Professional Documents

Culture Documents

Chapter 1 - Introduction To Economics

Uploaded by

Pramod HiremathOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 1 - Introduction To Economics

Uploaded by

Pramod HiremathCopyright:

Available Formats

slide 0

Introduction to

Macroeconomics

CHAPTER 1 Introduction to Macroeconomics

slide 1

Learning Objectives

This chapter introduces you to

the issues macroeconomists study

the tools macroeconomists use

some important concepts in macroeconomic

analysis

CHAPTER 1 Introduction to Macroeconomics

slide 2

Why are call centers located in India? why textiles

made in Bangladesh? Why do we buy so much in

China?

Why does cost of living keep rising? Why do goods

prices rise? Are gas/ oil / gold prices really that high?

What causes recessions? Can the government do

anything to combat recessions? Should it? Why does

recession in US affect India?

CHAPTER 1 Introduction to Macroeconomics

Important issues in Macroeconomics

Macroeconomics, the study of the economy as

a whole, addresses many topical issues:

slide 3

What is the government budget deficit?

How does it affect the economy?

What causes unemployment? Why are millions

of people unemployed, even when the

economy is booming?

Why do people migrate?

CHAPTER 1 Introduction to Macroeconomics

Important issues in macroeconomics

Macroeconomics, the study of the economy as

a whole, addresses many topical issues:

slide 4

Why is US so rich? Why are so many countries

poor? What policies might help them grow out

of poverty?

What is the best way to measure well being

Why do government intervene in an economy?

...........................

CHAPTER 1 Introduction to Macroeconomics

Important issues in macroeconomics

Macroeconomics, the study of the economy as

a whole, addresses many topical issues:

slide 5

Why learn macroeconomics?

1. Macro economy affects societys well-

being.

Each one-point increase in the unemployment rate

is associated with:

920 more suicides

650 more homicides

4000 more people admitted to state mental

institutions

3300 more people sent to state prisons

37,000 more deaths

increases in domestic violence and homelessness

CHAPTER 1 Introduction to Macroeconomics

slide 6

CHAPTER 1 Introduction to Macroeconomics

Why learn macroeconomics?

2. Macro economy affects your well-being.

-3

-2

-1

0

1

2

3

4

5

1965 1970 1975 1980 1985 1990 1995 2000 2005

-7

-5

-3

-1

1

3

5

unemployment rate inflation-adjusted mean wage (right scale)

c

h

a

n

g

e

f

r

o

m

1

2

m

o

s

e

a

r

l

i

e

r

p

e

r

c

e

n

t

c

h

a

n

g

e

f

r

o

m

1

2

m

o

s

e

a

r

l

i

e

r

In most years, wage growth falls

when unemployment is rising.

slide 7

CHAPTER 1 Introduction to Macroeconomics

Why learn macroeconomics?

The popularity of the political party often

rises when the economy is doing well and

falls when it is doing poorly.

3. Macro economy affects politics.

slide 8

study of economics actions of individuals.

Includes individual prices, quantities and

markets, thus it studies how resources are

allocated to the production of particular

goods and services and how efficiently they

are distributed.

It does not necessarily study the allocation

of resources to the economy as a whole.

Thus it looks into the micro aspects of the

economy,

CHAPTER 1 Introduction to Macroeconomics

Microeconomics

slide 9

Study of aggregates or averages covering the

entire economy.

The aggregates or averages includes

Total employment, National income and output

Total investment, Total consumption and

savings

Aggregate supply, Aggregate demand

General price level, Wage level

Thus, macro economics studies the broader

aspects of the economy and studies the

behavior of an economy as a whole.

CHAPTER 1 Introduction to Macroeconomics

Macro economics

slide 10

Next, you will learn

the meaning and measurement of the

most important macroeconomic statistics:

Gross Domestic Product (GDP)

Real GDP and Nominal GDP

The Consumer Price Index (CPI)

Calculating Inflation

CHAPTER 1 Introduction to Macroeconomics

slide 11

Gross Domestic Product:

Expenditure and Income

Two definitions:

Total expenditure on domestically-produced

final goods and services.

