For Class Inflation

Uploaded by

Nagarjuna Atukuri0 ratings0% found this document useful (0 votes)

13 views13 pagesThis document discusses instruments of monetary policy used by central banks, including quantitative measures like open market operations, discount rates, and cash reserve ratios. It also discusses qualitative credit controls like credit rationing and direct lending controls. The RBI policy review outlines current repo, reverse repo, cash reserve, and statutory liquidity ratios. Repo and reverse repo rates are also defined. Inflation can be caused by excessive money supply growth, demand-pull from too much money chasing too few goods, or cost-push from increasing production costs which are passed to consumers.

Original Description:

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document discusses instruments of monetary policy used by central banks, including quantitative measures like open market operations, discount rates, and cash reserve ratios. It also discusses qualitative credit controls like credit rationing and direct lending controls. The RBI policy review outlines current repo, reverse repo, cash reserve, and statutory liquidity ratios. Repo and reverse repo rates are also defined. Inflation can be caused by excessive money supply growth, demand-pull from too much money chasing too few goods, or cost-push from increasing production costs which are passed to consumers.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

13 views13 pagesFor Class Inflation

Uploaded by

Nagarjuna AtukuriThis document discusses instruments of monetary policy used by central banks, including quantitative measures like open market operations, discount rates, and cash reserve ratios. It also discusses qualitative credit controls like credit rationing and direct lending controls. The RBI policy review outlines current repo, reverse repo, cash reserve, and statutory liquidity ratios. Repo and reverse repo rates are also defined. Inflation can be caused by excessive money supply growth, demand-pull from too much money chasing too few goods, or cost-push from increasing production costs which are passed to consumers.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 13

Instruments of Monetary Policy

• Quantitative measures ( Traditional measures)

1. Open Market Operations

2. Discount Rate or Bank Rate

3. Cash Reserve Ratio (CRR) and Statutory Liquidity Requirement(SLR)

• Qualitative or Selective Credit Controls

1. Credit rationing

2. Change in Lending margins

3. Direct controls

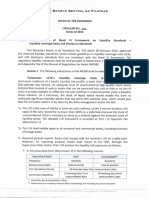

RBI POLICY REVIEW October 27, 2009

The Annual Policy Statement on October 27, 2009

1. Repo rate (4.75%)

2. Reverse repo rate (3.25%

3. Cash reserve ratio (5%) have stayed unchanged at

earlier levels; the status quo is in line with

expectations.

4. The statutory liquidity ratio (SLR) has been restored

to 25% of net demand and time liabilities.

Repo is a collateralized lending i.e. the banks which borrow money

from Reserve Bank to meet short term needs have to sell

securities, usually bonds to Reserve Bank with an agreement to

repurchase the same at a predetermined rate and date.

Reverse repo Reserve Bank borrows money from banks by lending

securities. The interest paid by Reserve Bank in this case is called

reverse repo rate.

Inflation Causes and Effects

In economics, inflation is a rise in the general

level of prices of goods and services in an

economy over a period of time.

Impact ?

Purchasing Power of money

Decrease in the real value of money and other monetary

items over time

Uncertainty about future inflation may discourage investment

and saving, and high inflation may lead to shortages of goods

if consumers begin hoarding out of concern that prices will

increase in the future.

Income redistribution - many people have to live off fixed

incomes, particularly those on pensions. The higher the level

of inflation the less their income will be worth. This effect can

also happen among people who are working, as their incomes

go up either faster or slower than inflation. These effects can

arbitrarily redistribute income.

Inflation - Causes

• Excessive growth of the money supply.

• Money supply growing faster than the rate of

economic growth.

• Demand-pull inflation

• Cost-push inflation

Monetary authorities are the central banks

that control the size of the money supply

through the setting of interest rates,

through open market operations, and

through the setting of banking reserve

requirements

Demand-pull inflation

Demand-pull inflation happens where there is 'too

much money chasing too few goods'. Excessive

growth in demand literally pulls prices up

Cost-push inflation

If costs rise too fast, companies will need to put

prices up to maintain their margins. This will cause

inflation.

Excessive demand - 'too much money chasing too

few goods'. If demand is growing faster than the

level of supply, then prices will increase.