Total income earned by domestically-located

factors of production.

Expenditure equals income because

every rupee spent by a buyer

becomes income to the seller.

CHAPTER 1 Introduction to Macroeconomics

slide 12

The Circular Flow

Households Firms

Goods

Labor

Expenditure (Rs)

Income (Rs)

CHAPTER 1 Introduction to Macroeconomics

slide 13 fig

Factor

payments

Consumption of

domestically

produced goods

and services (C

d

)

Investment (I)

Government

expenditure (G)

Export

expenditure (X)

BANKS, etc

Net

saving (S)

GOV.

Net

taxes (T)

ABROAD

Import

expenditure (M)

The circular flow of income

WITHDRAWALS

INJECTIONS

slide 14

Value added

definition:

A firms value added is

the value of its output

minus

the value of the intermediate goods

the firm used to produce that output.

CHAPTER 1 Introduction to Macroeconomics

slide 15

Exercise:

A farmer grows a bushel of wheat

and sells it to a miller for Rs. 2.00.

The miller turns the wheat into flour

and sells it to a baker for Rs. 6.00.

The baker uses the flour to make a loaf of

bread and sells it to an engineer for Rs.12.00.

The engineer eats the bread.

Compute & compare

value added at each stage of production

and GDP

CHAPTER 1 Introduction to Macroeconomics

slide 16

Final goods, value added, and GDP

GDP = value of final goods produced

= sum of value added at all stages

of production.

The value of the final goods already includes the

value of the intermediate goods,

so including intermediate and final goods in GDP

would be double-counting.

CHAPTER 1 Introduction to Macroeconomics

slide 17

The expenditure components of

GDP

consumption

investment

government spending

net exports

CHAPTER 1 Introduction to Macroeconomics

slide 18

Consumption (C)

durable goods

last a long time

ex: cars, home

appliances

nondurable goods

last a short time

ex: food, clothing

services

work done for

consumers

ex: dry cleaning,

air travel.

definition: The value of all

goods and services bought

by households. Includes:

CHAPTER 1 Introduction to Macroeconomics

slide 19

Investment (I)

Spending on goods bought for future use

Includes:

business fixed investment

Spending on plant and equipment that firms will use to

produce other goods & services.

residential fixed investment

Spending on housing units by consumers / landlords.

inventory investment

The change in the value of all firms inventories.

Note: Investment is spending on new capital

CHAPTER 1 Introduction to Macroeconomics

slide 20

Stocks vs. Flows

A flow is a quantity measured per unit of time.

E.g., Indian investment was Rs.2.5 billion during 2006.

Flow

Stock

A stock is a

quantity measured

at a point in time.

E.g.,

The Indian capital

stock was Rs.26 billion

on January 1, 2006.

CHAPTER 1 Introduction to Macroeconomics

slide 21

Stocks vs. Flows - examples

the govt budget deficit the govt debt

No. of new college

graduates this year

No. of people with

college degrees

persons

saving/income/expendi

ture

a persons wealth

flow stock

CHAPTER 1 Introduction to Macroeconomics

slide 22

Now you try:

Stock or flow?

the balance on your credit card statement

how much you study economics outside of

class

the size of your compact disc collection

the inflation rate

CHAPTER 1 Introduction to Macroeconomics

slide 23

Government spending (G)

G includes all government spending on goods

and services..

G excludes transfer payments

(e.g., unemployment insurance payments),

because they do not represent spending on

goods and services.

CHAPTER 1 Introduction to Macroeconomics

slide 24

Net exports: NX = EX IM

def: The value of total exports (EX)

minus the value of total imports

(IM).