Demand Pull Inflation

Cost-push inflation happens when firms' costs

go up. To maintain their profit margins, firms

then need to put their prices up.

•Wage increases - wages are a major proportion of costs for many firms

and so if wages are increasing, this may well cause cost-push inflation.

•Government - if the government changes taxes, this may push up

firms' costs. This is particularly true with excise duties on fuel and oil.

Changes in interest rates can also affect firms costs if they have

borrowed significant amounts.

•Abroad - exchange rate changes can affect firms' costs, particularly if

they import many of their raw materials. An exchange rate depreciation

will increase import prices and may therefore increase firms costs.

The effect of cost increases is to shift the

aggregate supply to the left

Cost push inflation

You might also like

- INFLATIONDocument46 pagesINFLATIONGladys Torreros CanteroNo ratings yet

- Eco ReportDocument6 pagesEco ReportKim GabrielNo ratings yet

- 1618574888-4. InflationDocument5 pages1618574888-4. InflationshagunNo ratings yet

- Manar DerbelDocument8 pagesManar DerbelManar DerbelNo ratings yet

- Economic Development: Capistrano, Karen Dumdum, Christine Maraño, Mary Rose Milario, AngeloDocument14 pagesEconomic Development: Capistrano, Karen Dumdum, Christine Maraño, Mary Rose Milario, AngeloRAMIREZ, KRISHA R.No ratings yet

- Inflation 161202135538Document18 pagesInflation 161202135538Sidhartha MohapatraNo ratings yet

- The Dynamics of Inflation and UnemploymentDocument82 pagesThe Dynamics of Inflation and Unemploymentt0ckNo ratings yet

- CH 4 AS - Inflation and DeflationDocument20 pagesCH 4 AS - Inflation and DeflationRabee BasitNo ratings yet

- B V M Engineering College Vallabh VidyanagarDocument9 pagesB V M Engineering College Vallabh VidyanagarShish DattaNo ratings yet

- INFLATIONDocument17 pagesINFLATIONlillygujjarNo ratings yet

- tiền tệDocument35 pagestiền tệNga BuiNo ratings yet

- Inflation: Presented byDocument18 pagesInflation: Presented byKhan ProductionsNo ratings yet

- Inflation, Monetary and Fiscal Policy of IndiaDocument51 pagesInflation, Monetary and Fiscal Policy of IndiaVikku AgarwalNo ratings yet

- Financial Instruments and InflationDocument67 pagesFinancial Instruments and Inflationarjun_chauhan_2No ratings yet

- Inflation and MPDocument38 pagesInflation and MPsampritcNo ratings yet

- Assignment of InflationDocument5 pagesAssignment of InflationAY ChNo ratings yet

- Seminar in Economic Policies: Assignment # 1Document5 pagesSeminar in Economic Policies: Assignment # 1Muhammad Tariq Ali KhanNo ratings yet

- Project Investment Evaluation: Chethan S.GowdaDocument70 pagesProject Investment Evaluation: Chethan S.GowdaTodesa HinkosaNo ratings yet

- A Persistent Increase in The Level of Consumer Prices or A Persistent Decline in The Purchasing Power of Money... "Document6 pagesA Persistent Increase in The Level of Consumer Prices or A Persistent Decline in The Purchasing Power of Money... "marketfreekNo ratings yet

- Inflation Handout-2021Document5 pagesInflation Handout-2021Mark SmithNo ratings yet

- 18 InflationDocument27 pages18 InflationBhaskar KondaNo ratings yet

- Effects of InflationDocument21 pagesEffects of InflationNikhil PrasannaNo ratings yet

- Economic Influences: Learning ObjectivesDocument40 pagesEconomic Influences: Learning Objectivessk001No ratings yet

- Inflation and UnemplymentDocument19 pagesInflation and UnemplymentHawary SaadonNo ratings yet

- L22 Inflation Causes and ConsequencesDocument21 pagesL22 Inflation Causes and ConsequencesPrajay GNo ratings yet

- Inflation Bba20Document24 pagesInflation Bba20ssd200123No ratings yet

- INFLATIONDocument3 pagesINFLATIONRohan JhaNo ratings yet

- Inflation By:: Hanadia Pasca Y.Document20 pagesInflation By:: Hanadia Pasca Y.HanadiaYuristaNo ratings yet