CHAPTER 1 Introduction to Macroeconomics

slide 25

An important identity

Y = C + I + G + NX

aggregate

expenditure

value of

total output

CHAPTER 1 Introduction to Macroeconomics

slide 26

GDP:

An important and versatile concept

We have now seen that GDP measures

total income

total output

total expenditure

the sum of value-added at all stages

in the production of final goods

CHAPTER 1 Introduction to Macroeconomics

slide 27

GNP vs. GDP

Gross National Product (GNP):

Total income earned by the nations factors of

production, regardless of where located. (ownership)

Gross Domestic Product (GDP):

Total income earned by domestically-located factors of

production, regardless of nationality.

(GNP GDP) = (factor payments from abroad)

(factor payments to abroad)

=NFIA (net factor income from abroad)

CHAPTER 1 Introduction to Macroeconomics

slide 28

Discussion question:

In your country,

which would you want

to be bigger, GDP, or GNP?

Why?

CHAPTER 1 Introduction to Macroeconomics

slide 29

Other Measures of Income

GDP at factor cost =GDP at market price indirect

taxes + subsidies.

GDP at market price + net factor income from abroad

= GNP at market price

NNP: found out by deducting depreciation charges

from national income. NNP = GNP depreciation

NDP = GDP depreciation

Note: factor cost = market price indirect tax +

subsidies

CHAPTER 1 Introduction to Macroeconomics

slide 30

Example: National Income

Accounting

The following

particulars are given

for an economy for

the year 2008-09.

Compute

Depreciation

NDP at factor cost

GNP at factor cost

GDP at market price

NNP at market price

CHAPTER 1 Introduction to Macroeconomics

Particulars Rs. In Crore

GDP at factor cost 6000

Subsidies 400

Factor income received

from abroad

1200

Factor income paid

abroad

1800

Indirect taxes 800

Gross investment 800

Net investment 400

slide 31

Solution

Depreciation = gross investment net investment =

800 400 = 400

NDP at FC = GDP at FC Depreciation = 6000

400 = 5600

GNP at FC = GDP at FC + NFIA =6000 + (-600) =

5400

GDP at MP = GDP at FC + indirect taxes

subsidies = 6000 + 800 400 = 6400

NNP at MP = GNP at MP(GDP at MP + NFIA)

depreciation = 5000 400 = 4600

CHAPTER 1 Introduction to Macroeconomics

slide 32

Real vs. nominal GDP

GDP is the value of all final goods and services

produced.

nominal GDP measures these values using

current prices.

real GDP measure these values using the prices

of a base year.

CHAPTER 1 Introduction to Macroeconomics

slide 33

Real vs. nominal GDP

GDP

t

= P

it

Q

it

i=1

n

RGDP

t

= P

iB

Q

it

i=1

n

CHAPTER 1 Introduction to Macroeconomics

slide 34

Practice problem, part 1

Compute nominal GDP in each year.

Compute real GDP in each year using 2006 as

the base year.

2006 2007 2008

P Q P Q P Q

good A Rs.30 900 Rs. 31 1,000 Rs.36 1,050

good B Rs.100 192 Rs.102 200 Rs.100 205

CHAPTER 1 Introduction to Macroeconomics

slide 35

Answers to practice problem, part 1

nominal GDP multiply Ps & Qs from same year

2006: Rs.46,200 = Rs.30 900 + Rs.100 192

2007: Rs.51,400

2008: Rs.58,300

real GDP multiply each years Qs by 2006 Ps

2006: Rs.46,200

2007: Rs.50,000

2008: Rs.52,000 = Rs.30 1050 + Rs.100 205

CHAPTER 1 Introduction to Macroeconomics

slide 36

Real GDP controls for inflation

Changes in nominal GDP can be due to:

changes in prices.

changes in quantities of output produced.

Changes in real GDP can only be due to

changes in quantities,

because real GDP is constructed using

constant base-year prices.

CHAPTER 1 Introduction to Macroeconomics

slide 37

GDP Deflator

The inflation rate is the percentage increase in

the overall level of prices.