- Inflation and Its TypesDocument12 pagesInflation and Its TypesUP 16 GhaziabadNo ratings yet

- PPTS On InflationDocument13 pagesPPTS On InflationDhawal RajNo ratings yet

- Lecture 15 InflationDocument13 pagesLecture 15 InflationDevyansh GuptaNo ratings yet

- Macro Economics: Inflation and UnemploymentDocument11 pagesMacro Economics: Inflation and UnemploymentHashim RiazNo ratings yet

- About InflationDocument4 pagesAbout InflationKomal SharmaNo ratings yet

- Liquidity TrapDocument5 pagesLiquidity TrapManish KumarNo ratings yet

- International Finance PresentationDocument29 pagesInternational Finance PresentationY.h. TariqNo ratings yet

- Monetary Policy & InflationDocument26 pagesMonetary Policy & InflationsunilNo ratings yet

- Inflation (Lecture 7, 8, & 9) - 12321250 - 2022 - 10 - 30 - 09 - 37Document10 pagesInflation (Lecture 7, 8, & 9) - 12321250 - 2022 - 10 - 30 - 09 - 37Chandan MishraNo ratings yet

- Economics ProjectDocument21 pagesEconomics ProjectMalvika SoodNo ratings yet

- Inflation (Bba)Document46 pagesInflation (Bba)Sailesh GoenkkaNo ratings yet

- Chapter 5 ATW 108 USM Tutorial SlidesDocument21 pagesChapter 5 ATW 108 USM Tutorial Slidesraye brahmNo ratings yet

- Inflation VaishuDocument4 pagesInflation Vaishuvaishnavi tipirneniNo ratings yet

- Inflation Economics Study Material Amp NotesDocument5 pagesInflation Economics Study Material Amp NotesRaghav DhillonNo ratings yet

- Inflation Means A Persistent Rise in The Price Levels of Commodities and Services, Leading To A Fall in The Currency's Purchasing PowerDocument25 pagesInflation Means A Persistent Rise in The Price Levels of Commodities and Services, Leading To A Fall in The Currency's Purchasing Powerganadhish_374477023No ratings yet

- General Price Level & InflationDocument6 pagesGeneral Price Level & Inflationharan5533No ratings yet

- The Advantages and Disadvantages of Fixed Exchange RatesDocument2 pagesThe Advantages and Disadvantages of Fixed Exchange RatesMoud Khalfani100% (1)

- Local Media3234683759531526224Document24 pagesLocal Media3234683759531526224Jeoven Dave T. MejosNo ratings yet

- Tutorial 3Document4 pagesTutorial 3Nayama NayamaNo ratings yet

- Module 7 - Inflation & UnemploymentDocument51 pagesModule 7 - Inflation & UnemploymentPrashasti100% (1)

- InflationDocument4 pagesInflationJyoti NarainNo ratings yet

- Inflation, Its Causes & ImpactsDocument20 pagesInflation, Its Causes & ImpactsSaima Nazir KhanNo ratings yet

- MBADocument17 pagesMBAKrishnamoorthy Ramakrishnan100% (1)

- Unit 5: Long-Run Consequences of Stabilization PoliciesDocument81 pagesUnit 5: Long-Run Consequences of Stabilization PoliciesPriscilla SamaniegoNo ratings yet

- Three Pillars of Central BankingDocument22 pagesThree Pillars of Central BankingJaden Christian67% (3)

- INFLATION (Notes For March 2020) : - Teacher SarahDocument22 pagesINFLATION (Notes For March 2020) : - Teacher SarahCharity AtukundaNo ratings yet

- Inflation Upsc Notes 70Document5 pagesInflation Upsc Notes 70sandhyapandey18634No ratings yet

- Chaopte r34 NotesDocument5 pagesChaopte r34 Noteschinsu6893No ratings yet

- Week 5 - SII2013 (Compatibility Mode)Document65 pagesWeek 5 - SII2013 (Compatibility Mode)Jason PanNo ratings yet

- Economics Assingment Swati SDocument17 pagesEconomics Assingment Swati SSwati SontakkeNo ratings yet

- Effects of Inflation:: Inflation and Interest RateDocument10 pagesEffects of Inflation:: Inflation and Interest RatesangramlifeNo ratings yet