One measure of the price level is

the GDP deflator, defined as

Nominal GDP

GDP deflator = 100

Real GDP

CHAPTER 1 Introduction to Macroeconomics

slide 38

Practice problem, part 2

Use your previous answers to compute

the GDP deflator in each year.

Use GDP deflator to compute the inflation rate

from 2006 to 2007, and from 2007 to 2008.

Nom. GDP Real GDP

GDP

deflator

Inflation

rate

2006 Rs.46,200 Rs.46,200 n.a.

2007 51,400 50,000

2008 58,300 52,000

CHAPTER 1 Introduction to Macroeconomics

slide 39

Answers to practice problem, part 2

Nominal

GDP

Real GDP

GDP

deflator

Inflation

rate

2006 Rs.46,200 Rs.46,200 100.0 n.a.

2007 51,400 50,000 102.8 2.8%

2008 58,300 52,000 112.1 9.1%

CHAPTER 1 Introduction to Macroeconomics

slide 40

Understanding the GDP deflator

Example with 3 goods

For good i = 1, 2, 3

P

it

= the market price of good i in month t

Q

it

= the quantity of good i produced in month t

NGDP

t

= Nominal GDP in month t

RGDP

t

= Real GDP in month t

CHAPTER 1 Introduction to Macroeconomics

slide 41

Consumer Price Index (CPI)

A measure of the overall level of prices

Published by the Bureau of Labor Statistics

(BLS)

Uses:

tracks changes in the typical households

cost of living

adjusts many contracts for inflation (COLAs)

allows comparisons of dollar amounts over time

CHAPTER 1 Introduction to Macroeconomics

slide 42

How the BLS constructs the CPI

1. Survey consumers to determine composition

of the typical consumers basket of goods.

2. Every month, collect data on prices of all items

in the basket; compute cost of basket

3. CPI in any month equals

Cost of basket in that month

Cost of basket in base period

100

CHAPTER 1 Introduction to Macroeconomics

slide 43

Exercise: Compute the CPI

Basket contains 20 pizzas and 10 compact discs.

prices:

pizza CDs

(Rs.) (Rs.)

2002 10 15

2003 11 15

2004 12 16

2005 13 15

For each year, compute

the cost of the basket

the CPI (use 2002 as

the base year)

the inflation rate from

the preceding year

CHAPTER 1 Introduction to Macroeconomics

slide 44

Cost of Inflation

basket CPI rate

2002 Rs.350 100.0 n.a.

2003 370 105.7 5.7%

2004 400 114.3 8.1%

2005 410 117.1 2.5%

Answers:

CHAPTER 1 Introduction to Macroeconomics

slide 45

The composition of the CPIs basket

15.1%

42.4%

3.8%

17.4%

6.2%

5.6%

3.0%

3.1%

3.5%

Food and bev.

Housing

Apparel

Transportation

Medical care

Recreation

Education

Communication

Other goods

and services

CHAPTER 1 Introduction to Macroeconomics

slide 46

Understanding the CPI

Example with n goods

For good i = 1, 2, 3, ., n

Q

iB

= the amount of good i in the CPIs basket

P

it

= the price of good i in month t

E

t

= the cost of the CPI basket in month t

E

b

= the cost of the basket in the base period

CHAPTER 1 Introduction to Macroeconomics

slide 47

Understanding the CPI

The CPI is a weighted average of prices.

The weight on each price reflects

that goods relative importance in the CPIs basket.

Note that the weights remain fixed over time.

CPI in month t =

E

t

E

b

=

P

1t

C

1

+ P

2t

C

2

+ P

3t

C

3

E

b

=

C

1

E

b

|

\

|

.

|

P

1t

+

C

2

E

b

|

\

|

.

|

P

2t

+

C

3

E

b

|

\

|

.

|

P

3t

CHAPTER 1 Introduction to Macroeconomics

slide 48

Understanding the CPI

CPI =

E

t

E

B

=

Q

iB

P

it

i=1

n

Q

iB

P

iB

i=1

n

=

Q

iB

P

iB

P

it

/ P

iB

i=1

n

Q

iB

P

iB

i=1

n

CHAPTER 1 Introduction to Macroeconomics

slide 49

Understanding the CPI

CPI =

E

t

E

B

=

iB

P

it

/ P

iB

i=1

n

iB

=

Q

iB

P

iB

Q

iB

P

iB

i=1

n

where the weights are

given by:

CHAPTER 1 Introduction to Macroeconomics

slide 50

Understanding the CPI

The CPI is a weighted average of prices relative

to their value in the base period.

The weight on each price relative reflects

that goods relative importance in the CPIs

basket.

Note that the weights remain fixed over time.

CHAPTER 1 Introduction to Macroeconomics

slide 51

Reasons why

the CPI may overstate inflation

Substitution bias: The CPI uses fixed weights,

so it cannot reflect consumers ability to substitute

toward goods whose relative prices have fallen.

Introduction of new goods: The introduction of

new goods makes consumers better off and, in effect,

increases the real value of the dollar. But it does not

reduce the CPI, because the CPI uses fixed weights.

Unmeasured changes in quality:

Quality improvements increase the value of the dollar,

but are often not fully measured. Has to do with how

prices of goods are measured.

CHAPTER 1 Introduction to Macroeconomics

slide 52

Discussion questions:

If your grandmother receives Social Security,

how is she affected by the CPIs bias?

Where does the government get the money to pay

COLAs to Social Security recipients?

If you pay income and Social Security taxes,

how does the CPIs bias affect you?

Is the government giving your grandmother

too much of a COLA?

How does your grandmothers basket

differ from the CPIs?

CHAPTER 1 Introduction to Macroeconomics

slide 53

CHAPTER 1 Introduction to Macroeconomics

CPI vs. GDP Deflator

Prices of Capital Goods

included in GDP deflator (if produced domestically)

excluded from CPI

Prices of Imported Consumer Goods

included in CPI

excluded from GDP deflator

The Basket of Goods

CPI: fixed

GDP deflator: changes every year

slide 54

Categories of the population

employed

working at a paid job

unemployed

not employed but looking for a job

labor force

the amount of labor available for producing

goods and services; all employed plus

unemployed persons

not in the labor force

not employed, not looking for work

CHAPTER 1 Introduction to Macroeconomics

slide 55

Chapter Summary

1. Gross Domestic Product (GDP) measures both

total income and total expenditure on the

economys output of goods & services.

2. Nominal GDP values output at current prices;

real GDP values output at constant prices.

Changes in output affect both measures,

but changes in prices only affect nominal GDP.

3. GDP is the sum of consumption, investment,

government purchases, and net exports.

slide 55

CHAPTER 1 Introduction to Macroeconomics

slide 56

Chapter Summary

4. The overall level of prices can be measured by

either

the Consumer Price Index (CPI),

the price of a fixed basket of goods

purchased by the typical consumer, or

the GDP deflator,

the ratio of nominal to real GDP

slide 56

CHAPTER 1 Introduction to Macroeconomics

slide 57

Thank You

CHAPTER 1 Introduction to Macroeconomics

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- MH5-C Prospekt PDFDocument16 pagesMH5-C Prospekt PDFvatasaNo ratings yet

- Hockney-Falco Thesis: 1 Setup of The 2001 PublicationDocument6 pagesHockney-Falco Thesis: 1 Setup of The 2001 PublicationKurayami ReijiNo ratings yet

- 25 Middlegame Concepts Every Chess Player Must KnowDocument2 pages25 Middlegame Concepts Every Chess Player Must KnowKasparicoNo ratings yet

- HUMSS - Introduction To World Religions & Belief Systems CGDocument13 pagesHUMSS - Introduction To World Religions & Belief Systems CGAliuqus SirJasper89% (18)

- SP-Chapter 14 PresentationDocument83 pagesSP-Chapter 14 PresentationLoiDa FloresNo ratings yet