- Inflation Hacking: Inflation Investing Techniques to Benefit from High InflationFrom EverandInflation Hacking: Inflation Investing Techniques to Benefit from High InflationNo ratings yet

- Term 1: EconomicsDocument26 pagesTerm 1: EconomicsShubh GuptaNo ratings yet

- Northern Cpa Review: Business Law Law On SalesDocument16 pagesNorthern Cpa Review: Business Law Law On SalesAvocado HunterNo ratings yet

- Chapter 2: Asset Classes and Financial Instruments: Problem SetsDocument6 pagesChapter 2: Asset Classes and Financial Instruments: Problem SetsBiloni KadakiaNo ratings yet

- FMT Homework W1Document9 pagesFMT Homework W1Hằngg ĐỗNo ratings yet

- Dtirm (2) - 20170901-19594896Document32 pagesDtirm (2) - 20170901-19594896Bhavik Solanki100% (2)

- Compliance RBI Circulars Jan'22-Jun'22Document46 pagesCompliance RBI Circulars Jan'22-Jun'22Gautam MehtaNo ratings yet

- RBI Credit Policy (Rough)Document15 pagesRBI Credit Policy (Rough)Nidhi NavneetNo ratings yet

- Chapter 10 Conduct of Monetary Policy (Chapter 10) MishkinDocument82 pagesChapter 10 Conduct of Monetary Policy (Chapter 10) MishkinethandanfordNo ratings yet

- FINMARKETS - Prelim ExamDocument7 pagesFINMARKETS - Prelim ExamArmalyn CangqueNo ratings yet

- BankingDocument49 pagesBankingRitu BhatiyaNo ratings yet

- Mirae Asset Monthly Full Portfolio August 2019Document61 pagesMirae Asset Monthly Full Portfolio August 2019sunnyramidiNo ratings yet

- GK FM&I Q&ADocument8 pagesGK FM&I Q&Acương trươngNo ratings yet

- Final ModuleDocument150 pagesFinal ModuletemedebereNo ratings yet

- Banking Awareness CapsuleDocument56 pagesBanking Awareness CapsuleTEERDHA MANIKANTA NADIMPALLINo ratings yet

- CRISIL Mutual Fund Ranking June 22Document48 pagesCRISIL Mutual Fund Ranking June 22Saurabh BhargavaNo ratings yet

- Bar Examinations Q - A SalesDocument23 pagesBar Examinations Q - A SalesFLOYD MORPHEUSNo ratings yet

- Valuation and Hedging of Inv Floaters PDFDocument4 pagesValuation and Hedging of Inv Floaters PDFtiwariaradNo ratings yet

- Fomc Minutes 20231101Document10 pagesFomc Minutes 20231101ZerohedgeNo ratings yet

- Investment Analysis and Portfolio Management-KRISTINA L PDFDocument166 pagesInvestment Analysis and Portfolio Management-KRISTINA L PDFWahyu S. Furqonnanto100% (2)

- BlogDocument4 pagesBlogShabih FatimaNo ratings yet

- International Reserves and Foreign Currency LiquidityDocument5 pagesInternational Reserves and Foreign Currency LiquidityOmer Bin SaleemNo ratings yet

- Nar Vol. 19 No. 4Document419 pagesNar Vol. 19 No. 4joseb100% (1)

- Lehman BrothersDocument4 pagesLehman BrothersHenri De sloovereNo ratings yet

- Money Market vs. Capital Market: What Is Money Markets?Document4 pagesMoney Market vs. Capital Market: What Is Money Markets?Ash imoNo ratings yet

- Important Banking TermsDocument4 pagesImportant Banking TermsmedeepikaNo ratings yet

- Final Non Budgetary KrasDocument548 pagesFinal Non Budgetary KrasRakesh KushwahaNo ratings yet

- Circular No 905Document55 pagesCircular No 905chrisNo ratings yet

- Essay. FM.Document1 pageEssay. FM.Roseanne RebucasNo ratings yet

- Question Paper Investment Banking and Financial Services-I (261) : April 2006Document192 pagesQuestion Paper Investment Banking and Financial Services-I (261) : April 2006neeraj_adorable4409100% (3)

- Ready Forward ContractsDocument7 pagesReady Forward ContractsSatyendra Veer SinghNo ratings yet