- 18 Composition Rules For Photos That ShineDocument20 pages18 Composition Rules For Photos That Shinemahfuzkhan100% (1)

- Img 20201010 0005Document1 pageImg 20201010 0005Tarek SalehNo ratings yet

- Pubb-0589-L-Rock-mass Hydrojacking Risk Related To Pressurized Water TunnelsDocument10 pagesPubb-0589-L-Rock-mass Hydrojacking Risk Related To Pressurized Water Tunnelsinge ocNo ratings yet

- IT Level 4 COCDocument2 pagesIT Level 4 COCfikru tesefaye0% (1)

- Soft Skills & Personality DevelopmentDocument62 pagesSoft Skills & Personality DevelopmentSajid PashaNo ratings yet

- Victor 2Document30 pagesVictor 2EmmanuelNo ratings yet

- Grammar and Vocabulary TestDocument5 pagesGrammar and Vocabulary TestLeonora ConejosNo ratings yet

- EMD Question Bank II 2Document4 pagesEMD Question Bank II 2Soham MisalNo ratings yet

- PostScript Quick ReferenceDocument2 pagesPostScript Quick ReferenceSneetsher CrispyNo ratings yet

- Best Mutual Funds For 2023 & BeyondDocument17 pagesBest Mutual Funds For 2023 & BeyondPrateekNo ratings yet

- Simran's ResumeDocument1 pageSimran's ResumesimranNo ratings yet

- Immunity Question Paper For A Level BiologyDocument2 pagesImmunity Question Paper For A Level BiologyJansi Angel100% (1)

- Evidence Prove DiscriminationDocument5 pagesEvidence Prove DiscriminationRenzo JimenezNo ratings yet

- Trina 440W Vertex-S+ DatasheetDocument2 pagesTrina 440W Vertex-S+ DatasheetBrad MannNo ratings yet

- CA21159 MG 8 Digital BookletDocument5 pagesCA21159 MG 8 Digital BookletcantaloupemusicNo ratings yet

- Derivational and Inflectional Morpheme in English LanguageDocument11 pagesDerivational and Inflectional Morpheme in English LanguageEdificator BroNo ratings yet

- 11.3.1 Some Special CasesDocument10 pages11.3.1 Some Special CasesSiddharth KishanNo ratings yet

- Optimized Maximum Power Point Tracker For Fast Changing Environmental ConditionsDocument7 pagesOptimized Maximum Power Point Tracker For Fast Changing Environmental ConditionsSheri ShahiNo ratings yet

- Five Reasons Hazards Are Downplayed or Not ReportedDocument19 pagesFive Reasons Hazards Are Downplayed or Not ReportedMichael Kovach100% (1)

- Alaba Adeyemi AdediwuraDocument12 pagesAlaba Adeyemi AdediwuraSchahyda ArleyNo ratings yet

- Lady in The House, Her Responsibilities & Ambitions: Amrita DuhanDocument7 pagesLady in The House, Her Responsibilities & Ambitions: Amrita DuhanFitness FableNo ratings yet

- Analysis of Rates (Nh-15 Barmer - Sanchor)Document118 pagesAnalysis of Rates (Nh-15 Barmer - Sanchor)rahulchauhan7869No ratings yet

- Continuing Professional Development PlanDocument4 pagesContinuing Professional Development Planvviki50% (2)

- A Content Analysis of SeabankDocument13 pagesA Content Analysis of SeabankMarielet Dela PazNo ratings yet

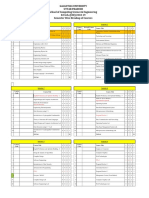

- Galgotias University Uttar Pradesh School of Computing Science & Engineering B.Tech. (CSE) 2018-19 Semester Wise Breakup of CoursesDocument2 pagesGalgotias University Uttar Pradesh School of Computing Science & Engineering B.Tech. (CSE) 2018-19 Semester Wise Breakup of CoursesRohit Singh BhatiNo ratings yet